Truist Financial Corp Results Presentation Deck

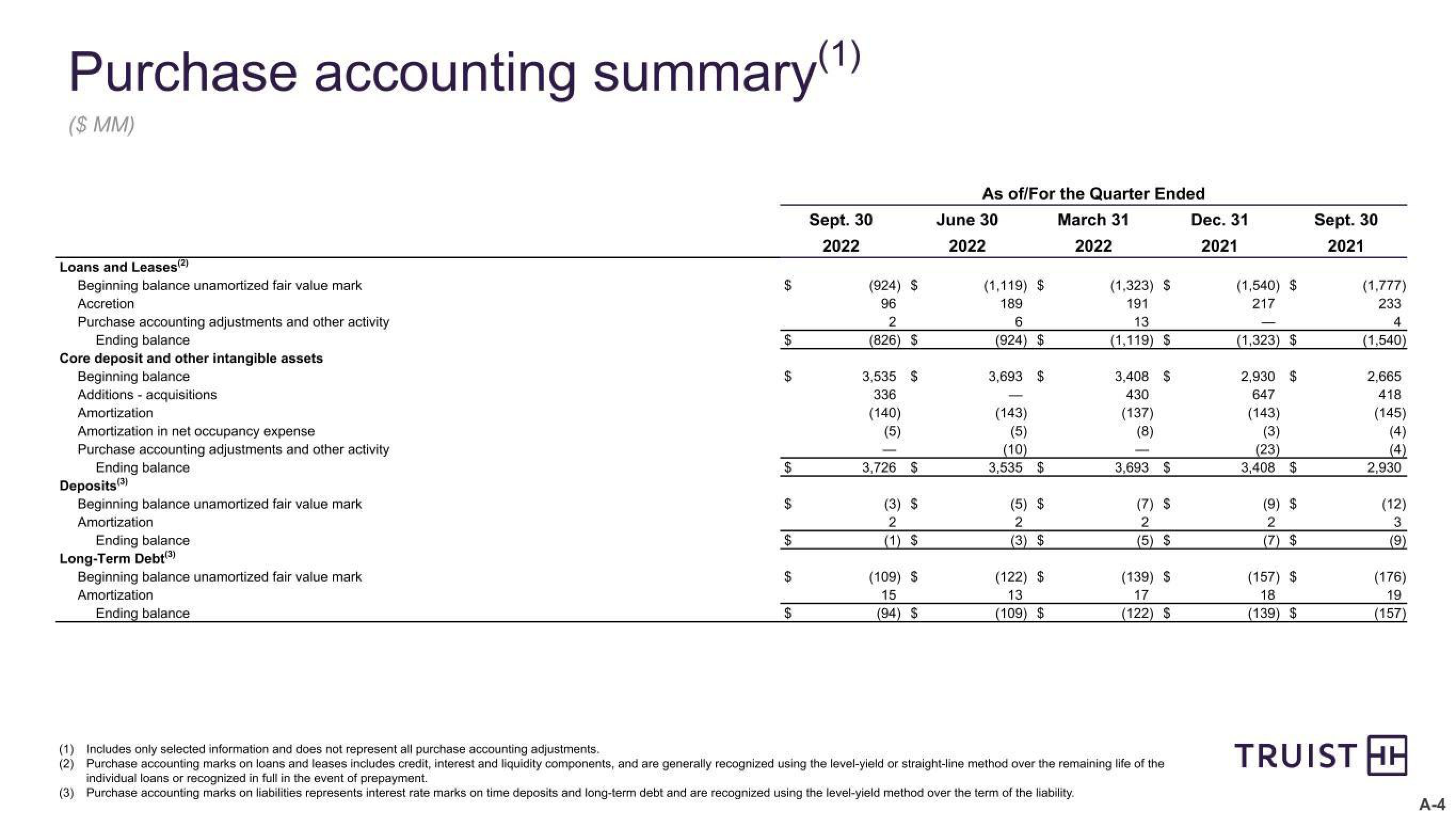

Purchase accounting summary(1)

($ MM)

Loans and Leases (²)

Beginning balance unamortized fair value mark

Accretion

Purchase accounting adjustments and other activity

Ending balance

Core deposit and other intangible assets

Beginning balance

Additions - acquisitions

Amortization

Amortization in net occupancy expense

Purchase accounting adjustments and other activity

Ending balance

Deposits (3)

Beginning balance unamortized fair value mark

Amortization

Ending balance

Long-Term Debt(3)

Beginning balance unamortized fair value mark

Amortization

Ending balance

$

$

69

$

$

$

so

$

Sept. 30

2022

(924) $

96

2

(826) $

3,535 $

336

(140)

(5)

3,726 $

(3) $

2

(1) S

(109) S

15

(94) $

As of/For the Quarter Ended

March 31

2022

June 30

2022

(1,119) $

189

6

(924) $

3,693 $

(143)

(5)

(10)

3,535 $

(5) $

2

(3) $

(122) $

13

(109) $

(1,323) S

191

13

(1,119) $

3,408 $

430

(137)

(8)

3,693 $

60

(7)

2

(5) $

(139) S

17

(122) S

(1) Includes only selected information and does not represent all purchase accounting adjustments.

(2) Purchase accounting marks on loans and leases includes credit, interest and liquidity components, and are generally recognized using the level-yield or straight-line method over the remaining life of the

individual loans or recognized in full in the event of prepayment.

(3) Purchase accounting marks on liabilities represents interest rate marks on time deposits and long-term debt and are recognized using the level-yield method over the term of the liability.

Dec. 31

2021

(1,540) $

217

(1,323) $

2,930 $

647

(143)

(3)

(23)

3,408 $

(9) $

2

(7) $

(157) $

18

(139) $

Sept. 30

2021

(1,777)

233

4

(1,540)

2,665

418

(145)

(4)

(4)

2,930

(12)

3

19

(176)

19

(157)

TRUIST HH

A-4View entire presentation