Nikola SPAC Presentation Deck

EXPECTED NET WORKING CAPITAL

REQUIREMENTS

NET WORKING CAPITAL CONSIDERATIONS

NWC

DESCRIPTION

NWC EXCL.

INVESTMENT IN

LEASES

EXPECTED

DEVELOPMENT

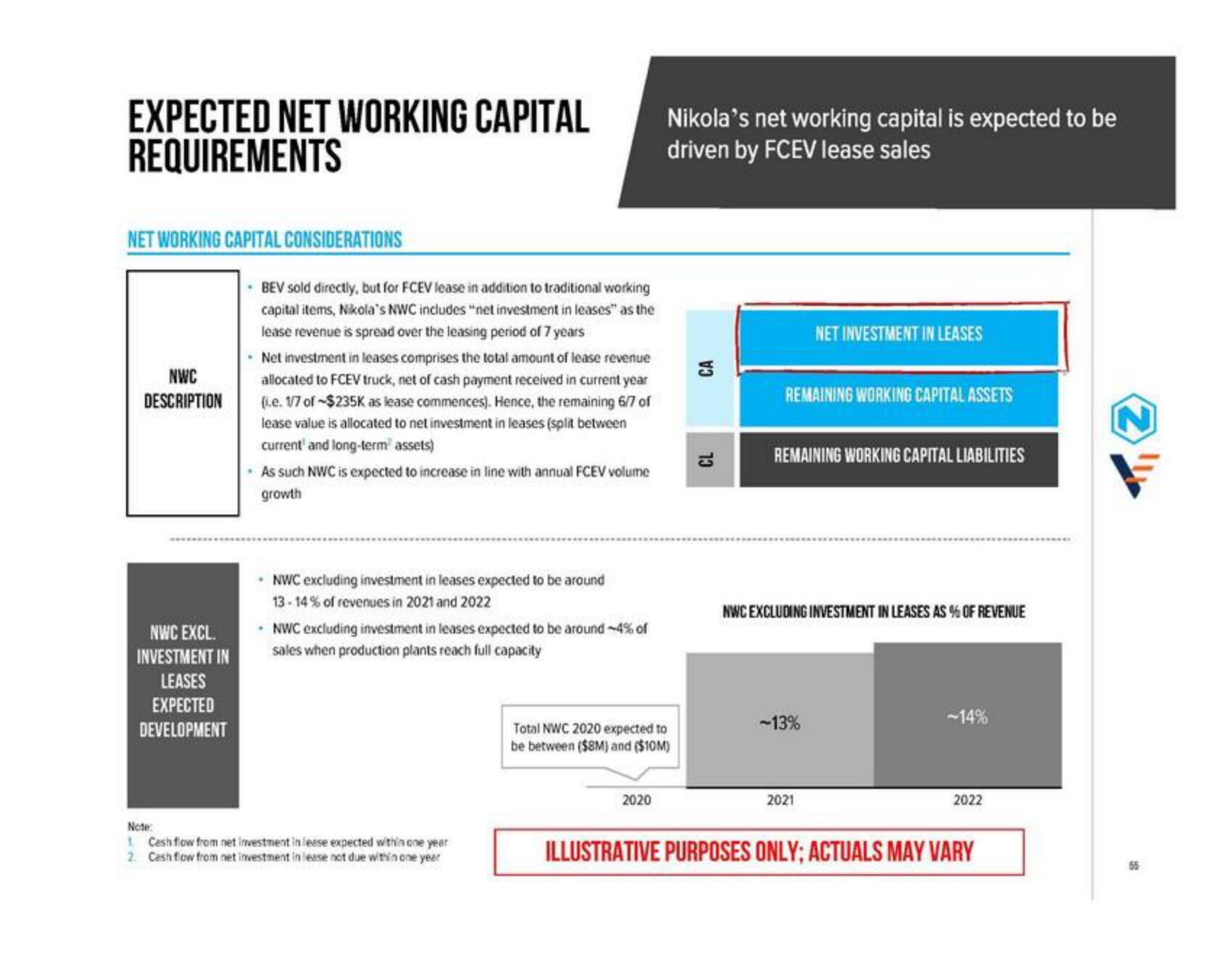

- BEV sold directly, but for FCEV lease in addition to traditional working

capital items, Nikola's NWC includes "net investment in leases" as the

lease revenue is spread over the leasing period of 7 years

• Net investment in leases comprises the total amount of lease revenue

allocated to FCEV truck, net of cash payment received in current year

(i.e. 1/7 of -$235K as lease commences). Hence, the remaining 6/7 of

lease value is allocated to net investment in leases (split between

current and long-term assets)

As such NWC is expected to increase in line with annual FCEV volume

growth

• NWC excluding investment in leases expected to be around

13-14% of revenues in 2021 and 2022

NWC excluding investment in leases expected to be around -4% of

sales when production plants reach full capacity

Note:

1. Cesh flow from net investment in lease expected within one year

2. Cash flow from net investment in lease not due within one year

Nikola's net working capital is expected to be

driven by FCEV lease sales

Total NWC 2020 expected to

be between ($8M) and ($10M)

2020

CA

CL

REMAINING WORKING CAPITAL ASSETS

NET INVESTMENT IN LEASES

REMAINING WORKING CAPITAL LIABILITIES

NWC EXCLUDING INVESTMENT IN LEASES AS % OF REVENUE

-13%

2021

-14%

2022

ILLUSTRATIVE PURPOSES ONLY; ACTUALS MAY VARYView entire presentation