Tripadvisor Results Presentation Deck

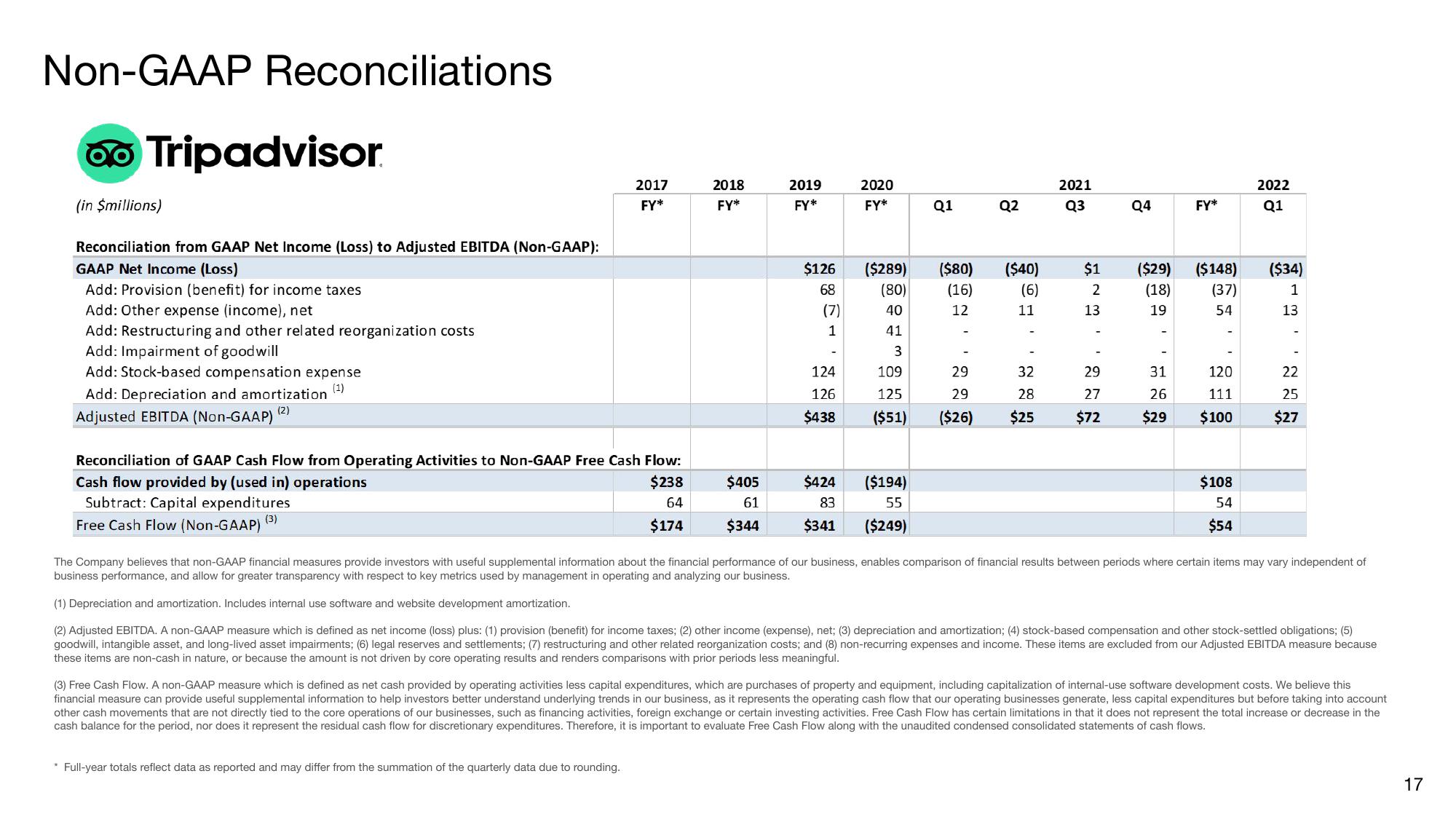

Non-GAAP Reconciliations

a Tripadvisor

(in $millions)

Reconciliation from GAAP Net Income (Loss) to Adjusted EBITDA (Non-GAAP):

GAAP Net Income (Loss)

Add: Provision (benefit) for income taxes

Add: Other expense (income), net

Add: Restructuring and other related reorganization costs

Add: Impairment of goodwill

Add: Stock-based compensation expense

Add: Depreciation and amortization (¹)

(2)

Adjusted EBITDA (Non-GAAP)

2017

FY*

Reconciliation of GAAP Cash Flow from Operating Activities to Non-GAAP Free Cash Flow:

Cash flow provided by (used in) operations

$238

64

Subtract: Capital expenditures

Free Cash Flow (Non-GAAP)

(3)

$174

2018

FY*

* Full-year totals reflect data as reported and may differ from the summation of the quarterly data due to rounding.

$405

61

$344

2019

FY*

$126

68

(7)

1

124

126

$438

$424

83

$341

2020

FY*

($289)

(80)

40

41

3

109

125

($51)

($194)

55

($249)

Q1

($80)

(16)

12

Q2

($40)

(6)

11

2021

Q3

$1

2

13

29

32

29

29

27

28

($26) $25 $72

Q4

FY*

31

26

$29

($29) ($148) ($34)

(18) (37)

1

19

54

13

120

111

$100

2022

Q1

$108

54

$54

22

25

$27

The Company believes that non-GAAP financial measures provide investors with useful supplemental information about the financial performance of our business, enables comparison of financial results between periods where certain items may vary independent of

business performance, and allow for greater transparency with respect to key metrics used by management in operating and analyzing our business.

(1) Depreciation and amortization. Includes internal use software and website development amortization.

(2) Adjusted EBITDA. A non-GAAP measure which is defined as net income (loss) plus: (1) provision (benefit) for income taxes; (2) other income (expense), net; (3) depreciation and amortization; (4) stock-based compensation and other stock-settled obligations; (5)

goodwill, intangible asset, and long-lived asset impairments; (6) legal reserves and settlements; (7) restructuring and other related reorganization costs; and (8) non-recurring expenses and income. These items are excluded from our Adjusted EBITDA measure because

these items are non-cash in nature, or because the amount is not driven by core operating results and renders comparisons with prior periods less meaningful.

(3) Free Cash Flow. A non-GAAP measure which is defined as net cash provided by operating activities less capital expenditures, which are purchases of property and equipment, including capitalization of internal-use software development costs. We believe this

financial measure can provide useful supplemental information to help investors better understand underlying trends in our business, as it represents the operating cash flow that our operating businesses generate, less capital expenditures but before taking into account

other cash movements that are not directly tied to the core operations of our businesses, such as financing activities, foreign exchange or certain investing activities. Free Cash Flow has certain limitations in that it does not represent the total increase or decrease in the

cash balance for the period, nor does it represent the residual cash flow for discretionary expenditures. Therefore, it is important to evaluate Free Cash Flow along with the unaudited condensed consolidated statements of cash flows.

17View entire presentation