Affirm Results Presentation Deck

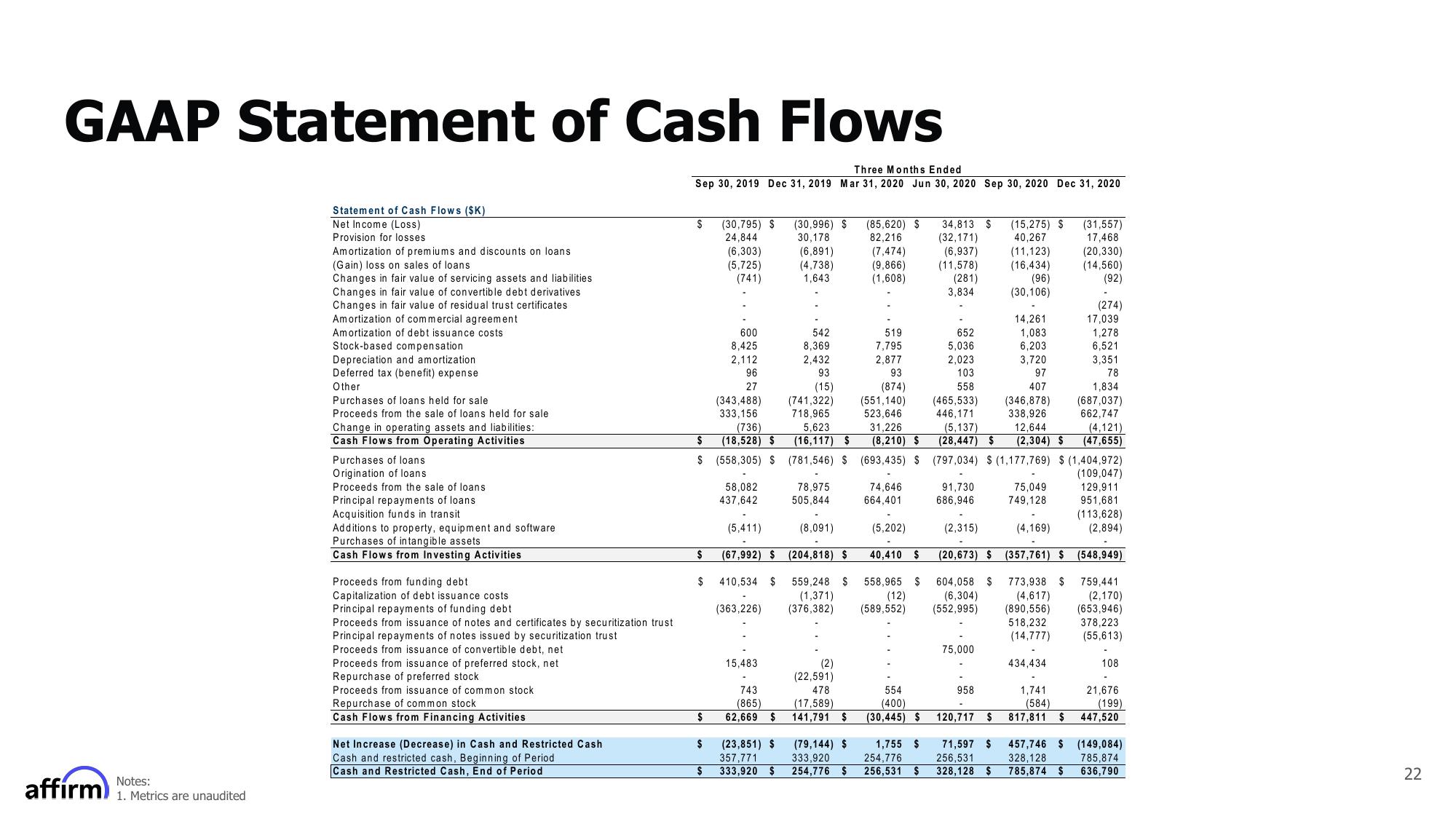

GAAP Statement of Cash Flows

affirm

Notes:

1. Metrics are unaudited

Statement of Cash Flows (SK)

Net Income (Loss)

Provision for losses

Amortization of premiums and discounts on loans

(Gain) loss on sales of loans

Changes in fair value of servicing assets and liabilities

Changes in fair value of convertible debt derivatives

Changes in fair value of residual trust certificates

Amortization of commercial agreement

Amortization of debt issuance costs

Stock-based compensation

Depreciation and amortization

Deferred tax (benefit) expense

Other

Purchases of loans held for sale

Proceeds from the sale of loans held for sale

Change in operating assets and liabilities:

Cash Flows from Operating Activities

Purchases of loans.

Origination of loans

Proceeds from the sale of loans

Principal repayments of loans

Acquisition funds in transit

Additions to property, equipment and software

Purchases of intangible assets

Cash Flows from Investing Activities

Proceeds from funding debt

Capitalization of debt issuance costs

Principal repayments of funding debt

Proceeds from issuance of notes and certificates by securitization trust

Principal repayments of notes issued by securitization trust

Proceeds from issuance of convertible debt, net

Proceeds from issuance of preferred stock, net

Repurchase of preferred stock

Proceeds from issuance of common stock

Repurchase of common stock

Cash Flows from Financing Activities

Net Increase (Decrease) in Cash and Restricted Cash

Cash and restricted cash, Beginning of Period

Cash and Restricted Cash, End of Period

Three Months Ended

Sep 30, 2019 Dec 31, 2019 Mar 31, 2020 Jun 30, 2020 Sep 30, 2020 Dec 31, 2020

$

$

(736)

(18,528) $

$

$ (558,305) $

$

$

(30,795) $ (30,996) $

24,844

30,178

(6,303) (6,891)

(5,725)

(741)

(4,738)

1.643

$

600

8,425

2,112

96

27

(343,488)

333,156

58,082

437,642

(5,411)

(67,992) $

410,534 $

(363,226)

15,483

-

743

(865)

62,669 $

(23,851) $

357,771

333,920 $

542

8,369

2,432

93

(15)

(741,322)

718,965

519

7,795

2,877

93

(874)

(551,140)

523,646

31,226

(8,210) $

(781,546) S (693,435) $

5,623

(16,117) $

78,975

505,844

(8,091)

(204,818) $

559,248 $

(1,371)

(376,382)

(2)

(22,591)

478

(17,589)

141,791 $

(85,620) $

82,216

(79,144) $

333,920

254,776 $

(7,474)

(9,866)

(1,608)

74,646

664,401

(5,202)

40,410 $

558,965 $

(12)

(589,552)

554

(400)

(30,445) $

34,813 $

(32,171)

(6,937)

(11,578)

(281)

3,834

91,730

686,946

(2,315)

(20,673) $

604,058 $

(6,304)

(552,995)

75,000

14,261

1,083

652

5,036

2,023

6,203

3,720

103

97

558

407

(465,533) (346,878)

446,171 338,926

(5,137)

12,644

(28,447) $

(2,304) $

(797,034) $ (1,177,769) $ (1,404,972)

(109,047)

129,911

951,681

(113,628)

(2,894)

(548,949)

759,441

(2,170)

(653,946)

378,223

(55,613)

958

120,717 $

(15,275) $

40,267

(11,123)

(16,434)

(96)

(30,106)

1,755 $ 71,597 $

254,776 256,531

256,531 $ 328,128 $

75,049

749,128

(4,169)

(357,761) $

773,938 $

(4,617)

(890,556)

518,232

(14,777)

434,434

1,741

(584)

817,811 $

(31,557)

17,468

(20,330)

(14,560)

(92)

457,746 $

328,128

785,874 $

-

(274)

17,039

1,278

6,521

3,351

78

1,834

(687,037)

662,747

(4,121)

(47,655)

108

21,676

(199)

447,520

(149,084)

785,874

636,790

22View entire presentation