Ready Capital Investor Presentation Deck

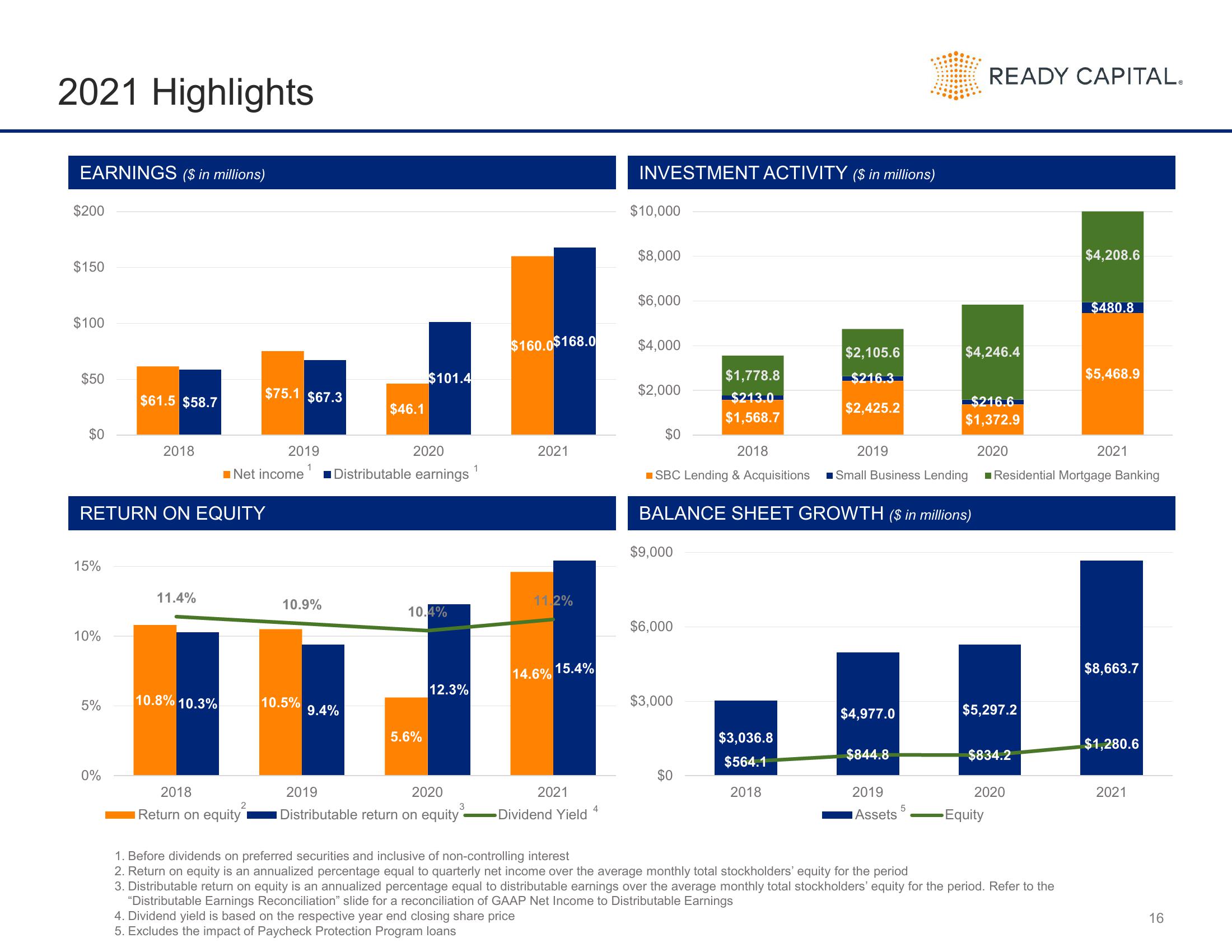

2021 Highlights

EARNINGS ($ in millions)

$200

$150

$100

$50

$0

15%

10%

RETURN ON EQUITY

5%

$61.5 $58.7

0%

2018

11.4%

10.8% 10.3%

$75.1 $67.3

Net income

2018

2

Return on equity

2019

1

10.9%

10.5%

$46.1

9.4%

2020

Distributable earnings

$101.4

10.4%

5.6%

12.3%

2019

2020

Distributable return on equity

3

1

$160.0$168.0

2021

11.2%

14.6%

4. Dividend yield is based on the respective year end closing share price

5. Excludes the impact of Paycheck Protection Program loans

15.4%

2021

Dividend Yield

4

INVESTMENT ACTIVITY ($ in millions)

$10,000

$8,000

$6,000

$4,000

$2,000

$1,778.8

$213.0

$1,568.7

2018

■SBC Lending & Acquisitions

2019

Small Business Lending

BALANCE SHEET GROWTH ($ in millions)

$0

$9,000

$6,000

$3,000

$0

$2,105.6

$216.3

$2,425.2

$3,036.8

$564.1

2018

$4,977.0

$844.8

2019

Assets

5

$4,246.4

READY CAPITAL.

$216.6

$1,372.9

2020

$5,297.2

$834.2

Equity

2020

1. Before dividends on preferred securities and inclusive of non-controlling interest

2. Return on equity is an annualized percentage equal to quarterly net income over the average monthly total stockholders' equity for the period

3. Distributable return on equity is an annualized percentage equal to distributable earnings over the average monthly total stockholders' equity for the period. Refer to the

"Distributable Earnings Reconciliation" slide for a reconciliation of GAAP Net Income to Distributable Earnings

$4,208.6

Residential Mortgage Banking

$480.8

$5,468.9

2021

$8,663.7

$1,280.6

2021

16View entire presentation