Credit Suisse Investment Banking Pitch Book

CONFIDENTIAL

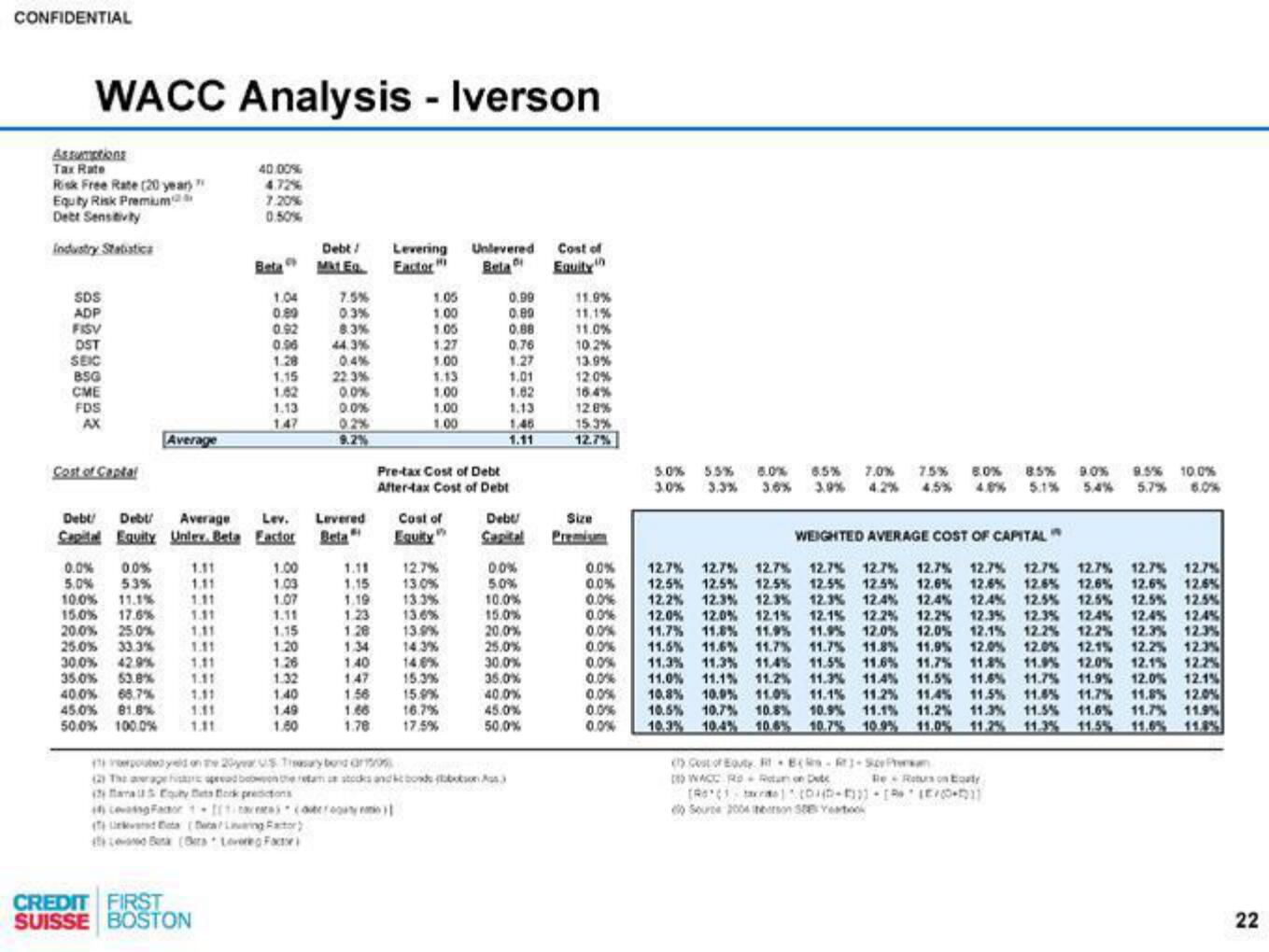

WACC Analysis - Iverson

Assumptions

Tax Rate

Risk Free Rate (20 year)"

Equity Risk Premium

Debt Sensitivity

Industry Statistics

SDS

ADP

FISV

DST

SEXC

BSG

CME

FDS

AX

Cost of Captal

0.0% 0.0%

5.0% 53%

Average

10.0% 11.1%

15.0% 17.6%

20.0% 25.0%

25.0% 33.3%

30.0% 42.9%

35.0% 53.8%

40.0% 68.7%

45.0% 81.8%

50.0% 100.0%

1.11

1.11

1.11

1.11

1.11

1.11

1.11

1.11

1.11

1.11

40.00%

4.72%

7.20%

0.50%

Debt! Debl

Average Lev.

Capital Equity Unler. Beta Factor

Beta

CREDIT FIRST

SUISSE BOSTON

1.04

0.89

0.92

0.96

1.28

1.15

1.62

1.13

1.47

1.00

1.03

1.07

1.11

1.15

1.20

1.26

1.32

1.40

1.49

1.60

Debt/

Mit Eq

7.5%

0.3%

8.3%

44.3%

0.4%

22.3%

0.0%

0.0%

0.2%

9.2%

Levered

Beta"

scouter

Levering Unlevered Cost of

Eactor M

Beta

Equity

1.05

1.00

1.05

1.27

1.00

1.13

1.00

1.00

1.00

Cost of

Pre-tax Cost of Debt

After-tax Cost of Debt

Equity

1.11

12.7%

1.15

13.0 %

1.19

13.3 %

1.23 13.6%

1.28 13.9%

1.34 14.3 %

1.40

14.6%

1.47

15.3%

1.56 15.9%

1.66 16.7%

1.78

17.5%

0.99

0.89

0.88

0.76

1.27

1.01

1.82

1.13

1.46

1.11

Debt

pued yeld on the 20yar US Tsary bond 150

(2) The awageur pead bobonteretana stocks and kebobons)

amal Equty Bets Bock predictions

1) covang Fator 11

(k ta (DecaLivering Factor)

Le B (Bers Levereg Factor

0.0%

5.0%

10.0%

15.0%

20.0%

25.0%

30.0%

35.0%

40.0%

45.0%

50.0%

11.9%

11.1%

11.0%

10.2%

13.9%

12.0%

16.4%

12.8 %

15.3%

12.7%

Size

Premium

0.0%

0.0%

0.0%

0.0%

0.0%

0.0%

0.0%

0.0%

0.0%

0.0%

0.0%

5.0% 55% 6.0% 6.5%

3.0% 3.3% 3.6%

3.9%

7.0%

7.0 % 75 %

4.2% 4.5 %

8.0%

4.8 %

8.5%

5.1%

(1) Cest of Eauty Rt B-Rr+ScPm

WACC RS Ruon Dete

Re Returs on Earty

[R] [DD-]-[RLE/00+011

0 Source 2004 heerson 50B Yeatook

9.0% 9.5% 10.0%

5,4 % 5.7% 6.0%

WEIGHTED AVERAGE COST OF CAPITAL"

12.7% 12.7% 12.7% 12.7% 12.7% 12.7% 12.7% 12.7% 12.7%

12.5% 12.5% 12.5% 12.5% 12.5% 12.6% 12.6% 12.6% 12.6%

12.2 % 12.3% 12.3% 12.3% 12.4% 12.4% 12.4% 12.5%

12.0% 12.0% 12.1% 12.1% 12.2% 12.2% 12.3% 12.3%

11.7% 11.8 % 11,9% 11.9% 12.0% 12.0% 12.1% 12.2 %

11.5% 11.6% 11.7% 11.7% 11.8% 11.9% 12.0% 12.0%

11.3% 11.3 % 11,4% 11.5% 11.6% 11.7% 11.3% 11.9 %

11.0% 11.1% 11.2% 11.3% 11.4% 11.5% 11.6%

11.6% 11.7% 11.9 % 12.0% 12.1%

10.8 % 10.0% 11.0% 11.1% 11.2% 11.4% 11.5% 11.5% 11.7% 11.8% 12.0%

10.5% 10.7% 10.8 % 10.9% 11.1% 11.2% 11.3% 11.5% 11.6% 11.7% 11.9%

10.3% 10.4 % 10.6 % 10.7% 10.9% 11.0% 11.2% 11.3% 11.5% 11.6% 11.8%

12.7% 12.7%

12.6 % 12.6%

12.5% 12.5% 12.5%

12.4% 12.4% 12.4%

12.2% 12.3% 12.3%

12.1% 12.2% 12.3%

12.0% 12.1% 12.2%

22View entire presentation