Tesla Results Presentation Deck

9

OTHER HIGHLIGHTS

Energy Storage

Energy storage deployments decreased by 11% YoY in Q2 to 1.1 GWh, mainly due to

semiconductor challenges, which are having a greater impact on our Energy

business than our Automotive business. Demand for our storage products remains in

excess of our ability to supply. We are in the process of ramping production at our

dedicated Megapack factory to address the growing demand.

Solar

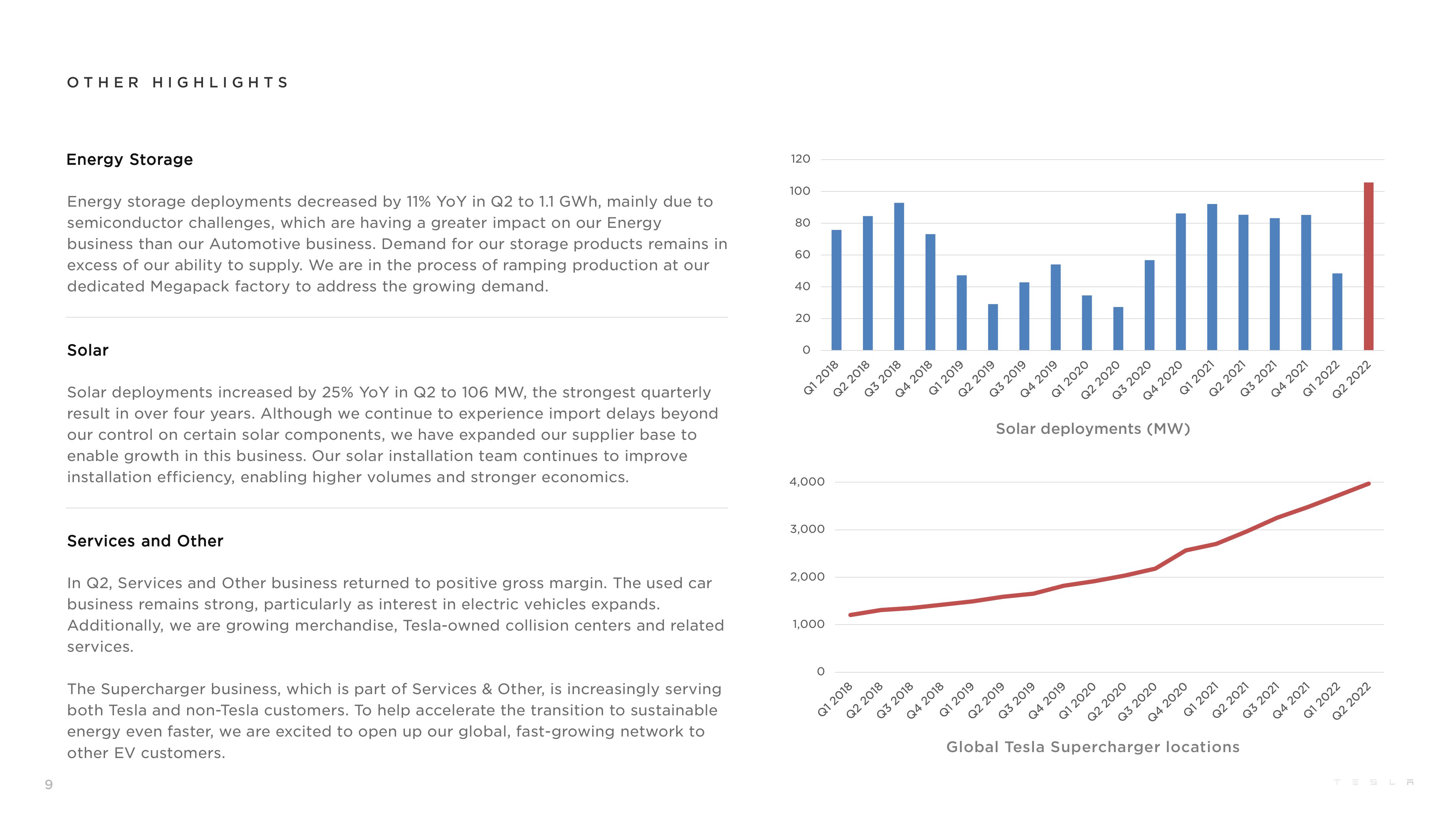

Solar deployments increased by 25% YoY in Q2 to 106 MW, the strongest quarterly

result in over four years. Although we continue to experience import delays beyond

our control on certain solar components, we have expanded our supplier base to

enable growth in this business. Our solar installation team continues to improve

installation efficiency, enabling higher volumes and stronger economics.

Services and Other

In Q2, Services and Other business returned to positive gross margin. The used car

business remains strong, particularly as interest in electric vehicles expands.

Additionally, we are growing merchandise, Tesla-owned collision centers and related

services.

The Supercharger business, which is part of Services & Other, is increasingly serving

both Tesla and non-Tesla customers. To help accelerate the transition to sustainable

energy even faster, we are excited to open up our global, fast-growing network to

other EV customers.

120

100

80

60

40

20

O

Q1 2018

4,000

3,000

2,000

1,000

O

Q2 2018

Q1 2018

Q3 2018

Q4 2018

Q2 2018

Q3 2018

Q1 2019

Q2 2019

Q1 2019

Q4 2018

H

Q3 2019

Q2 2019

Q4 2019

Q1 2020

Q3 2019

Q2 2020

Q4 2019

Solar deployments (MW)

Q1 2020

Q3 2020

Q2 2020

Q3 2020

Q4 2020

Q1 2021

Q4 2020

Q2 2021

Q1 2021

Q3 2021

Q2 2021

Global Tesla Supercharger locations

Q3 2021

Q4 2021

Q4 2021

Q1 2022

Q2 2022

Q1 2022

Q2 2022

TESLAView entire presentation