Deutsche Telekom Investor Day Presentation Deck

T-MOBILE US, INC.

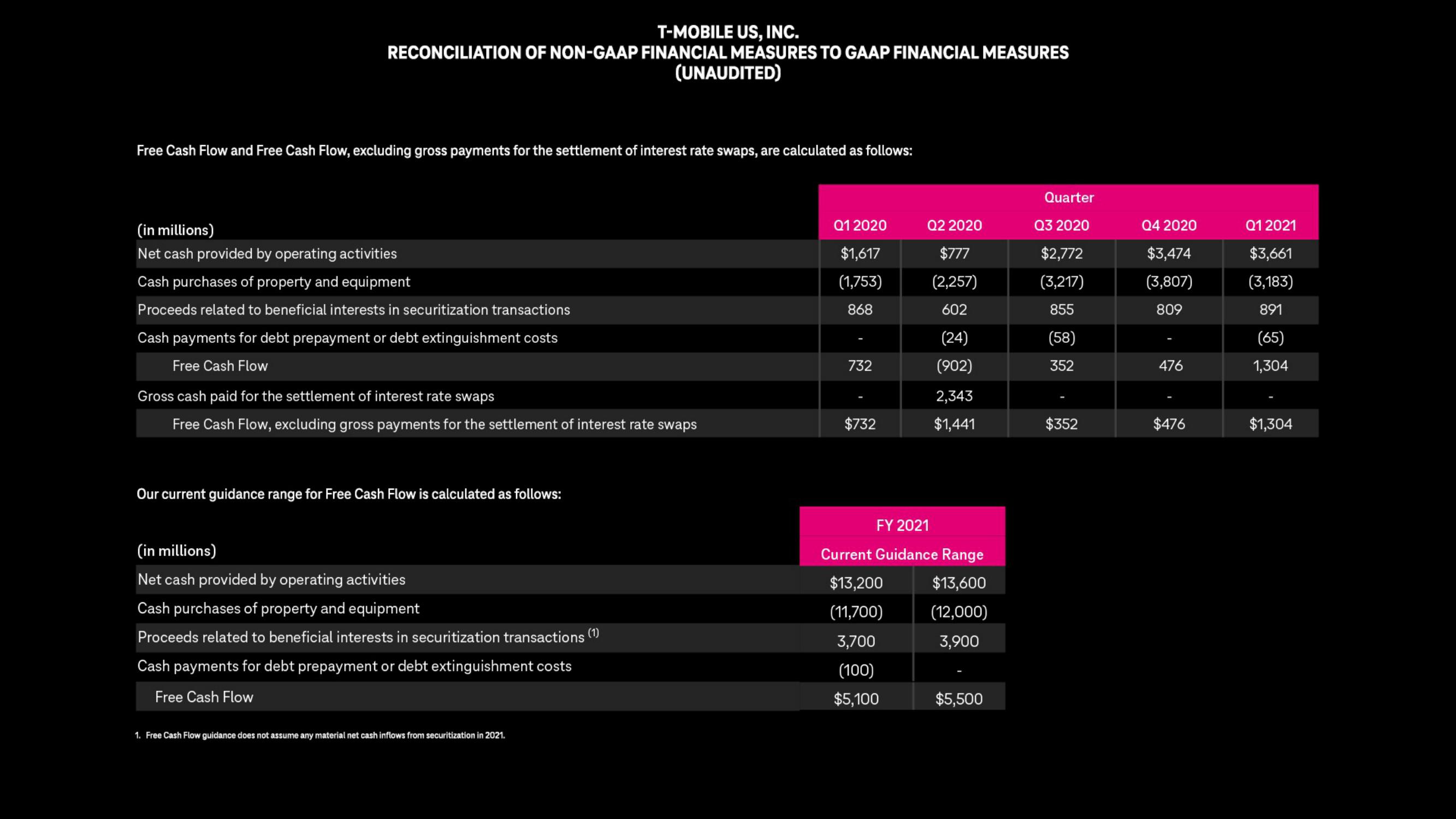

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES TO GAAP FINANCIAL MEASURES

(UNAUDITED)

Free Cash Flow and Free Cash Flow, excluding gross payments for the settlement of interest rate swaps, are calculated as follows:

(in millions)

Net cash provided by operating activities

Cash purchases of property and equipment

Proceeds related to beneficial interests in securitization transactions

Cash payments for debt prepayment or debt extinguishment costs

Free Cash Flow

Gross cash paid for the settlement of interest rate swaps

Free Cash Flow, excluding gross payments for the settlement of interest rate swaps

Our current guidance range for Free Cash Flow is calculated as follows:

(in millions)

Net cash provided by operating activities

Cash purchases of property and equipment

Proceeds related to beneficial interests in securitization transactions (1)

Cash payments for debt prepayment or debt extinguishment costs

Free Cash Flow

1. Free Cash Flow guidance does not assume any material net cash inflows from securitization in 2021.

Q1 2020

$1,617

(1,753)

868

732

$732

Q2 2020

$777

(2,257)

602

(24)

(902)

$13,200

(11,700)

3,700

(100)

$5,100

2,343

$1,441

FY 2021

Current Guidance Range

$13,600

(12,000)

3,900

$5,500

Quarter

Q3 2020

$2,772

(3,217)

855

(58)

352

$352

Q4 2020

$3,474

(3,807)

809

476

$476

Q1 2021

$3,661

(3,183)

891

(65)

1,304

$1,304View entire presentation