J.P.Morgan Results Presentation Deck

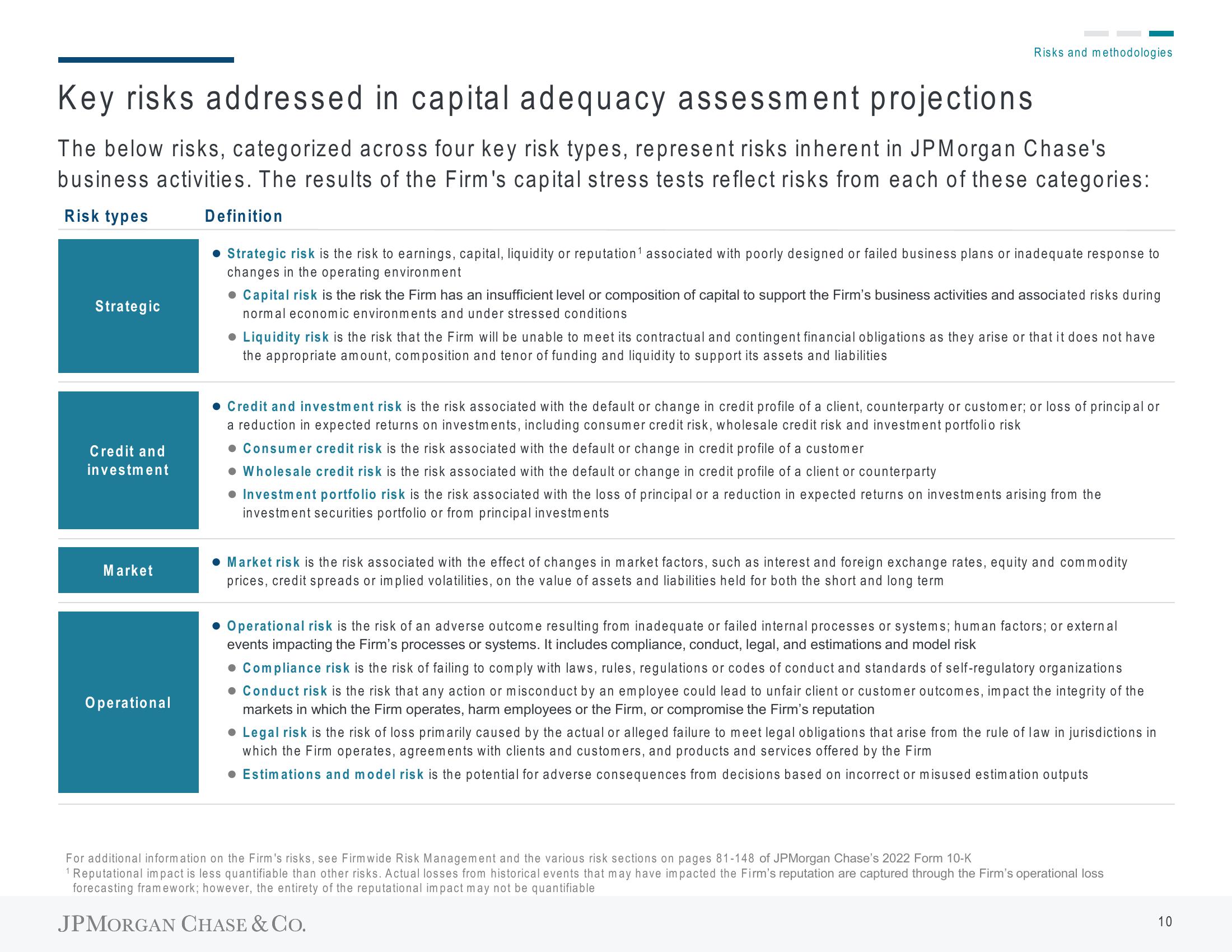

Key risks addressed in capital adequacy assessment projections

The below risks, categorized across four key risk types, represent risks inherent in JPMorgan Chase's

business activities. The results of the Firm's capital stress tests reflect risks from each of these categories:

Risk types

Strategic

Credit and

investment

Market

Operational

Risks and methodologies

Definition

• Strategic risk is the risk to earnings, capital, liquidity or reputation¹ associated with poorly designed or failed business plans or inadequate response to

changes in the operating environment

● Capital risk is the risk the Firm has an insufficient level or composition of capital to support the Firm's business activities and associated risks during

normal economic environments and under stressed conditions

• Liquidity risk is the risk that the Firm will be unable to meet its contractual and contingent financial obligations as they arise or that it does not have

the appropriate amount, composition and tenor of funding and liquidity to support its assets and liabilities

● Credit and investment risk is the risk associated with the default or change in credit profile of a client, counterparty or customer; or loss of principal or

a reduction in expected returns on investments, including consumer credit risk, wholesale credit risk and investment portfolio risk

• Consumer credit risk is the risk associated with the default or change in credit profile of a customer

• Wholesale credit risk is the risk associated with the default or change in credit profile of a client or counterparty

• Investment portfolio risk is the risk associated with the loss of principal or a reduction in expected returns on investments arising from the

investment securities portfolio or from principal investments

• Market risk is the risk associated with the effect of changes in market factors, such as interest and foreign exchange rates, equity and commodity

prices, credit spreads or implied volatilities, on the value of assets and liabilities held for both the short and long term

• Operational risk is the risk of an adverse outcome resulting from inadequate or failed internal processes or systems; human factors; or external

events impacting the Firm's processes or systems. It includes compliance, conduct, legal, and estimations and model risk

• Compliance risk is the risk of failing to comply with laws, rules, regulations or codes of conduct and standards of self-regulatory organizations

• Conduct risk is the risk that any action or misconduct by an employee could lead to unfair client or customer outcomes, impact the integrity of the

markets in which the Firm operates, harm employees or the Firm, or compromise the Firm's reputation

• Legal risk is the risk of loss primarily caused by the actual or alleged failure to meet legal obligations that arise from the rule of law in jurisdictions in

which the Firm operates, agreements with clients and customers, and products and services offered by the Firm

• Estimations and model risk is the potential for adverse consequences from decisions based on incorrect or misused estimation outputs

For additional information on the Firm's risks, see Firmwide Risk Management and the various risk sections on pages 81-148 of JPMorgan Chase's 2022 Form 10-K

Reputational impact is less quantifiable than other risks. Actual losses from historical events that may have impacted the Firm's reputation are captured through the Firm's operational loss

forecasting framework; however, the entirety of the reputational impact may not be quantifiable

JPMORGAN CHASE & CO.

10View entire presentation