Melrose Results Presentation Deck

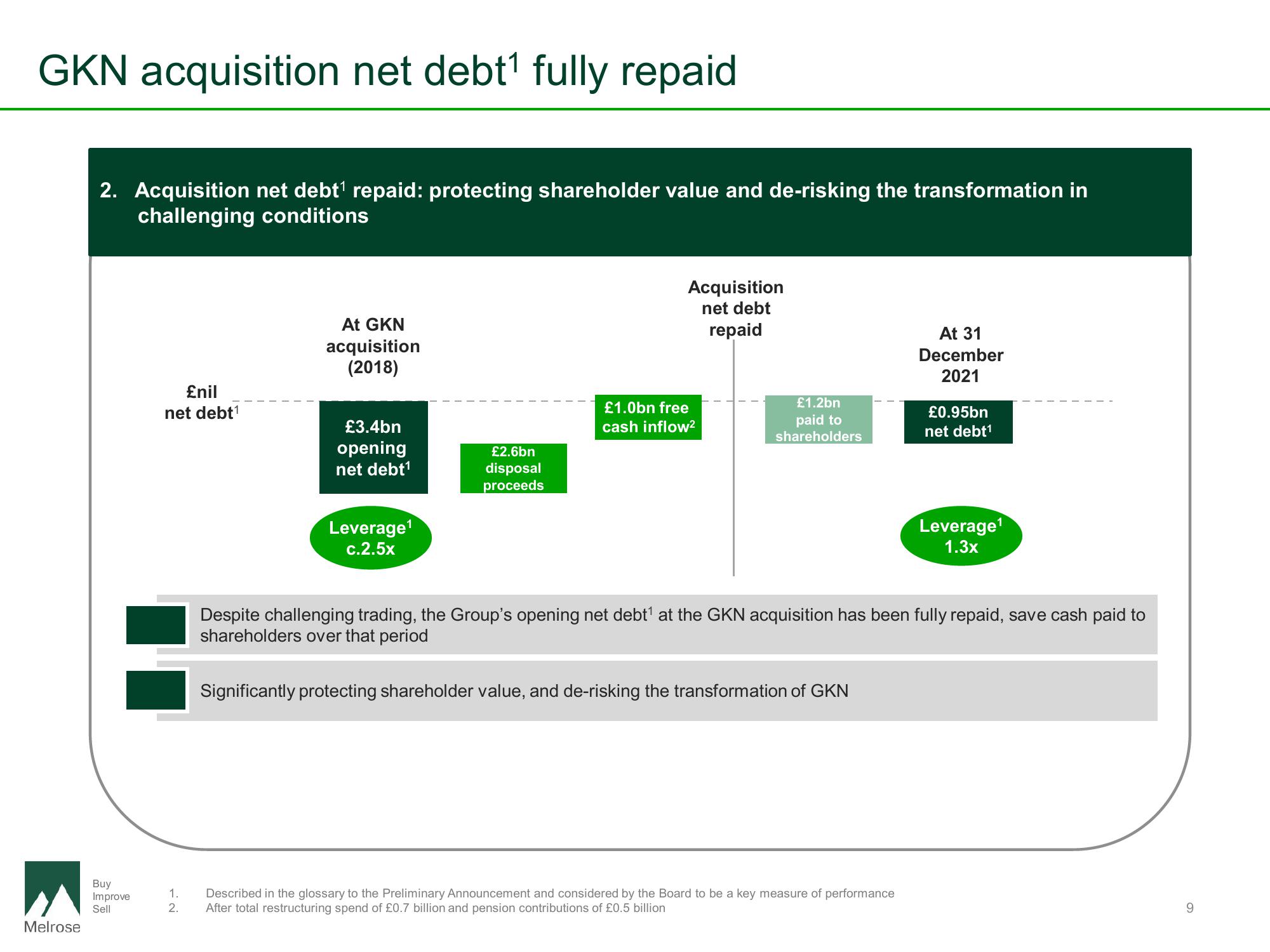

GKN acquisition net debt¹ fully repaid

Melrose

2. Acquisition net debt¹ repaid: protecting shareholder value and de-risking the transformation in

challenging conditions

Buy

Improve

Sell

£nil

net debt¹

At GKN

acquisition

(2018)

£3.4bn

opening

net debt¹

Leverage¹

c.2.5x

£2.6bn

disposal

proceeds

Acquisition

net debt

repaid

£1.0bn free

cash inflow²

£1.2bn

paid to

shareholders

Significantly protecting shareholder value, and de-risking the transformation of GKN

At 31

December

2021

1. Described in the glossary to the Preliminary Announcement and considered by the Board to be a key measure of performance

2. After total restructuring spend of £0.7 billion and pension contributions of £0.5 billion

£0.95bn

net debt¹

Despite challenging trading, the Group's opening net debt¹ at the GKN acquisition has been fully repaid, save cash paid to

shareholders over that period

Leverage¹

1.3x

9View entire presentation