Avantor Results Presentation Deck

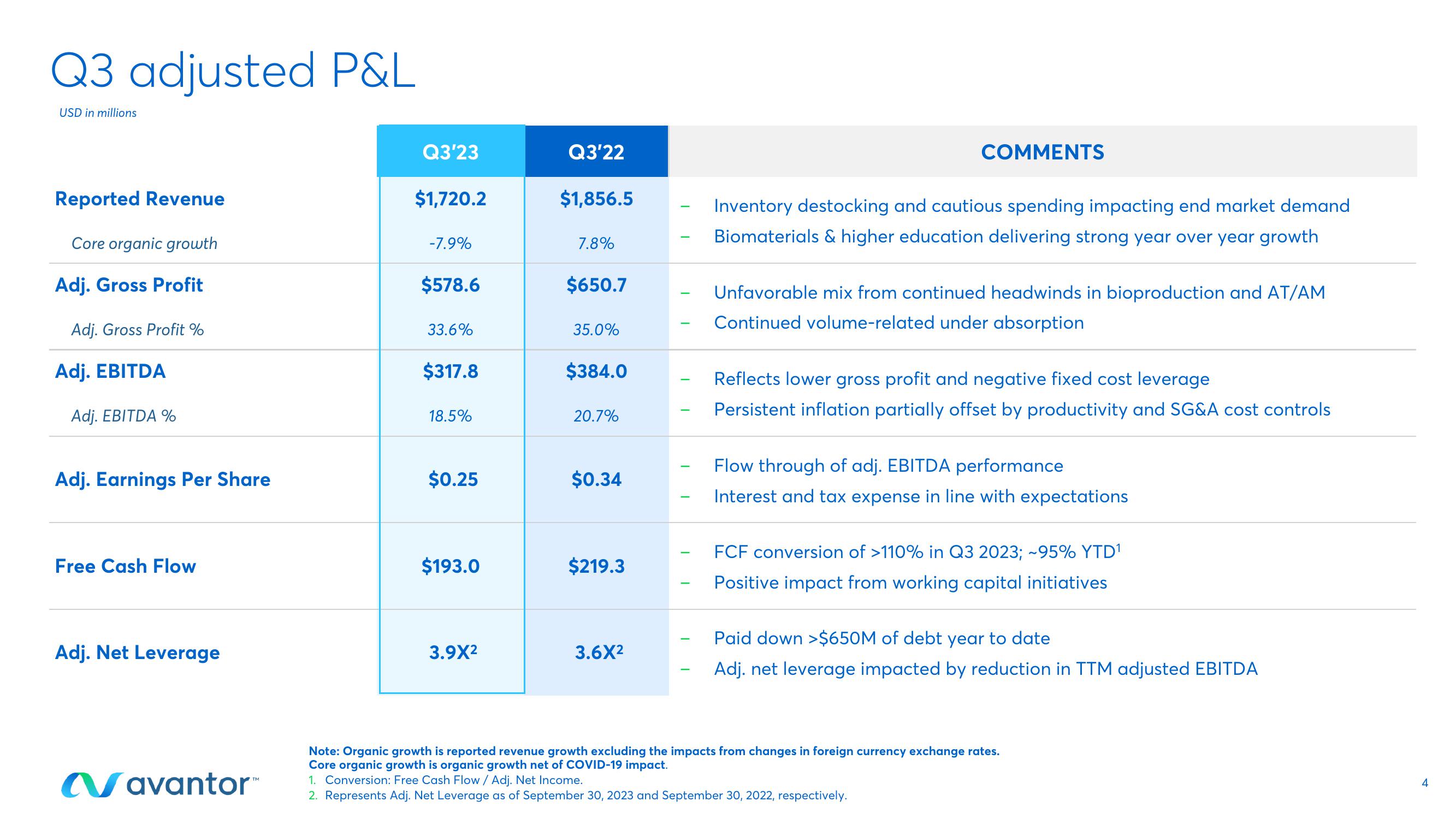

Q3 adjusted P&L

USD in millions

Reported Revenue

Core organic growth

Adj. Gross Profit

Adj. Gross Profit %

Adj. EBITDA

Adj. EBITDA %

Adj. Earnings Per Share

Free Cash Flow

Adj. Net Leverage

Navantor™

Q3'23

$1,720.2

-7.9%

$578.6

33.6%

$317.8

18.5%

$0.25

$193.0

3.9X²

Q3'22

$1,856.5

7.8%

$650.7

35.0%

$384.0

20.7%

$0.34

$219.3

3.6X²

-

-

-

-

-

COMMENTS

Inventory destocking and cautious spending impacting end market demand

Biomaterials & higher education delivering strong year over year growth

Unfavorable mix from continued headwinds in bioproduction and AT/AM

Continued volume-related under absorption

Reflects lower gross profit and negative fixed cost leverage

Persistent inflation partially offset by productivity and SG&A cost controls

Flow through of adj. EBITDA performance

Interest and tax expense in line with expectations

FCF conversion of >110% in Q3 2023; -95% YTD¹

Positive impact from working capital initiatives

Paid down >$650M of debt year to date

Adj. net leverage impacted by reduction in TTM adjusted EBITDA

Note: Organic growth is reported revenue growth excluding the impacts from changes in foreign currency exchange rates.

Core organic growth is organic growth net of COVID-19 impact.

1. Conversion: Free Cash Flow / Adj. Net Income.

2. Represents Adj. Net Leverage as of September 30, 2023 and September 30, 2022, respectively.

4View entire presentation