TradeStation SPAC Presentation Deck

38

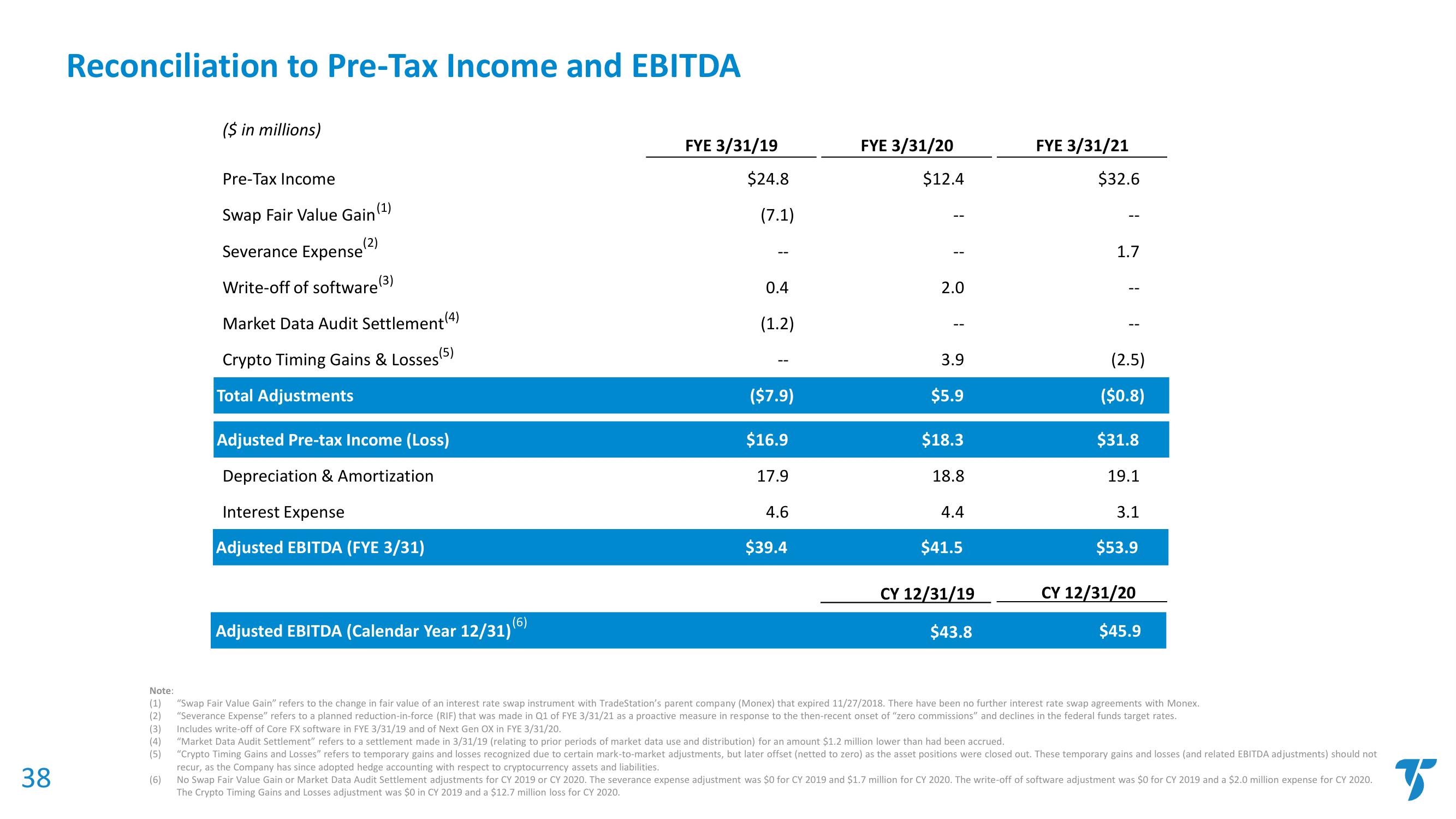

Reconciliation to Pre-Tax Income and EBITDA

($ in millions)

(3)

(4)

(5)

(6)

Pre-Tax Income

Swap Fair Value Gain

(2)

(1)

Severance Expense"

Write-off of software (3)

Market Data Audit Settlement (4)

Crypto Timing Gains & Losses (5)

Total Adjustments

Adjusted Pre-tax Income (Loss)

Depreciation & Amortization

Interest Expense

Adjusted EBITDA (FYE 3/31)

(6)

Adjusted EBITDA (Calendar Year 12/31)

FYE 3/31/19

$24.8

(7.1)

0.4

(1.2)

($7.9)

$16.9

17.9

4.6

$39.4

FYE 3/31/20

$12.4

2.0

3.9

$5.9

$18.3

18.8

4.4

$41.5

CY 12/31/19

$43.8

FYE 3/31/21

$32.6

1.7

1

(2.5)

($0.8)

$31.8

19.1

3.1

$53.9

CY 12/31/20

$45.9

Note:

(1) "Swap Fair Value Gain" refers to the change in fair value of an interest rate swap instrument with TradeStation's parent company (Monex) that expired 11/27/2018. There have been no further interest rate swap agreements with Monex.

(2) "Severance Expense" refers to a planned reduction-in-force (RIF) that was made in Q1 of FYE 3/31/21 as a proactive measure in response to the then-recent onset of "zero commissions" and declines in the federal funds target rates.

Includes write-off of Core FX software in FYE 3/31/19 and of Next Gen OX in FYE 3/31/20.

"Market Data Audit Settlement" refers to a settlement made in 3/31/19 (relating to prior periods of market data use and distribution) for an amount $1.2 million lower than had been accrued.

"Crypto Timing Gains and Losses" refers to temporary gains and losses recognized due to certain mark-to-market adjustments, but later offset (netted to zero) as the asset positions were closed out. These temporary gains and losses (and related EBITDA adjustments) should not

recur, as the Company has since adopted hedge accounting with respect to cryptocurrency assets and liabilities.

B

No Swap Fair Value Gain or Market Data Audit Settlement adjustments for CY 2019 or CY 2020. The severance expense adjustment was $0 for CY 2019 and $1.7 million for CY 2020. The write-off of software adjustment was $0 for CY 2019 and a $2.0 million expense for CY 2020.

The Crypto Timing Gains and Losses adjustment was $0 in CY 2019 and a $12.7 million loss for CY 2020.View entire presentation