3Q24 Investor Update

Consolidated

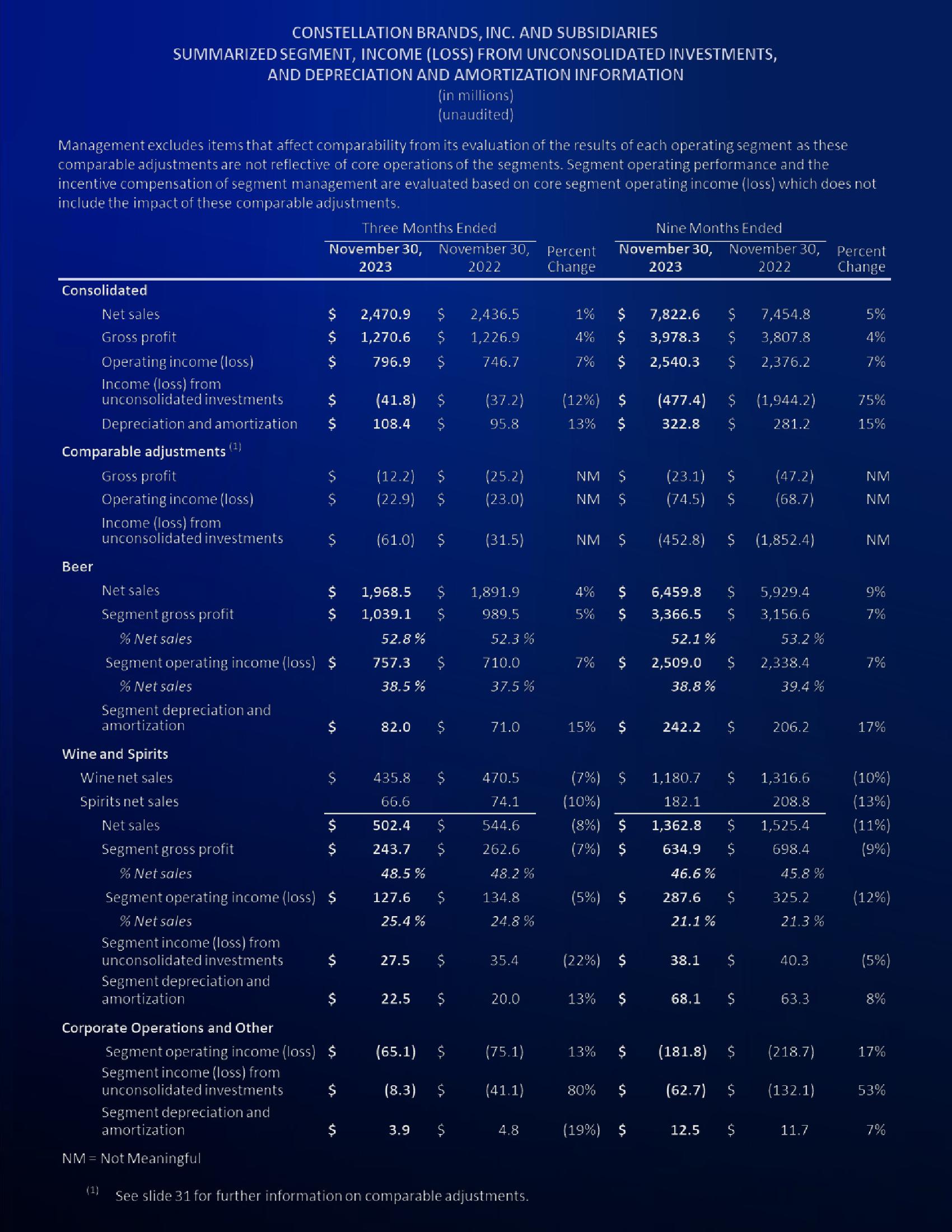

CONSTELLATION BRANDS, INC. AND SUBSIDIARIES

SUMMARIZED SEGMENT, INCOME (LOSS) FROM UNCONSOLIDATED INVESTMENTS,

AND DEPRECIATION AND AMORTIZATION INFORMATION

Management excludes items that affect comparability from its evaluation of the results of each operating segment as these

comparable adjustments are not reflective of core operations of the segments. Segment operating performance and the

incentive compensation of segment management are evaluated based on core segment operating income (loss) which does not

include the impact of these comparable adjustments.

Beer

Net sales

Gross profit

Operating income (loss)

Income (loss) from

unconsolidated investments

Depreciation and amortization

Comparable adjustments (¹)

Gross profit

Operating income (loss)

Income (loss) from

unconsolidated investments

Net sales

Segment gross profit

% Net sales

Segment depreciation and

amortization

Wine and Spirits

Wine net sales

Spirits net sales

Net sales

Segment gross profit

% Net sales

Segment depreciation and

amortization

Corporate Operations and Other

Three Months Ended

November 30, November 30, Percent

2023

2022

Change

$

$

$

$

Segment operating income (loss) $

% Net sales

$

Segment depreciation and

amortization

$

$

$

$

Segment operating income (loss) $

% Net sales

Segment income (loss) from

unconsolidated investments

$

$

$

$

Segment operating income (loss) $

Segment income (loss) from

unconsolidated investments

2,470.9

1,270.6

796.9

1,968.5

1,039.1

$

(41.8)

108.4 $

52.8%

$

(12.2)

(22.9) $

(61.0)

757.3

38.5%

82.0

435.8

66.6

502.4

243.7

48.5%

127.6

(in millions)

(unaudited)

25.4%

27.5

22.5

is in in

$

3.9

in in

$

$

$

in

$

$

$

in

2,436.5

1,226.9

746.7

(37.2)

95.8

(25.2)

(23.0)

(31.5)

1,891.9

989.5

52.3 %

710.0

37.5%

71.0

470.5

74.1

544.6

262.6

48.2 %

134.8

24.8%

35.4

20.0

(65.1) $ (75.1)

(8.3) $

(41.1)

$

4.8

NM = Not Meaningful

(1) See slide 31 for further information on comparable adjustments.

1% $

4% $

7% $

(12%) $

13% $

NM $

NM $

NM $

Nine Months Ended

November 30, November 30, Percent

2023

2022

Change

4% $

5%

$

7%

15% $

(7%) $

(10%)

(8%) $

(7%) $

(5%) $

(22%) $

13%

13%

80%

$

(19%) $

7,822.6 $

3,978.3 $

2,540.3 $

(477.4) $ (1,944.2)

322.8 $

281.2

(23.1) $

(74.5) $

(452.8) $

6,459.8 $

3,366.5 $

52.1%

2,509.0 $

38.8%

242.2

1,180.7 $

182.1

38.1

68.1

$

$

7,454.8

3,807.8

2,376.2

(181.8) $

(62.7) $

12.5 $

(47.2)

(68.7)

1,316.6

208.8

1,362.8 $ 1,525.4

698.4

634.9 $

46.6%

287.6 $

21.1%

(1,852.4)

5,929.4

3,156.6

53.2 %

2,338.4

39.4%

206.2

45.8%

325.2

21.3%

40.3

63.3

(218.7)

(132.1)

11.7

5%

4%

7%

75%

15%

NM

NM

NM

9%

7%

7%

17%

(10%)

(13%)

(11%)

(9%)

(12%)

(5%)

8%

17%

53%

7%View entire presentation