Ready Capital Investor Presentation Deck

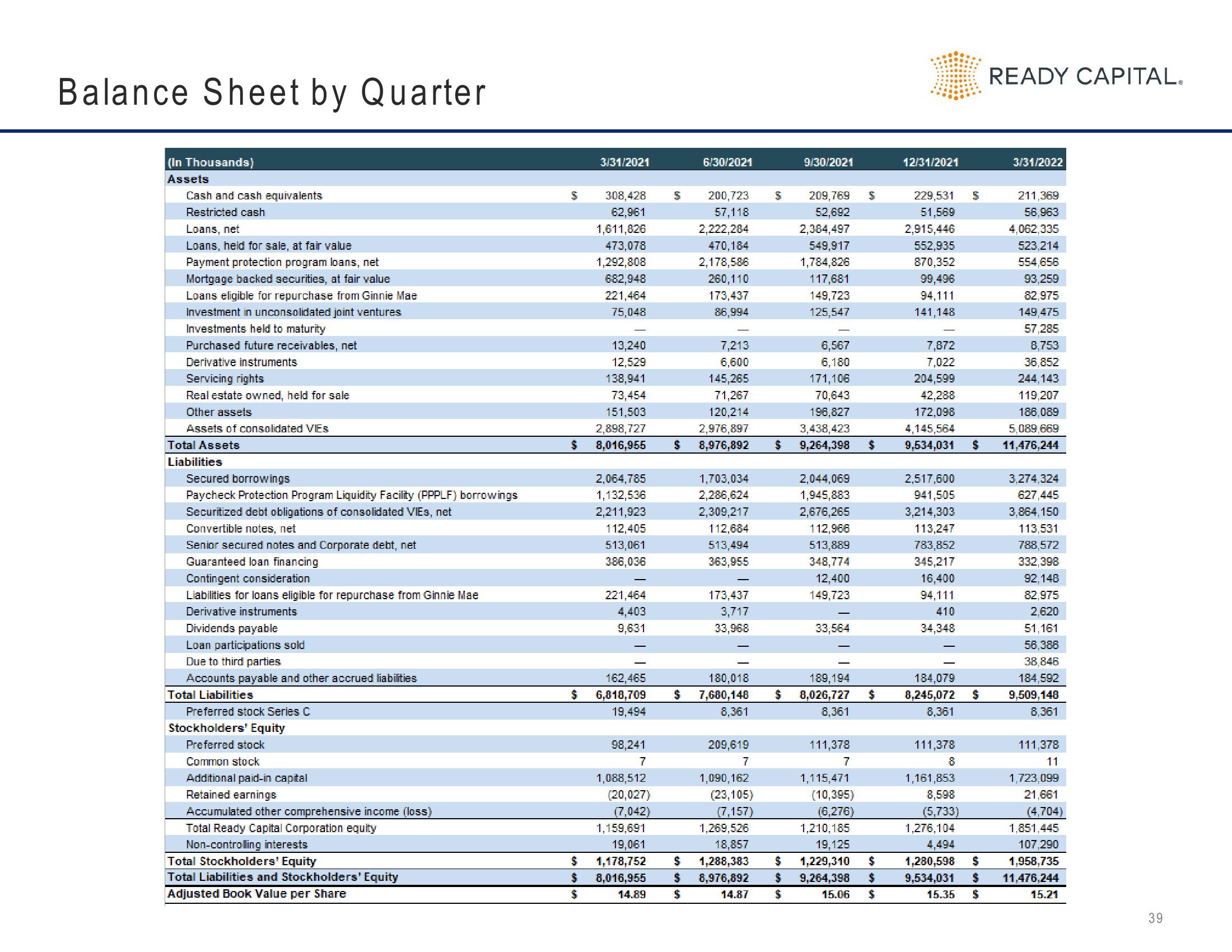

Balance Sheet by Quarter

(In Thousands)

Assets

Cash and cash equivalents

Restricted cash

Loans, net

Loans, held for sale, at fair value

Payment protection program loans, net

Mortgage backed securities, at fair value

Loans eligible for repurchase from Ginnie Mae

Investment in unconsolidated joint ventures

Investments held to maturity

Purchased future receivables, net

Derivative instruments

Servicing rights

Real estate owned, held for sale

Other assets

Assets of consolidated VIES

Total Assets

Liabilities

Secured borrowings

Paycheck Protection Program Liquidity Facility (PPPLF) borrowings

Securitized debt obligations of consolidated VIEs, net

Convertible notes, net

Senior secured notes and Corporate debt, net

Guaranteed loan financing

Contingent consideration

Liabilities for loans eligible for repurchase from Ginnie Mae

Derivative instruments

Dividends payable

Loan participations sold

Due to third parties

Accounts payable and other accrued liabilities

Total Liabilities

Preferred stock Series C

Stockholders' Equity

Preferred stock

Common stock

Additional paid-in capital

Retained earnings

Accumulated other comprehensive income (loss)

Total Ready Capital Corporation equity

Non-controlling interests

Total Stockholders' Equity

Total Liabilities and Stockholders' Equity

Adjusted Book Value per Share

S

3/31/2021

308,428

62,961

1,611,826

473,078

1,292,808

682,948

221,464

75,048

$

$

$

13,240

12,529

138,941

73,454

151,503

2,898,727

$ 8,016,955 $

2,064,785

1,132,536

2,211,923

112,405

513,061

386,036

221,464

4,403

9,631

162,465

$ 6,818,709

19,494

S

98,241

7

1,088,512

(20,027)

(7,042)

1,159,691

19,061

1,178,752 $

8,016,955

14.89

6/30/2021

$

200,723 S

57,118

2,222,284

470,184

2,178,586

260,110

173,437

86,994

7,213

6,600

145,265

71,267

120,214

2,976,897

8,976,892 $

1,703,034

2,286,624

2,309,217

112,684

513,494

363,955

180,018

$ 7,680,148

8,361

173,437

3,717

33,968

209,619

7

1,090,162

(23,105)

(7,157)

9/30/2021

209,769

52,692

2,384,497

549,917

1,784,826

117,681

149,723

125,547

6,567

6,180

171,106

70,643

196,827

3,438,423

9,264,398 $

2,044,069

1,945,883

2,676,265

112,966

513,889

348,774

12,400

149,723

33,564

S

189,194

$ 8,026,727 $

8,361

111,378

7

1,115,471

(10,395)

(6,276)

1,210,185

19,125

1,269,526

18,857

1,288,383 $ 1,229,310 $

8,976,892 $ 9,264,398 $

14.87 $

15.06

$

12/31/2021

229,531

51,569

2,915,446

552,935

870,352

99,496

94,111

141,148

7,872

7,022

211,369

56,963

4,062,335

523,214

554,656

93,259

82,975

149,475

57,285

8,753

36,852

204,599

244,143

119,207

42,288

172,098

186,089

4,145,564

5,089,669

9,534,031 $ 11,476,244

2,517,600

941,505

3,214,303

113,247

783,852

345,217

16,400

94,111

410

34,348

184,079

8,245,072

8,361

111,378

S

1,161,853

8,598

(5,733)

1,276,104

$

READY CAPITAL.

4,494

1,280,598 $

9,534,031 $

15.35 $

3/31/2022

3,274,324

627,445

3,864,150

113,531

788,572

332,398

92,148

82,975

2,620

51,161

56,386

38,846

184,592

9,509,148

8,361

111,378

11

1,723,099

21,661

(4,704)

1,851,445

107,290

1,958,735

11,476,244

15.21

39View entire presentation