MSR Value Growth & Market Trends

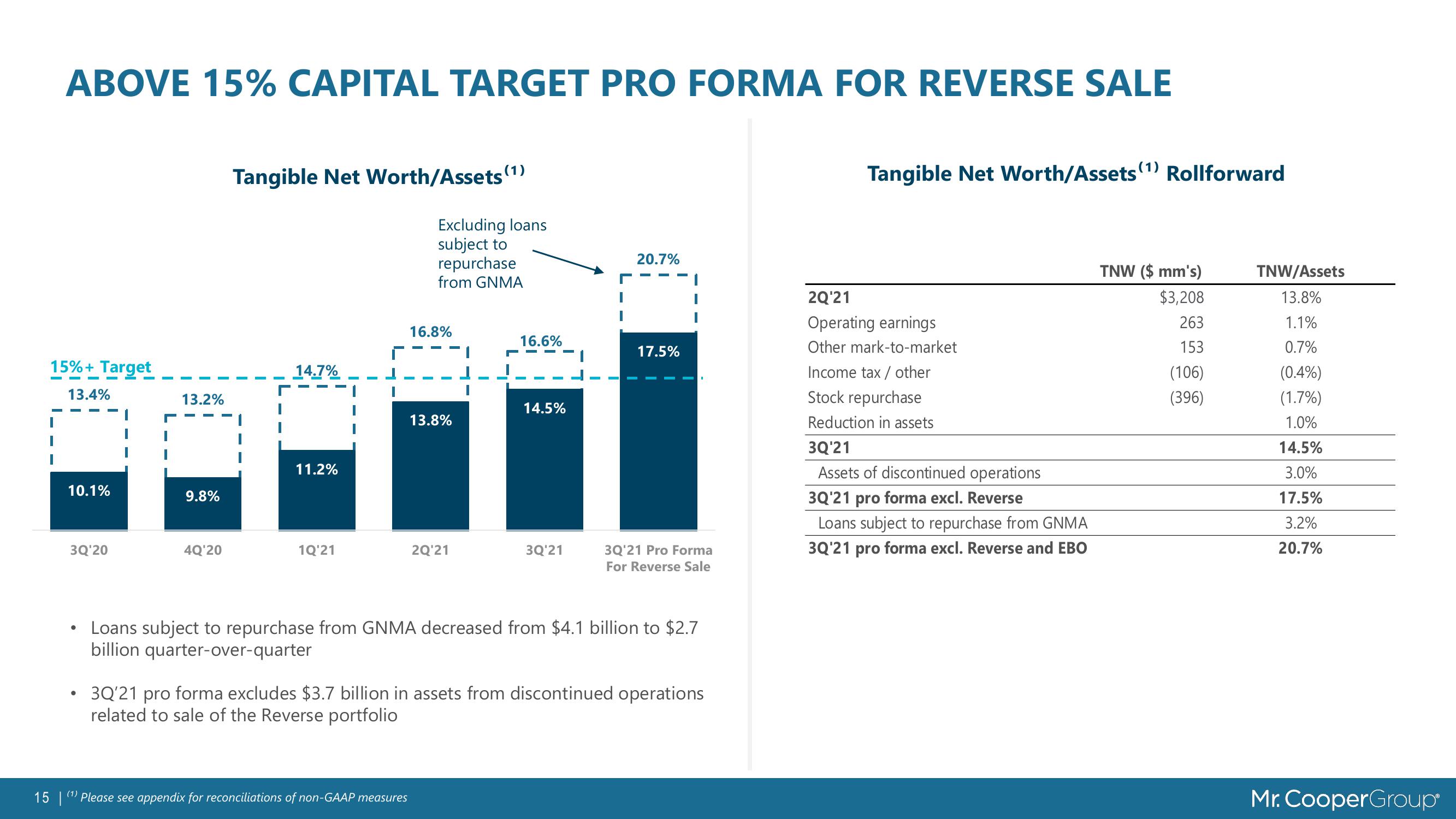

ABOVE 15% CAPITAL TARGET PRO FORMA FOR REVERSE SALE

15%+ Target

13.4%

10.1%

3Q'20

●

●

13.2%

9.8%

4Q'20

Tangible Net Worth/Assets (1)

14.7%

11.2%

1Q'21

Excluding loans

subject to

repurchase

from GNMA

16.8%

15 (¹)Please see appendix for reconciliations of non-GAAP measures

13.8%

2Q'21

16.6%

14.5%

3Q'21

20.7%

17.5%

3Q'21 Pro Forma

For Reverse Sale

Loans subject to repurchase from GNMA decreased from $4.1 billion to $2.7

billion quarter-over-quarter

3Q'21 pro forma excludes $3.7 billion in assets from discontinued operations

related to sale of the Reverse portfolio

Tangible Net Worth/Assets (1) Rollforward

2Q¹21

Operating earnings

Other mark-to-market

Income tax / other

Stock repurchase

Reduction in assets

3Q'21

Assets of discontinued operations

3Q'21 pro forma excl. Reverse

Loans subject to repurchase from GNMA

3Q'21 pro forma excl. Reverse and EBO

TNW ($ mm's)

$3,208

263

153

(106)

(396)

TNW/Assets

13.8%

1.1%

0.7%

(0.4%)

(1.7%)

1.0%

14.5%

3.0%

17.5%

3.2%

20.7%

Mr. CooperGroupView entire presentation