Barclays Credit Presentation Deck

STRATEGY, TARGETS

& GUIDANCE

7.3

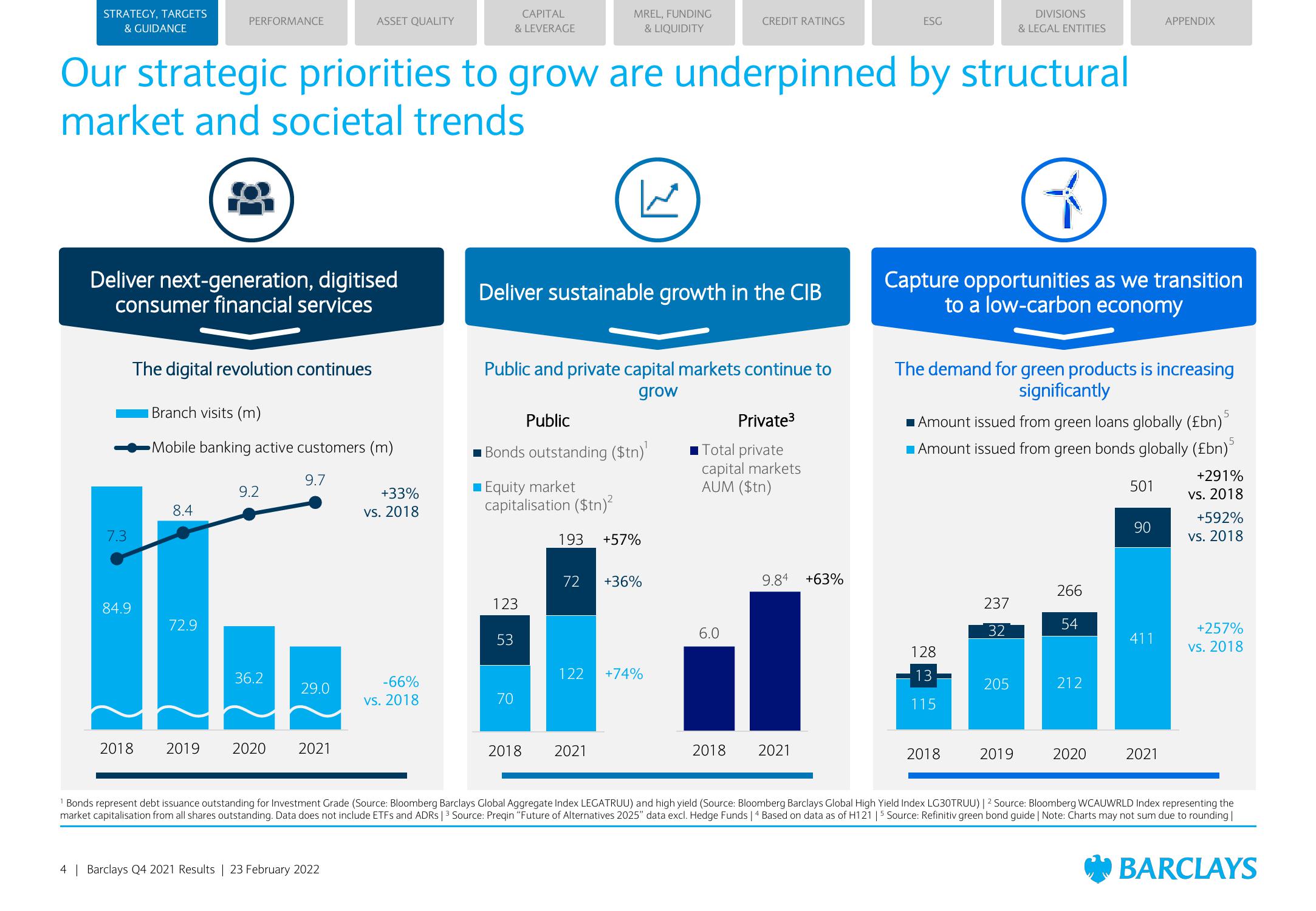

Deliver next-generation, digitised

consumer financial services

84.9

PERFORMANCE

The digital revolution continues

Branch visits (m)

Mobile banking active customers (m)

9.7

2018

8.4

Our strategic priorities to grow are underpinned by structural

market and societal trends

72.9

9.2

36.2

ASSET QUALITY

29.0

2019 2020 2021

4 | Barclays Q4 2021 Results | 23 February 2022

+33%

vs. 2018

-66%

vs. 2018

CAPITAL

& LEVERAGE

Deliver sustainable growth in the CIB

123

53

MREL, FUNDING

& LIQUIDITY

Public and private capital markets continue to

grow

Public

Bonds outstanding ($tn)¹

■ Equity market

capitalisation ($tn)²

70

2018

193 +57%

مرا

72 +36%

122 +74%

2021

CREDIT RATINGS

Private³

■Total private

capital markets

AUM ($tn)

6.0

2018

9.84

2021

ESG

+63%

Capture opportunities as we transition

to a low-carbon economy

128

13

115

The demand for green products is increasing

significantly

5

Amount issued from green loans globally (£bn)

Amount issued from green bonds globally (£bn)³

5

2018

DIVISIONS

& LEGAL ENTITIES

237

32

205

2019

266

54

212

2020

501

90

APPENDIX

411

2021

+291%

vs. 2018

+592%

vs. 2018

+257%

vs. 2018

1 Bonds represent debt issuance outstanding for Investment Grade (Source: Bloomberg Barclays Global Aggregate Index LEGATRUU) and high yield (Source: Bloomberg Barclays Global High Yield Index LG30TRUU) | 2 Source: Bloomberg WCAUWRLD Index representing the

market capitalisation from all shares outstanding. Data does not include ETFs and ADRS | 3 Source: Preqin "Future of Alternatives 2025" data excl. Hedge Funds | 4 Based on data as of H121 | 5 Source: Refinitiv green bond guide | Note: Charts may not sum due to rounding |

BARCLAYSView entire presentation