Comcast Results Presentation Deck

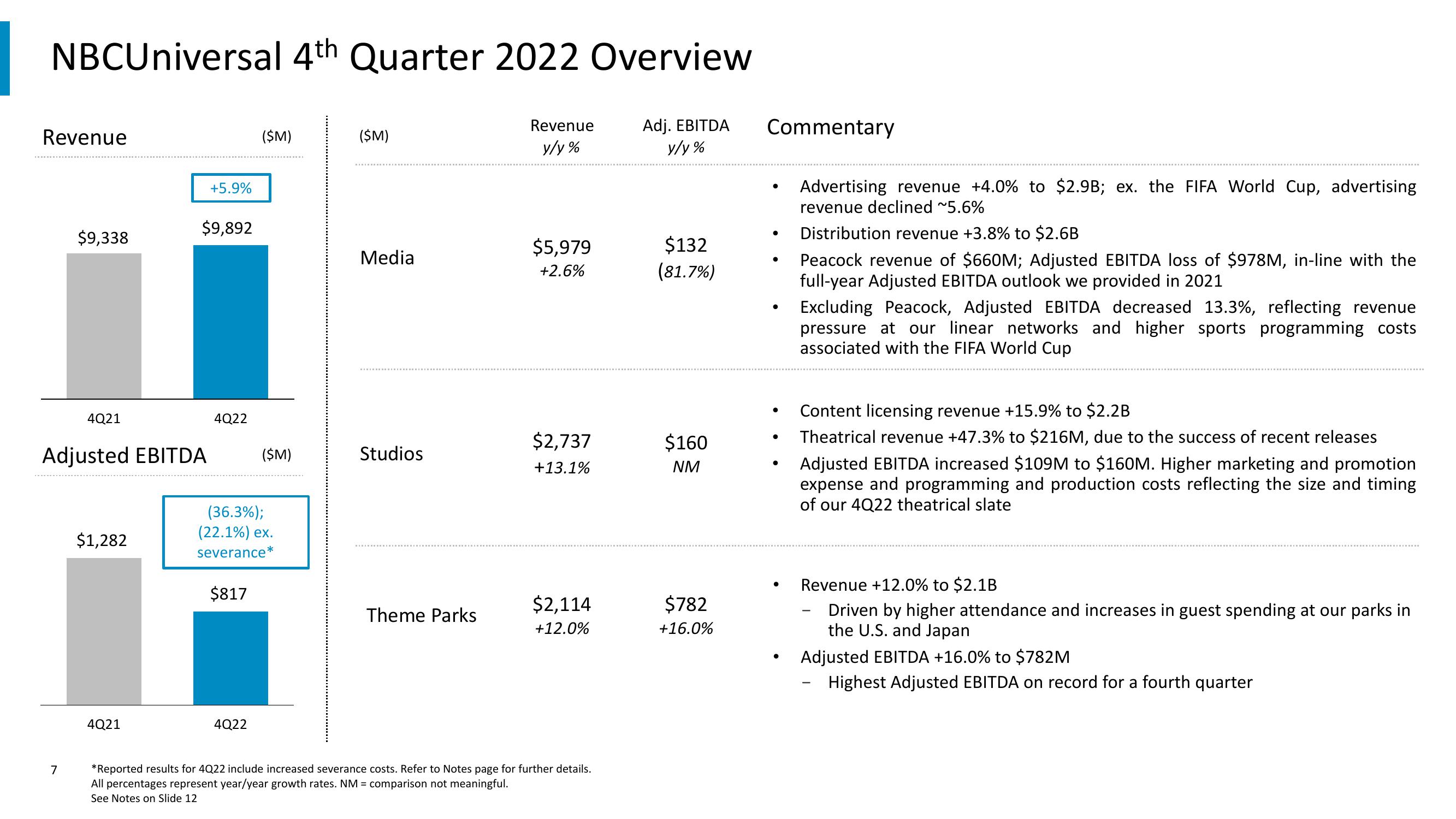

NBCUniversal 4th Quarter 2022 Overview

Revenue

y/y%

Adj. EBITDA

y/y%

Revenue

$9,338

7

4Q21

Adjusted EBITDA

$1,282

4Q21

+5.9%

$9,892

4Q22

($M)

4Q22

($M)

(36.3%);

(22.1%) ex.

severance*

$817

($M)

Media

Studios

Theme Parks

$5,979

+2.6%

$2,737

+13.1%

$2,114

+12.0%

*Reported results for 4Q22 include increased severance costs. Refer to Notes page for further details.

All percentages represent year/year growth rates. NM = comparison not meaningful.

See Notes on Slide 12

$132

(81.7%)

$160

NM

$782

+16.0%

Commentary

●

●

●

●

Advertising revenue +4.0% to $2.9B; ex. the FIFA World Cup, advertising

revenue declined ~5.6%

Distribution revenue +3.8% to $2.6B

Peacock revenue of $660M; Adjusted EBITDA loss of $978M, in-line with the

full-year Adjusted EBITDA outlook we provided in 2021

Excluding Peacock, Adjusted EBITDA decreased 13.3%, reflecting revenue

pressure at our linear networks and higher sports programming costs

associated with the FIFA World Cup

Content licensing revenue +15.9% to $2.2B

Theatrical revenue +47.3% to $216M, due to the success of recent releases

Adjusted EBITDA increased $109M to $160M. Higher marketing and promotion

expense and programming and production costs reflecting the size and timing

of our 4Q22 theatrical slate

Revenue +12.0% to $2.1B

Driven by higher attendance and increases in guest spending at our parks in

the U.S. and Japan

Adjusted EBITDA +16.0% to $782M

Highest Adjusted EBITDA on record for a fourth quarter

-View entire presentation