Bank of America Investment Banking Pitch Book

Executive Summary

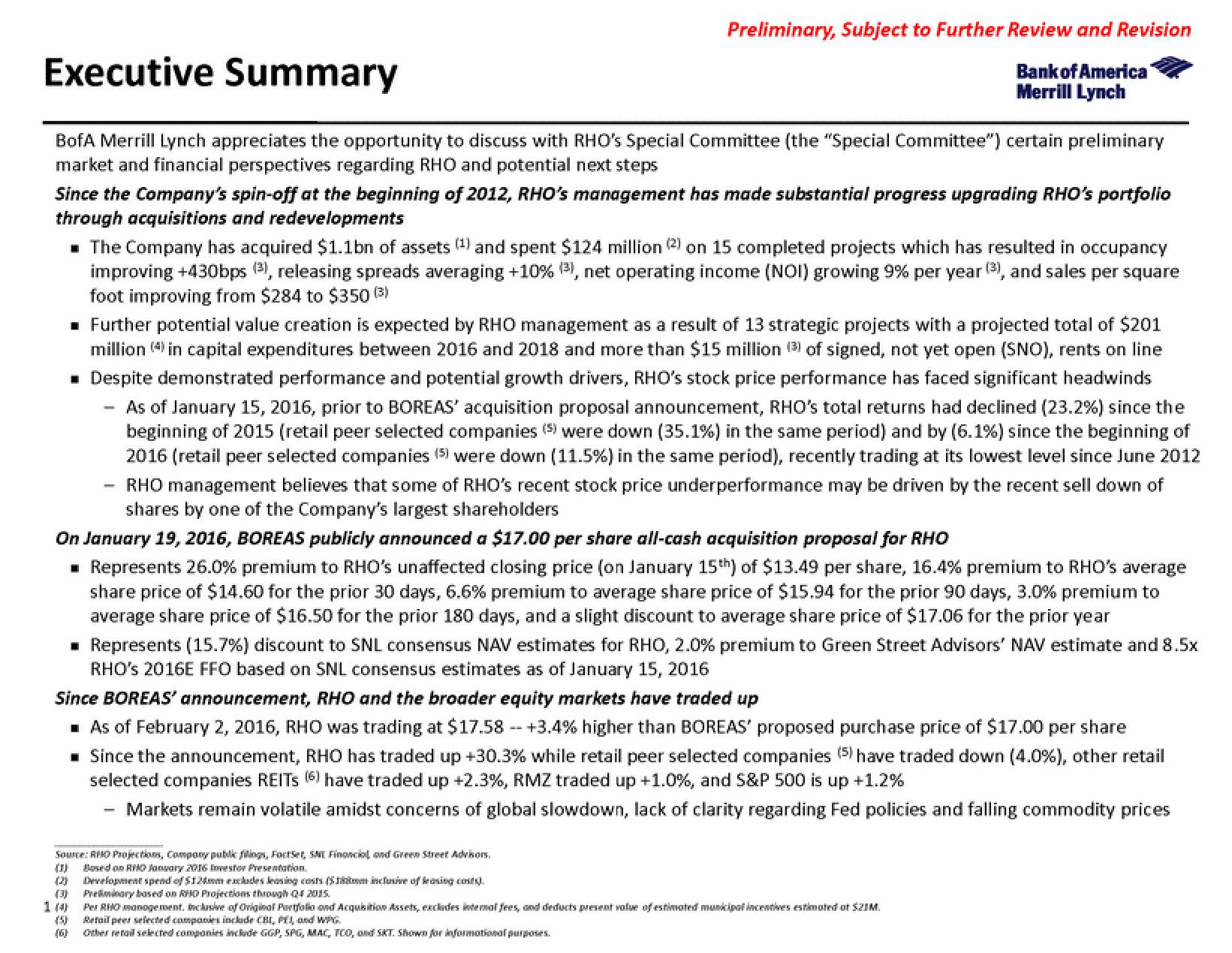

BofA Merrill Lynch appreciates the opportunity to discuss with RHO's Special Committee (the "Special Committee") certain preliminary

market and financial perspectives regarding RHO and potential next steps

Preliminary, Subject to Further Review and Revision

Bank of America

Merrill Lynch

Since the Company's spin-off at the beginning of 2012, RHO's management has made substantial progress upgrading RHO's portfolio

through acquisitions and redevelopments

■ The Company has acquired $1.1bn of assets (¹) and spent $124 million (2) on 15 completed projects which has resulted in occupancy

improving +430bps (3), releasing spreads averaging +10% (3), net operating income (NOI) growing 9% per year (3), and sales per square

foot improving from $284 to $350 (3)

■ Further potential value creation is expected by RHO management as a result of 13 strategic projects with a projected total of $201

million (4) in capital expenditures between 2016 and 2018 and more than $15 million (3) of signed, not yet open (SNO), rents on line

■ Despite demonstrated performance and potential growth drivers, RHO's stock price performance has faced significant headwinds

As of January 15, 2016, prior to BOREAS' acquisition proposal announcement, RHO's total returns had declined (23.2%) since the

beginning of 2015 (retail peer selected companies (5) were down (35.1%) in the same period) and by (6.1%) since the beginning of

2016 (retail peer selected companies (5) were down (11.5%) in the same period), recently trading at its lowest level since June 2012

RHO management believes that some of RHO's recent stock price underperformance may be driven by the recent sell down of

shares by one of the Company's largest shareholders

On January 19, 2016, BOREAS publicly announced a $17.00 per share all-cash acquisition proposal for RHO

■ Represents 26.0% premium to RHO's unaffected closing price (on January 15th) of $13.49 per share, 16.4% premium to RHO's average

share price of $14.60 for the prior 30 days, 6.6% premium to average share price of $15.94 for the prior 90 days, 3.0% premium to

average share price of $16.50 for the prior 180 days, and a slight discount to average share price of $17.06 for the prior year

(2)

(3)

1 (4)

(50)

■ Represents (15.7%) discount to SNL consensus NAV estimates for RHO, 2.0% premium to Green Street Advisors' NAV estimate and 8.5x

RHO's 2016E FFO based on SNL consensus estimates as of January 15, 2016

Since BOREAS' announcement, RHO and the broader equity markets have traded up

■ As of February 2, 2016, RHO was trading at $17.58 +3.4% higher than BOREAS' proposed purchase price of $17.00 per share

■ Since the announcement, RHO has traded up +30.3% while retail peer selected companies (5) have traded down (4.0%), other retail

selected companies REITS (6) have traded up +2.3%, RMZ traded up +1.0%, and S&P 500 is up +1.2%

Markets remain volatile amidst concerns of global slowdown, lack of clarity regarding Fed policies and falling commodity prices

Source:RMO Projections, Company public filings, FoctSet, SL Financial and Green Street Advisors.

Bosedon RHO January 2016 Investor Presentation

Development spend of $120mm excludes leasing costs (5188oom inclusive of leasing costs).

Preliminary based on RMO Projections through Q4 2015.

Per RHO management. Inclusive of Original Portfolio and Acquisition Assets, excludes internal fees, and deducts present value of estimated municipal incentives estimated of $21M.

Retail peer selected companies include CBI, PT and WPG.

Other retail selected companies include GGP, SPG, MAC, TCO, ond SKT. Shown for informational purposes.View entire presentation