WeWork Restructuring Presentation Deck

Transaction Term Sheet (Cont'd)

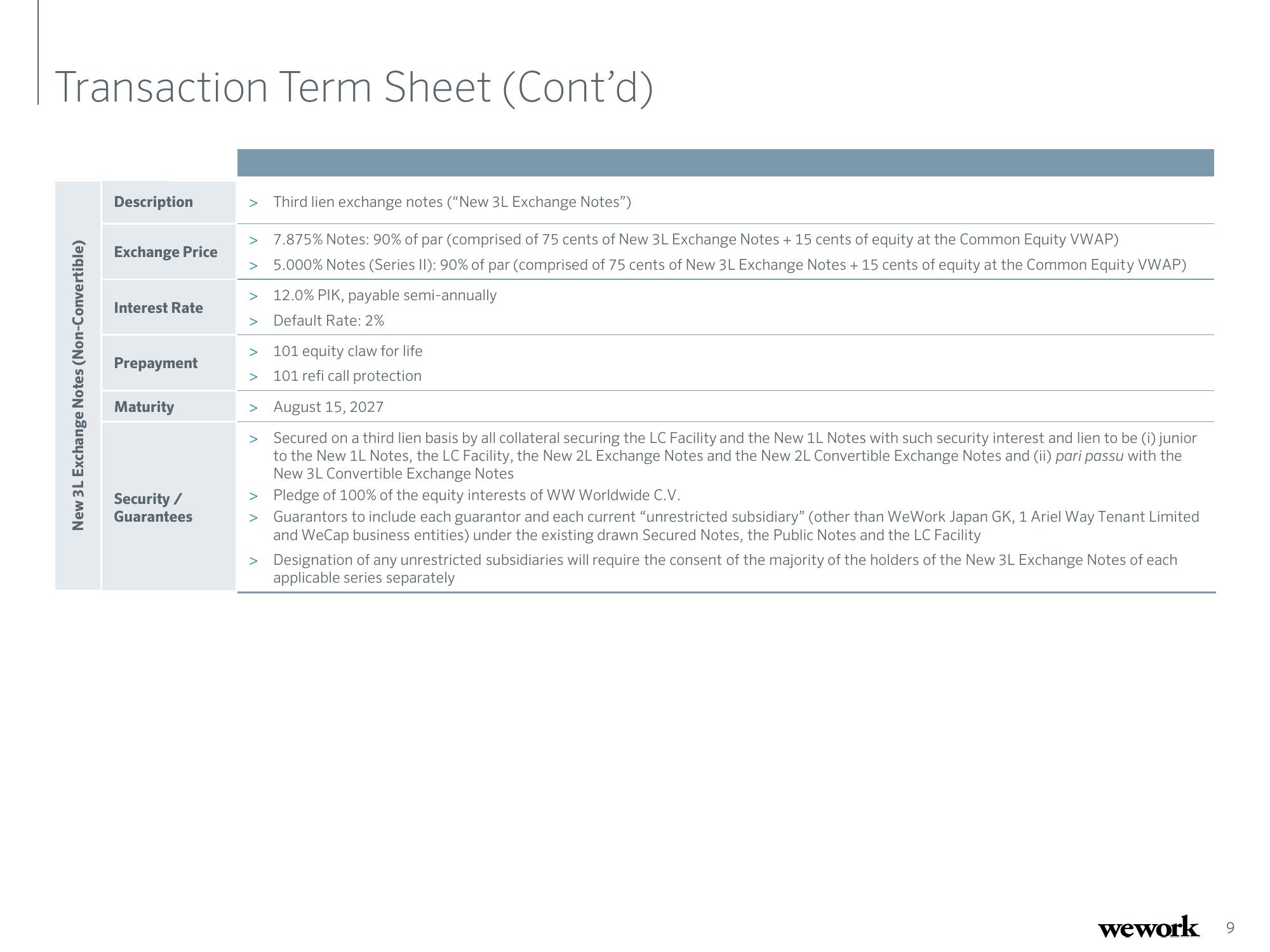

New 3L Exchange Notes (Non-Convertible)

Description

Exchange Price

Interest Rate

Prepayment

Maturity

Security /

Guarantees

> Third lien exchange notes ("New 3L Exchange Notes")

7.875% Notes: 90% of par (comprised of 75 cents of New 3L Exchange Notes + 15 cents of equity at the Common Equity VWAP)

> 5.000% Notes (Series II): 90% of par (comprised of 75 cents of New 3L Exchange Notes + 15 cents of equity at the Common Equity VWAP)

12.0% PIK, payable semi-annually

Default Rate: 2%

101 equity claw for life

101 refi call protection

August 15, 2027

Secured on a third lien basis by all collateral securing the LC Facility and the New 1L Notes with such security interest and lien to be (i) junior

to the New 1L Notes, the LC Facility, the New 2L Exchange Notes and the New 2L Convertible Exchange Notes and (ii) pari passu with the

New 3L Convertible Exchange Notes

> Pledge of 100% of the equity interests of WW Worldwide C.V.

Guarantors to include each guarantor and each current "unrestricted subsidiary" (other than WeWork Japan GK, 1 Ariel Way Tenant Limited

and WeCap business entities) under the existing drawn Secured Notes, the Public Notes and the LC Facility

>

>

>

> Designation of any unrestricted subsidiaries will require the consent of the majority of the holders of the New 3L Exchange Notes of each

applicable series separately

wework 9View entire presentation