Foxo SPAC Presentation Deck

Implied Valuation

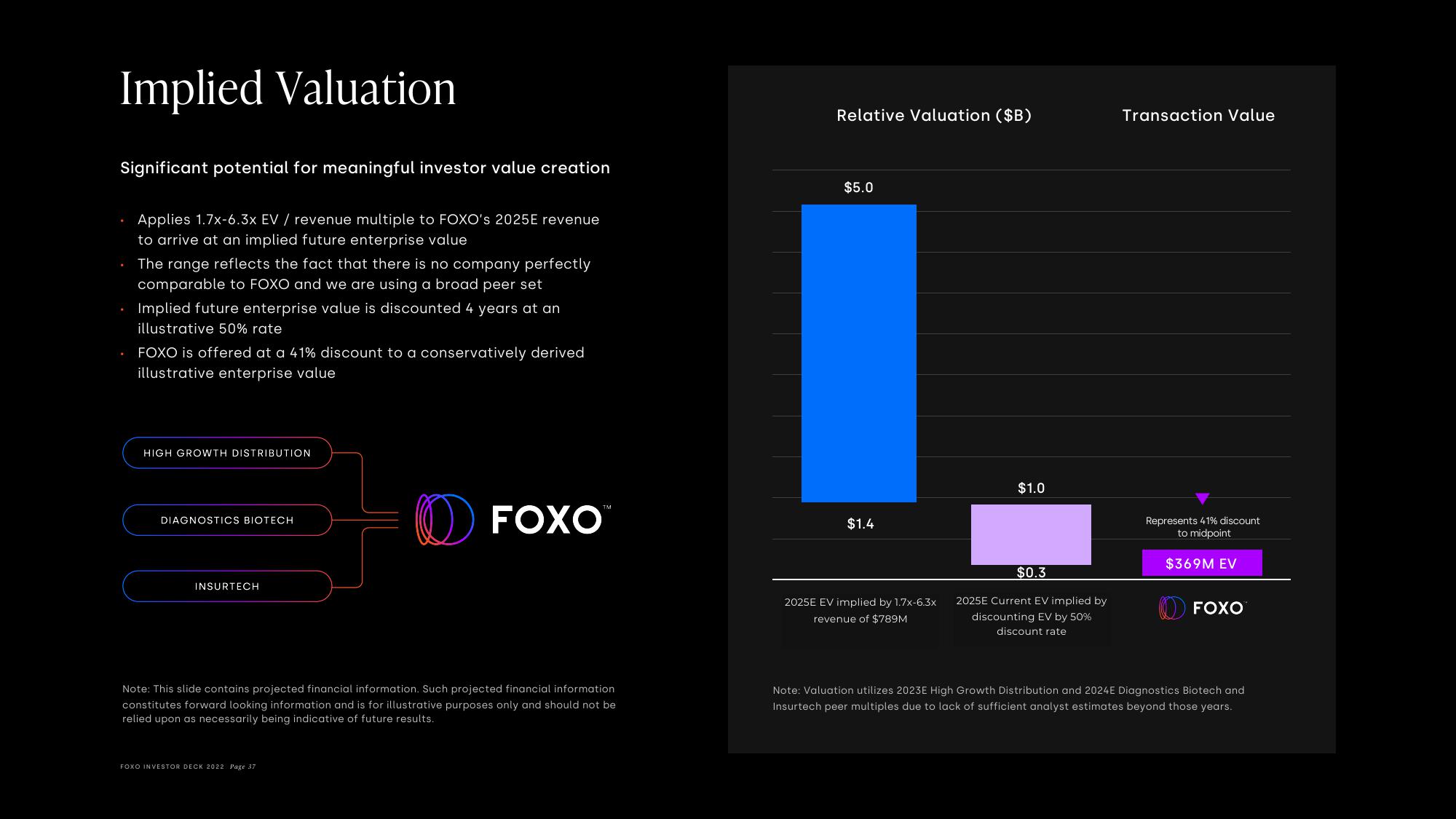

Significant potential for meaningful investor value creation

Applies 1.7x-6.3x EV / revenue multiple to FOXO's 2025E revenue

to arrive at an implied future enterprise value

The range reflects the fact that there is no company perfectly

comparable to FOXO and we are using a broad peer set

Implied future enterprise value is discounted 4 years at an

illustrative 50% rate

FOXO is offered at a 41% discount to a conservatively derived

illustrative enterprise value

HIGH GROWTH DISTRIBUTION

DIAGNOSTICS BIOTECH

INSURTECH

FOXO™

Note: This slide contains projected financial information. Such projected financial information

constitutes forward looking information and is for illustrative purposes only and should not be

relied upon as necessarily being indicative of future results.

FOXO INVESTOR DECK 2022 Page 37

Relative Valuation ($B)

$5.0

$1.4

2025E EV implied by 1.7x-6.3x

revenue of $789M

$1.0

$0.3

2025E Current EV implied by

discounting EV by 50%

discount rate

Transaction Value

Represents 41% discount

to midpoint

$369M EV

FOXO

Note: Valuation utilizes 2023E High Growth Distribution and 2024E Diagnostics Biotech and

Insurtech peer multiples due to lack of sufficient analyst estimates beyond those years.View entire presentation