Credit Suisse Results Presentation Deck

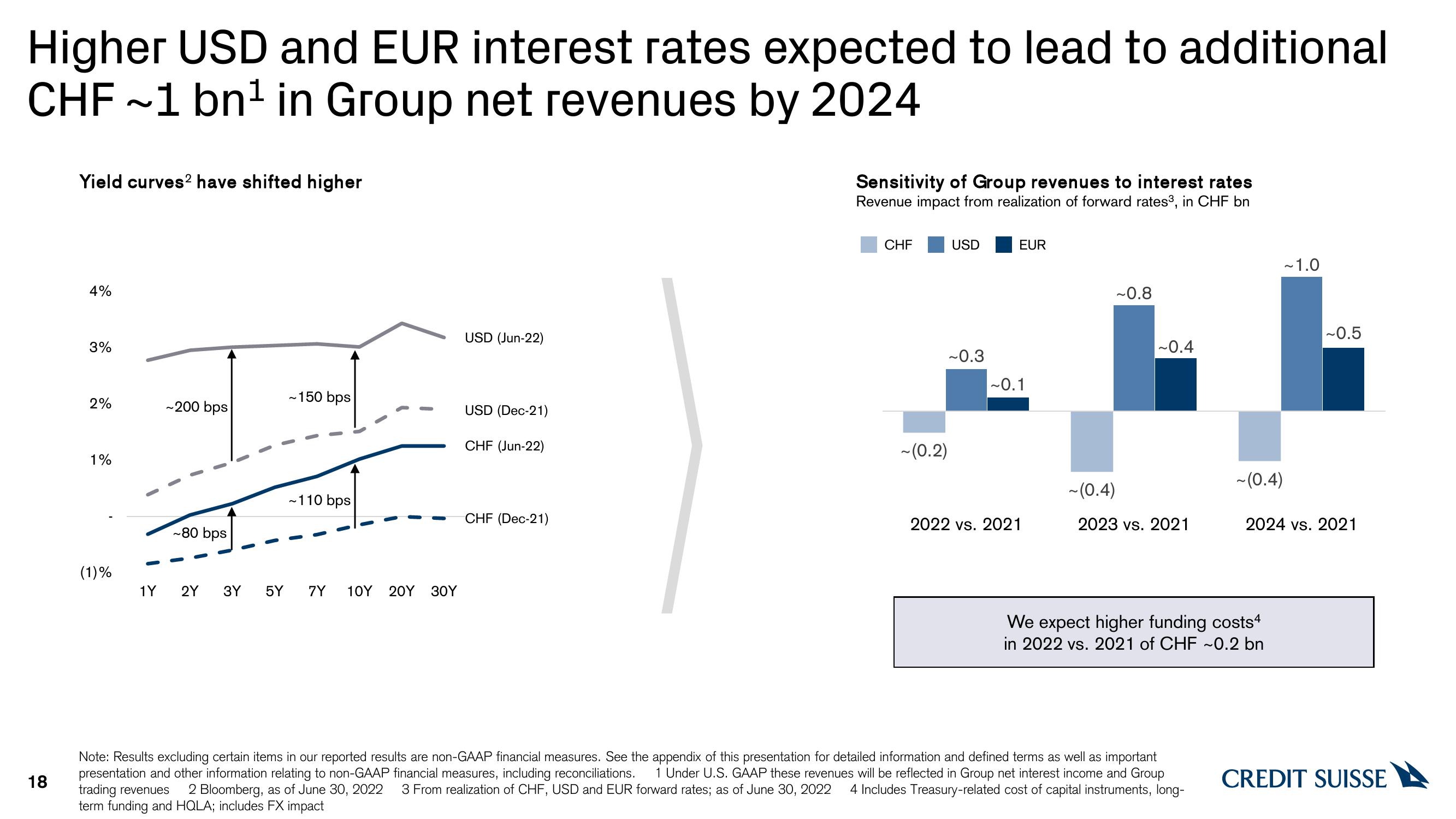

Higher USD and EUR interest rates expected to lead to additional

CHF ~1 bn¹ in Group net revenues by 2024

18

Yield curves² have shifted higher

4%

3%

2%

1%

(1)%

1Y

~200 bps

~80 bps

~150 bps

~110 bps

2Y 3Y 5Y 7Y 1ΟΥ 2ΟΥ 3ΟΥ

USD (Jun-22)

USD (Dec-21)

CHF (Jun-22)

CHF (Dec-21)

Sensitivity of Group revenues to interest rates

Revenue impact from realization of forward rates³, in CHF bn

CHF

~(0.2)

USD

~0.3

EUR

~0.1

2022 vs. 2021

~0.8

~0.4

~(0.4)

2023 vs. 2021

~(0.4)

Note: Results excluding certain items in our reported results are non-GAAP financial measures. See the appendix of this presentation for detailed information and defined terms as well as important

presentation and other information relating to non-GAAP financial measures, including reconciliations. 1 Under U.S. GAAP these revenues will be reflected in Group net interest income and Group

trading revenues 2 Bloomberg, as of June 30, 2022 3 From realization of CHF, USD and EUR forward rates; as of June 30, 2022 4 Includes Treasury-related cost of capital instruments, long-

term funding and HQLA; includes FX impact

We expect higher funding costs4

in 2022 vs. 2021 of CHF ~0.2 bn

~1.0

~0.5

2024 vs. 2021

CREDIT SUISSEView entire presentation