J.P.Morgan Results Presentation Deck

JPMORGAN CHASE & CO.

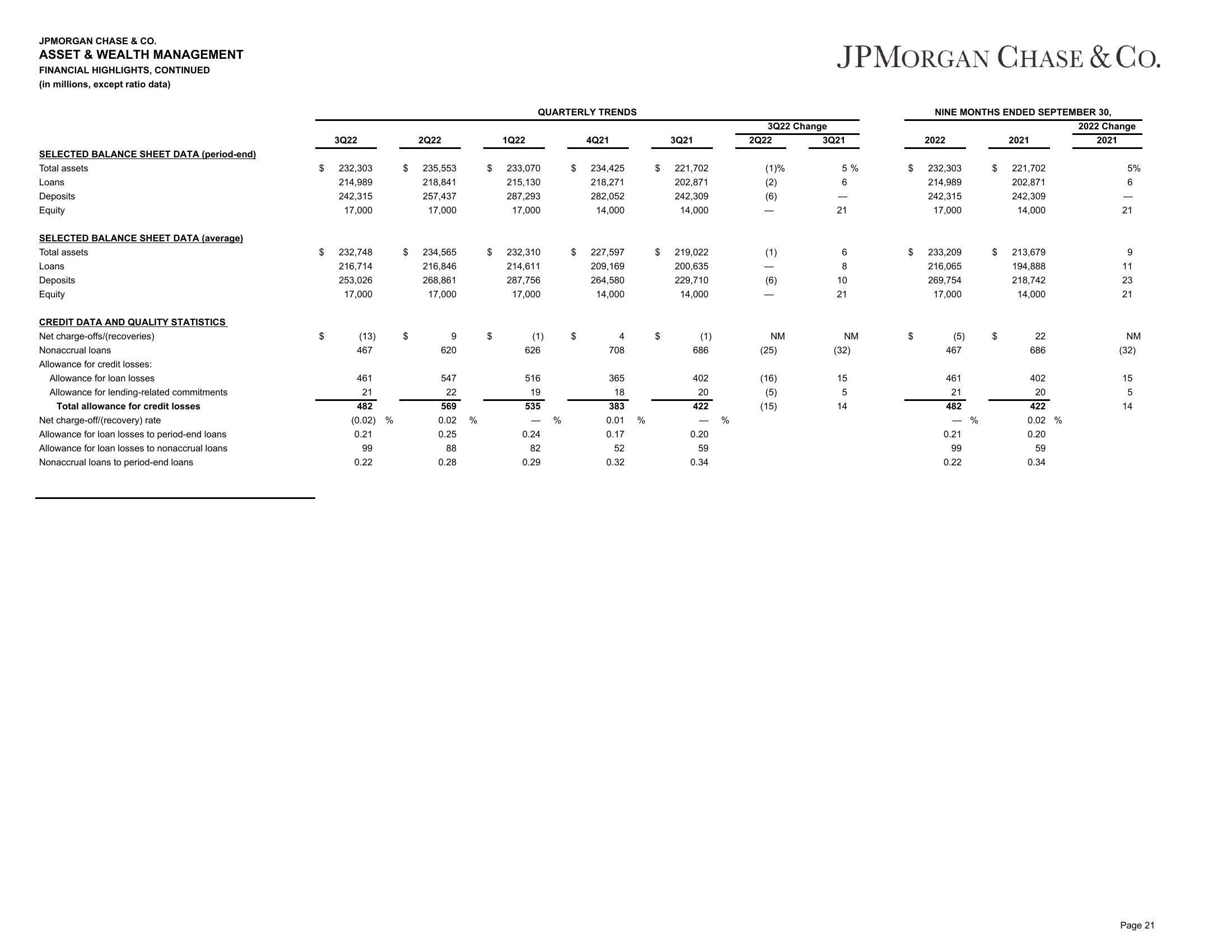

ASSET & WEALTH MANAGEMENT

FINANCIAL HIGHLIGHTS, CONTINUED

(in millions, except ratio data)

SELECTED BALANCE SHEET DATA (period-end)

Total assets

Loans

Deposits

Equity

SELECTED BALANCE SHEET DATA (average)

Total assets

Loans

Deposits

Equity

CREDIT DATA AND QUALITY STATISTICS

Net charge-offs/(recoveries)

Nonaccrual loans

Allowance for credit losses:

Allowance for loan losses

Allowance for lending-related commitments

Total allowance for credit losses

Net charge-off/(recovery) rate

Allowance for loan losses to period-end loans

Allowance for loan losses to nonaccrual loans

Nonaccrual loans to period-end loans

$ 232,303

214,989

242,315

17,000

$

3Q22

$

232,748

216,714

253,026

17,000

(13)

467

461

21

482

(0.02) %

0.21

99

0.22

$ 235,553

218,841

257,437

17,000

$

2Q22

$

234,565

216,846

268,861

17,000

9

620

547

22

569

0.02 %

0.25

88

0.28

$

1Q22

$ 233,070

215,130

287,293

17,000

$

QUARTERLY TRENDS

232,310

214,611

287,756

17,000

(1)

626

516

19

535

0.24

82

0.29

do

%

4Q21

$ 234,425

218,271

282,052

14,000

$ 227,597

209,169

264,580

14,000

$

4

708

365

18

383

0.01 %

0.17

52

0.32

$

3Q21

$

221,702

202,871

242,309

14,000

$ 219,022

200,635

229,710

14,000

(1)

686

402

20

422

0.20

59

0.34

do

%

3Q22 Change

2Q22

(1)%

(2)

(6)

(1)

101

NM

(25)

(16)

(5)

(15)

JPMORGAN CHASE & CO.

3Q21

5%

6

21

6

8

10

21

NM

(32)

15

5

14

$

$

$

NINE MONTHS ENDED SEPTEMBER 30,

2022

232,303

214,989

242,315

17,000

233,209

216,065

269,754

17,000

(5)

467

461

21

482

0.21

99

0.22

%

$

$

2021

221,702

202,871

242,309

14,000

213,679

194,888

218,742

14,000

22

686

402

20

422

0.02%

0.20

59

0.34

2022 Change

2021

5%

6

21

9

11

23

21

NM

(32)

15

5

14

Page 21View entire presentation