Crocs Results Presentation Deck

Q1 Financial Highlights

HEYDUDE Brand Q1 Highlights

• Revenues of $235M, +106% CC vs PY / +15% on a PF basis(1)

HEYDUDE ranked #1 in casual footwear for men and women in L.E.K.

report on footwear and apparel brand heat

• HEYDUDE ranked #8 preferred footwear brand for teens, up from Spring

'22, in Piper Sandler's Spring 2023 Taking Stock with Teens Survey

●

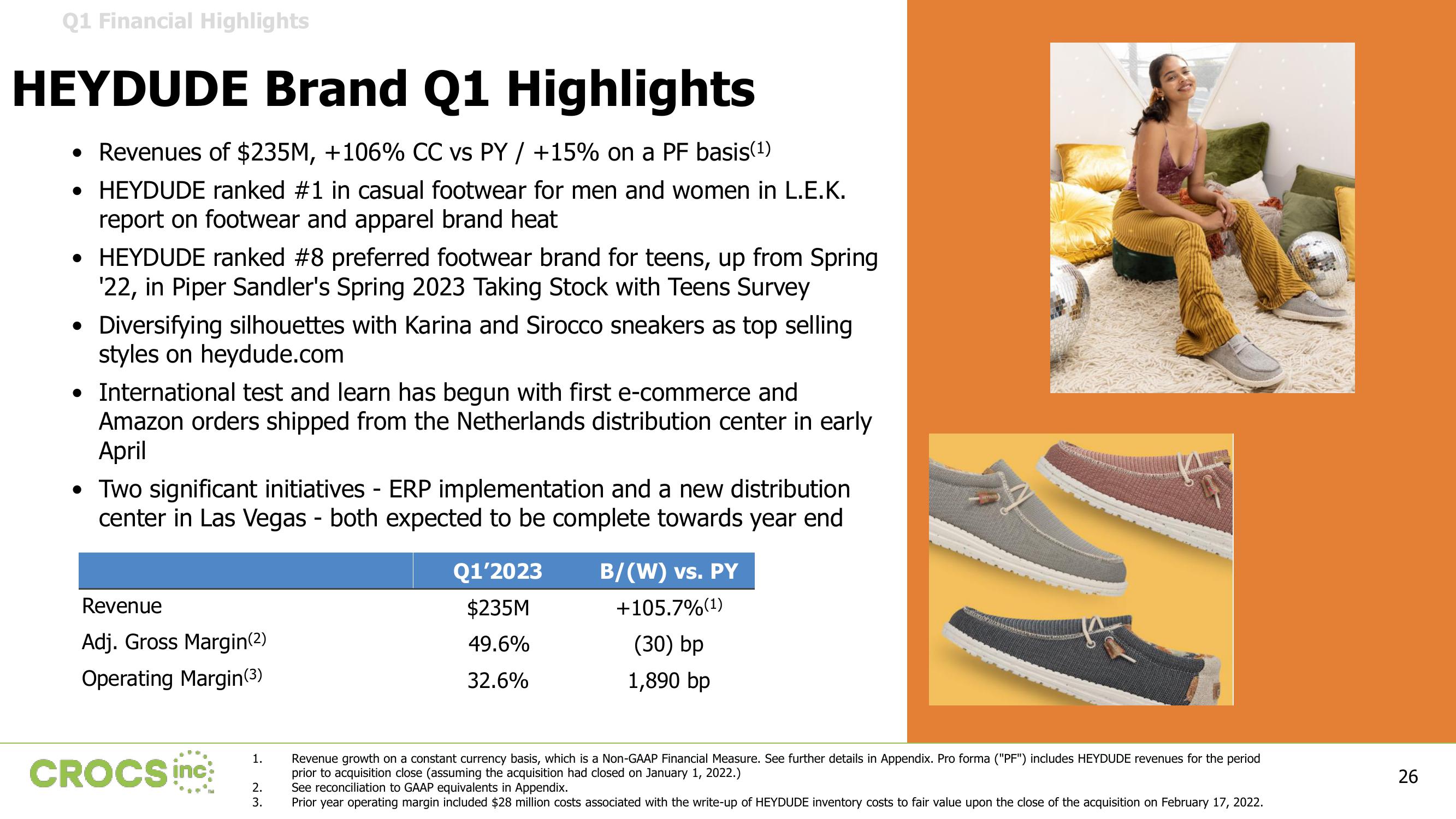

Diversifying silhouettes with Karina and Sirocco sneakers as top selling

styles on heydude.com

• International test and learn has begun with first e-commerce and

Amazon orders shipped from the Netherlands distribution center in early

April

• Two significant initiatives - ERP implementation and a new distribution

center in Las Vegas - both expected to be complete towards year end

Revenue

Adj. Gross Margin(2)

Operating Margin(3)

CROCS inc

1.

2.

3.

Q1'2023

$235M

49.6%

32.6%

B/(W) vs. PY

+105.7% (1)

(30) bp

1,890 bp

prants &

Revenue growth on a constant currency basis, which is a Non-GAAP Financial Measure. See further details in Appendix. Pro forma ("PF") includes HEYDUDE revenues for the period

prior to acquisition close (assuming the acquisition had closed on January 1, 2022.)

See reconciliation to GAAP equivalents in Appendix.

Prior year operating margin included $28 million costs associated with the write-up of HEYDUDE inventory costs to fair value upon the close of the acquisition on February 17, 2022.

26View entire presentation