AMC Other Presentation Deck

Executive Summary (Cont'd)

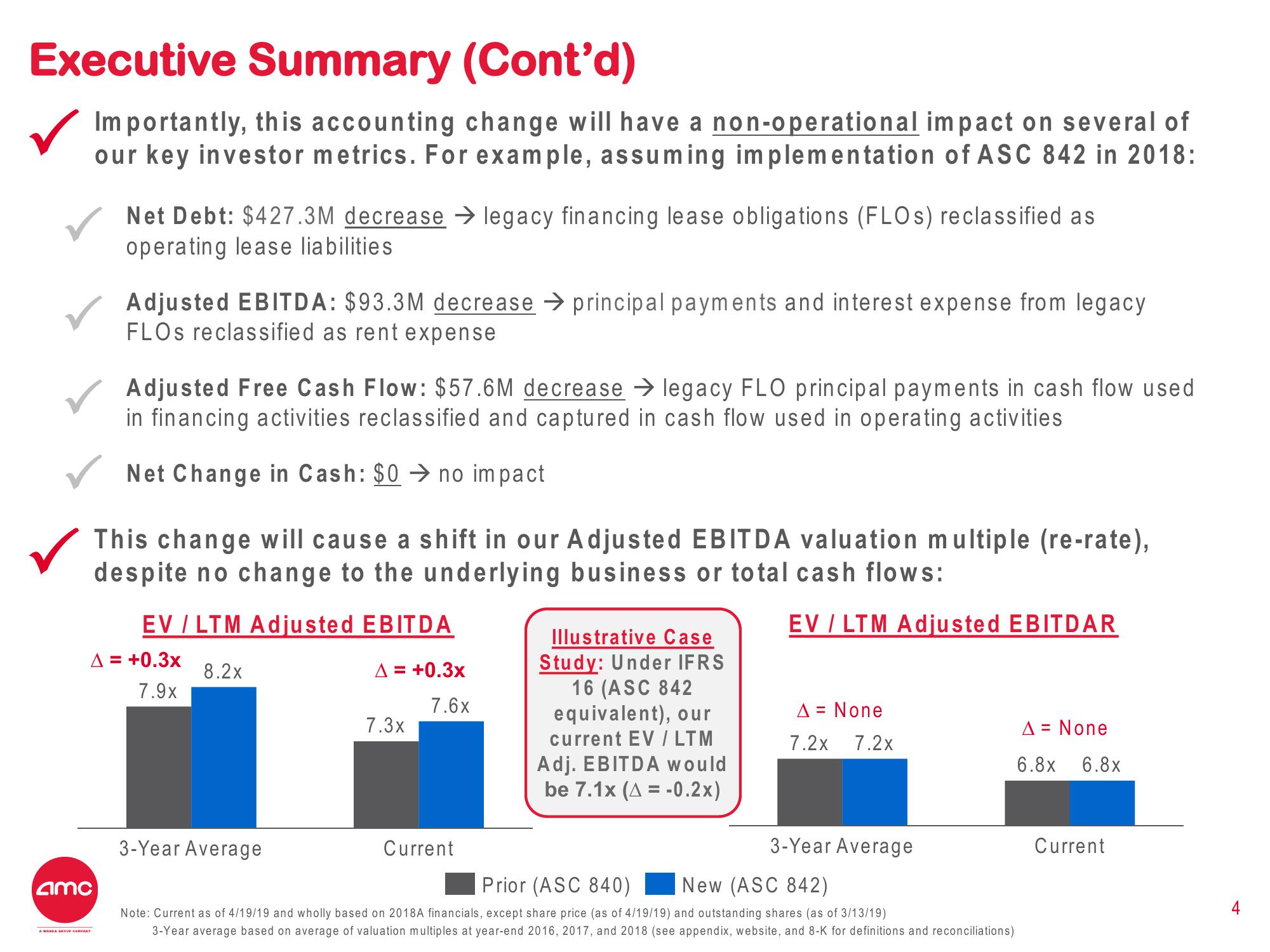

Importantly, this accounting change will have a non-operational impact on several of

our key investor metrics. For example, assuming implementation of ASC 842 in 2018:

amc

Net Debt: $427.3M decrease → legacy financing lease obligations (FLOs) reclassified as

operating lease liabilities

A WANDA GROUP COMPANY

Adjusted EBITDA: $93.3M decrease → principal payments and interest expense from legacy

FLOs reclassified as rent expense

Adjusted Free Cash Flow: $57.6M decrease → legacy FLO principal payments in cash flow used

in financing activities reclassified and captured in cash flow used in operating activities

Net Change in Cash: $0 ➜no impact

This change will cause a shift in our Adjusted EBITDA valuation multiple (re-rate),

despite no change to the underlying business or total cash flows:

EV / LTM Adjusted EBITDAR

A = +0.3x

7.9x

EV / LTM Adjusted EBITDA

8.2x

3-Year Average

A = +0.3x

7.6x

7.3x

Current

Illustrative Case

Study: Under IFRS

16 (ASC 842

equivalent), our

current EV / LTM

Adj. EBITDA would

be 7.1x (A = -0.2x)

A = None

7.2x 7.2x

3-Year Average

Prior (ASC 840)

New (ASC 842)

Note: Current as of 4/19/19 and wholly based on 2018A financials, except share price (as of 4/19/19) and outstanding shares (as of 3/13/19)

3-Year average based on average of valuation multiples at year-end 2016, 2017, and 2018 (see appendix, website, and 8-K for definitions and reconciliations)

A = None

6.8x 6.8x

Current

4View entire presentation