Kinnevik Results Presentation Deck

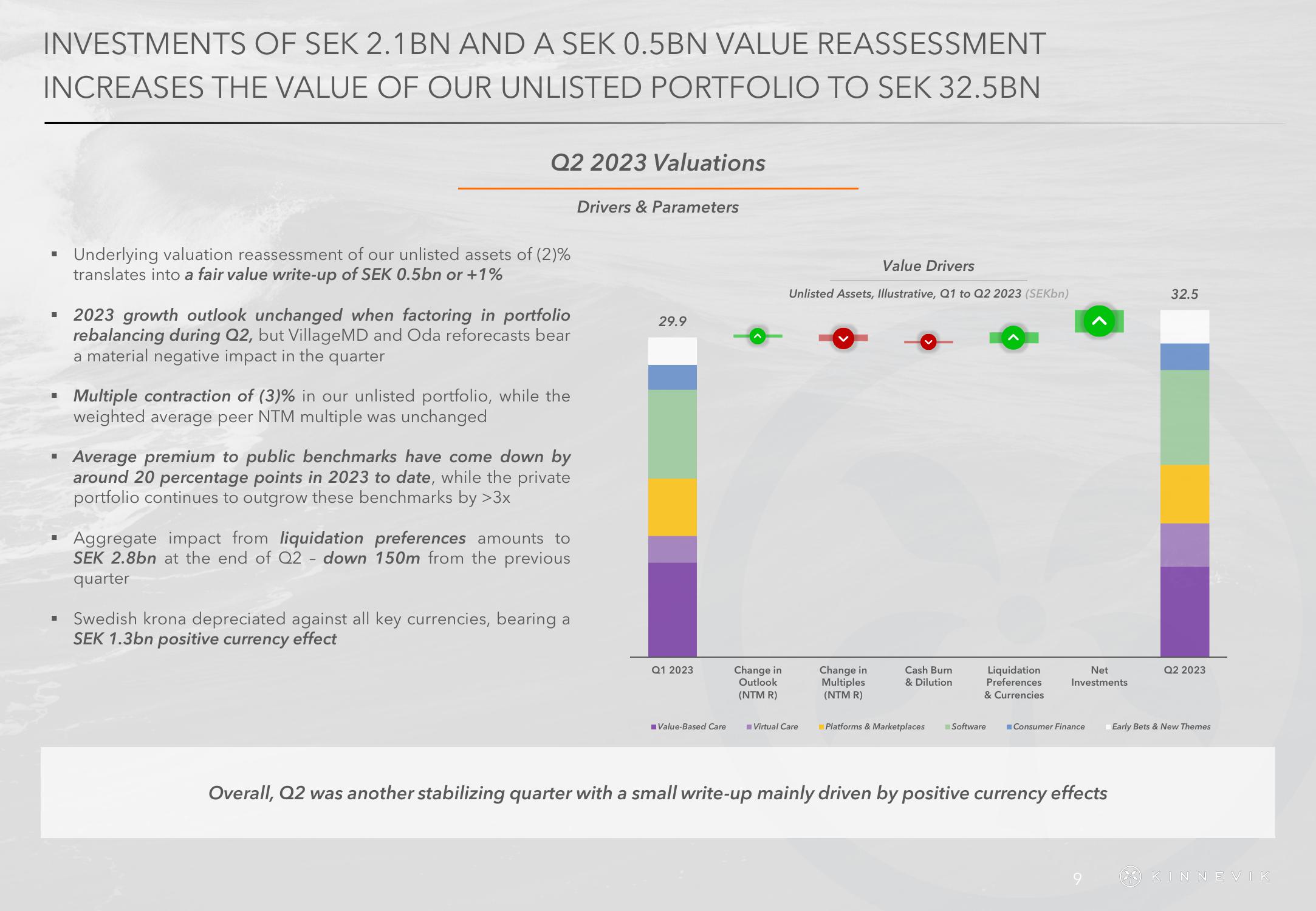

INVESTMENTS OF SEK 2.1 BN AND A SEK 0.5BN VALUE REASSESSMENT

INCREASES THE VALUE OF OUR UNLISTED PORTFOLIO TO SEK 32.5BN

I

■

■

Q2 2023 Valuations

Underlying valuation reassessment of our unlisted assets of (2)%

translates into a fair value write-up of SEK 0.5bn or +1%

2023 growth outlook unchanged when factoring in portfolio

rebalancing during Q2, but Village MD and Oda reforecasts bear

a material negative impact in the quarter

Multiple contraction of (3) % in our unlisted portfolio, while the

weighted average peer NTM multiple was unchanged

Average premium to public benchmarks have come down by

around 20 percentage points in 2023 to date, while the private

portfolio continues to outgrow these benchmarks by >3x

Aggregate impact from liquidation preferences amounts to

SEK 2.8bn at the end of Q2 - down 150m from the previous

quarter

Swedish krona depreciated against all key currencies, bearing a

SEK 1.3bn positive currency effect

Drivers & Parameters

29.9

Q1 2023

■Value-Based Care

Change in

Outlook

(NTM R)

Value Drivers

Unlisted Assets, Illustrative, Q1 to Q2 2023 (SEKbn)

Virtual Care

Change in

Multiples

(NTM R)

Cash Burn

& Dilution

Platforms & Marketplaces

Liquidation

Preferences

& Currencies

Software

Net

Investments

Consumer Finance

Overall, Q2 was another stabilizing quarter with a small write-up mainly driven by positive currency effects

32.5

Q2 2023

Early Bets & New Themes

KINNEVIKView entire presentation