BlackRock Global Long/Short Credit Absolute Return Credit

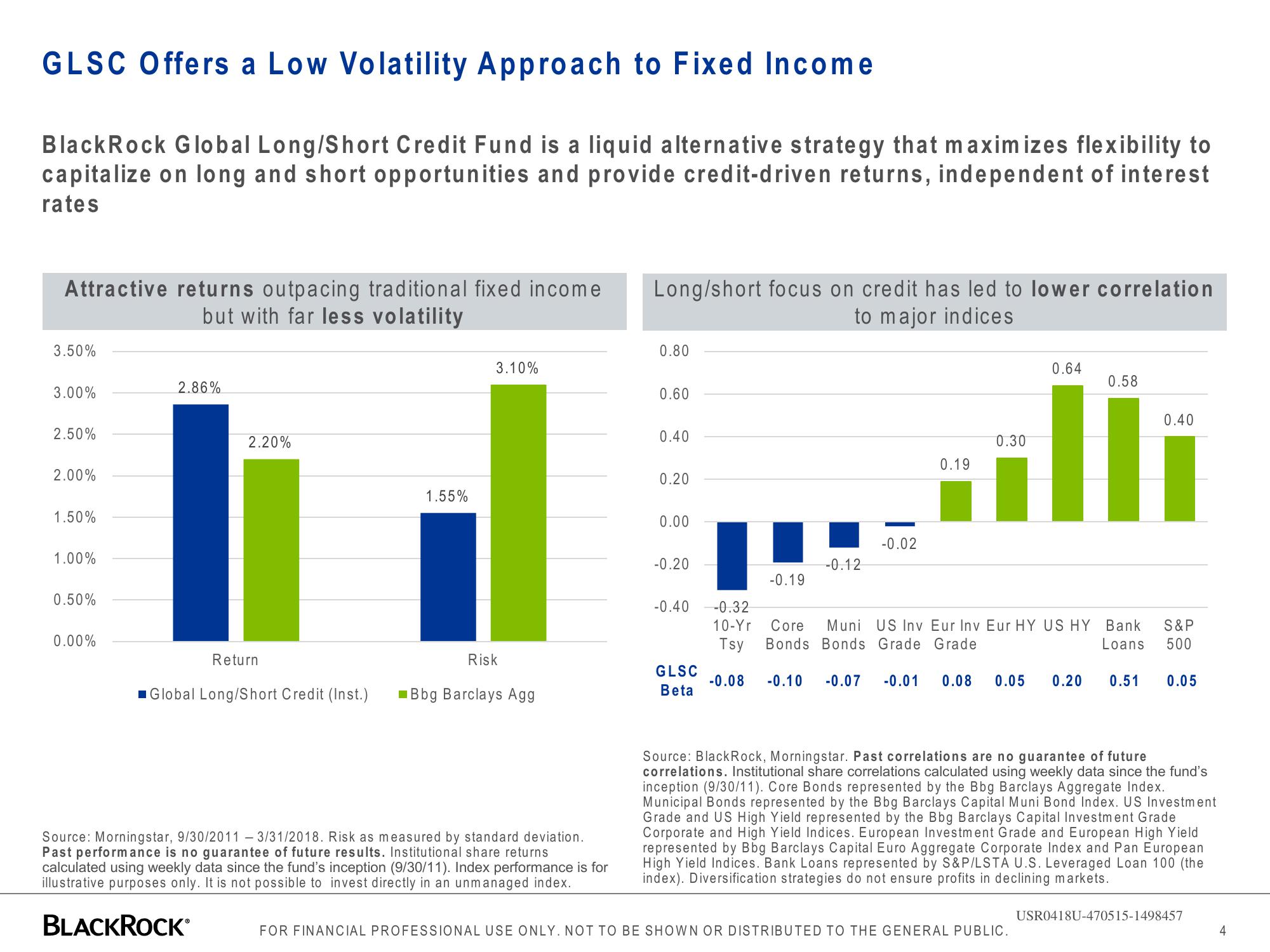

GLSC Offers a Low Volatility Approach to Fixed Income

BlackRock Global Long/Short Credit Fund is a liquid alternative strategy that maximizes flexibility to

capitalize on long and short opportunities and provide credit-driven returns, independent of interest

rates

Attractive returns outpacing traditional fixed income

but with far less volatility

3.50%

3.00%

2.50%

2.00%

1.50%

1.00%

0.50%

0.00%

2.86%

2.20%

Return

Global Long/Short Credit (Inst.)

1.55%

3.10%

Risk

Bbg Barclays Agg

Source: Morningstar, 9/30/2011 - 3/31/2018. Risk as measured by standard deviation.

Past performance is no guarantee of future results. Institutional share returns

calculated using weekly data since the fund's inception (9/30/11). Index performance is for

illustrative purposes only. It is not possible to invest directly in an unmanaged index.

BLACKROCK

Long/short focus on credit has led to lower correlation

to major indices

0.80

0.60

0.40

0.20

0.00

-0.20

-0.40 -0.32

GLSC

Beta

-0.19

-0.12

-0.02

0.19

0.30

0.64

0.58

0.40

li

10-Yr Core Muni US Inv Eur Inv Eur HY US HY Bank

Tsy

Bonds Bonds Grade Grade

-0.08 -0.10 -0.07 -0.01 0.08 0.05 0.20 0.51 0.05

FOR FINANCIAL PROFESSIONAL USE ONLY. NOT TO BE SHOWN OR DISTRIBUTED TO THE GENERAL PUBLIC.

S&P

Loans 500

Source: BlackRock, Morningstar. Past correlations are no guarantee of future

correlations. Institutional share correlations calculated using weekly data since the fund's

inception (9/30/11). Core Bonds represented by the Bbg Barclays Aggregate Index.

Municipal Bonds represented by the Bbg Barclays Capital Muni Bond Index. US Investment

Grade and US High Yield represented by the Bbg Barclays Capital Investment Grade

Corporate and High Yield Indices. European Investment Grade and European High Yield

represented by Bbg Barclays Capital Euro Aggregate Corporate Index and Pan European

High Yield Indices. Bank Loans represented by S&P/LSTA U.S. Leveraged Loan 100 (the

index). Diversification strategies do not ensure profits in declining markets.

USR0418U-470515-1498457

4View entire presentation