Allego Investor Presentation Deck

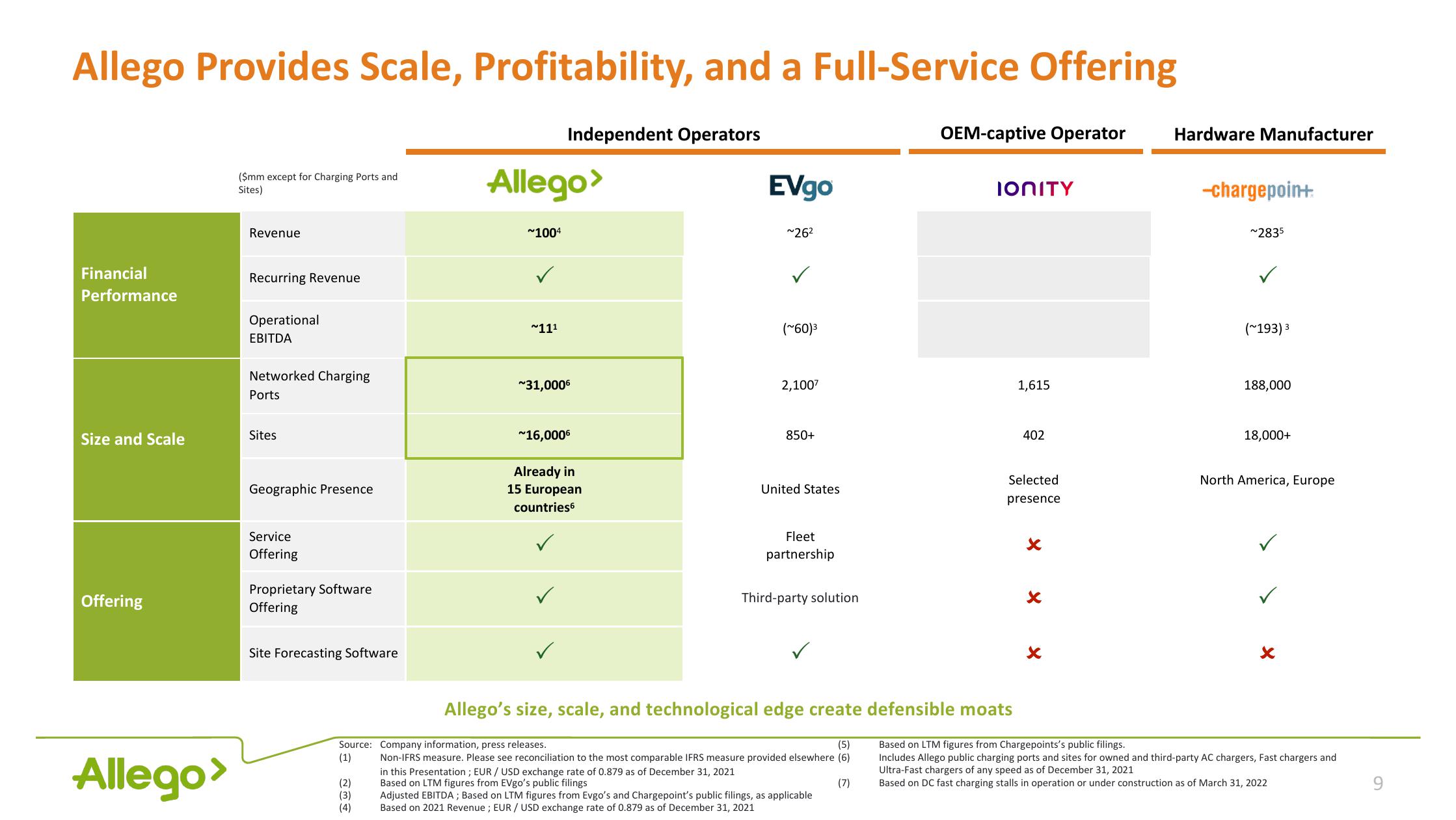

Allego Provides Scale, Profitability, and a Full-Service Offering

Financial

Performance

Size and Scale

Offering

Allego>

($mm except for Charging Ports and

Sites)

Revenue

Recurring Revenue

Operational

EBITDA

Networked Charging

Ports

Sites

Geographic Presence

Service

Offering

Proprietary Software

Offering

Site Forecasting Software

(2)

(3)

(4)

Allego>

~1004

~11¹

Independent Operators

~31,000€

~16,000€

Already in

15 European

countries6

✓

EVgo

~26²

(~60)³

2,1007

850+

United States

Fleet

partnership

Third-party solution

Source: Company information, press releases.

(5)

(1)

Non-IFRS measure. Please see reconciliation to the most comparable IFRS measure provided elsewhere (6)

in this Presentation; EUR / USD exchange rate of 0.879 as of December 31, 2021

Based on LTM figures from EVgo's public filings

(7)

Adjusted EBITDA; Based on LTM figures from Evgo's and Chargepoint's public filings, as applicable

Based on 2021 Revenue; EUR / USD exchange rate of 0.879 as of December 31, 2021

OEM-captive Operator

IONITY

Allego's size, scale, and technological edge create defensible moats

1,615

402

Selected

presence

X

X X

Hardware Manufacturer

-chargepoin+

~2835

(~193) ³

188,000

18,000+

North America, Europe

X

Based on LTM figures from Chargepoints's public filings.

Includes Allego public charging ports and sites for owned and third-party AC chargers, Fast chargers and

Ultra-Fast chargers of any speed as of December 31, 2021

Based on DC fast charging stalls in operation or under construction as of March 31, 2022

9View entire presentation