Allwyn Results Presentation Deck

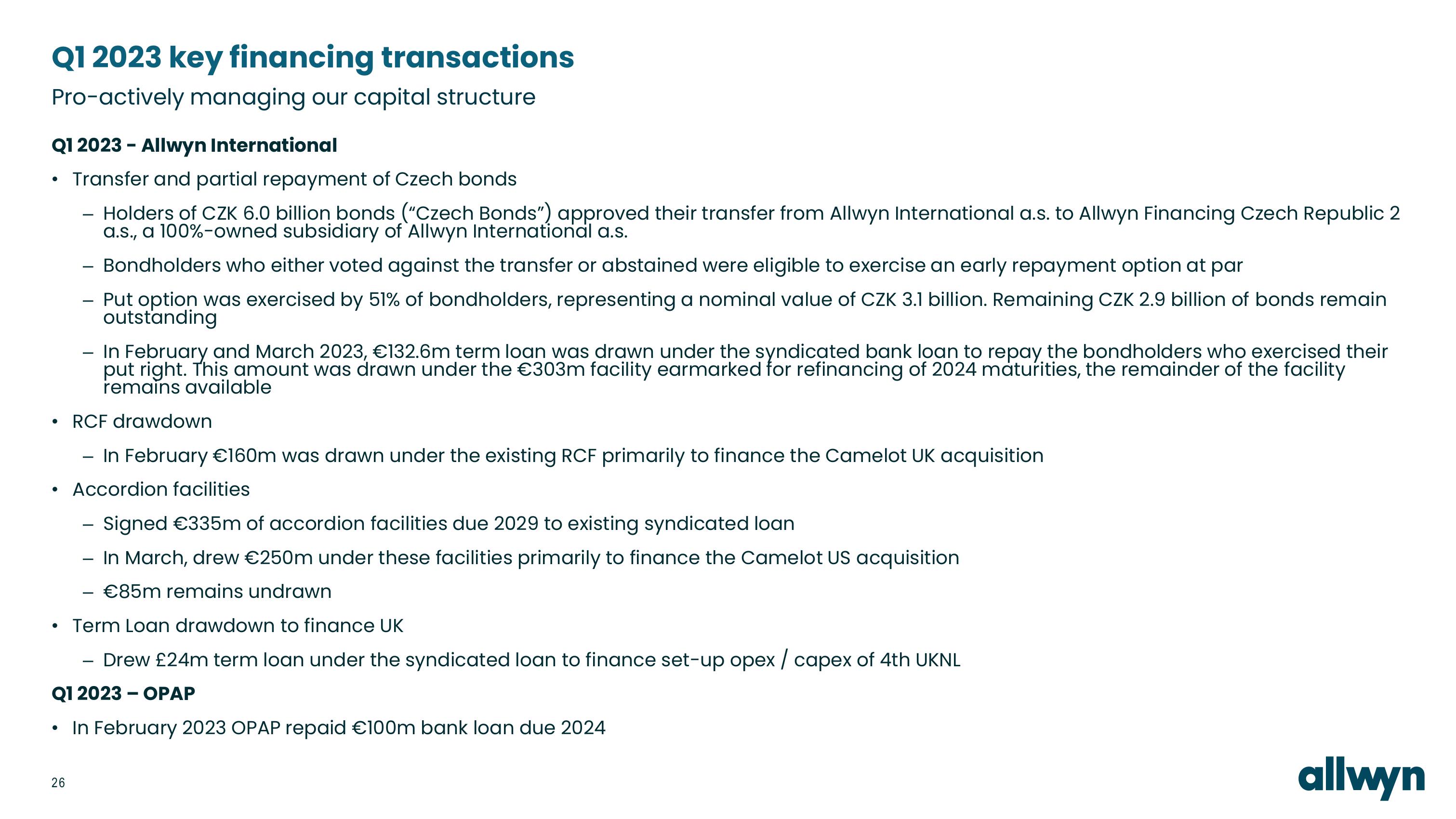

Q1 2023 key financing transactions

Pro-actively managing our capital structure

Q1 2023 - Allwyn International

Transfer and partial repayment of Czech bonds

Holders of CZK 6.0 billion bonds ("Czech Bonds") approved their transfer from Allwyn International a.s. to Allwyn Financing Czech Republic 2

a.s., a 100%-owned subsidiary of Allwyn International a.s.

Bondholders who either voted against the transfer or abstained were eligible to exercise an early repayment option at par

- Put option was exercised by 51% of bondholders, representing a nominal value of CZK 3.1 billion. Remaining CZK 2.9 billion of bonds remain

outstanding

●

●

●

●

In February and March 2023, €132.6m term loan was drawn under the syndicated bank loan to repay the bondholders who exercised their

put right. This amount was drawn under the €303m facility earmarked for refinancing of 2024 maturities, the remainder of the facility

remains available

Term Loan drawdown to finance UK

Drew £24m term loan under the syndicated loan to finance set-up opex / capex of 4th UKNL

Q1 2023 - OPAP

26

RCF drawdown

- In February €160m was drawn under the existing RCF primarily to finance the Camelot UK acquisition

Accordion facilities

Signed €335m of accordion facilities due 2029 to existing syndicated loan

In March, drew €250m under these facilities primarily to finance the Camelot US acquisition

- €85m remains undrawn

In February 2023 OPAP repaid €100m bank loan due 2024

allwynView entire presentation