Credit Suisse Results Presentation Deck

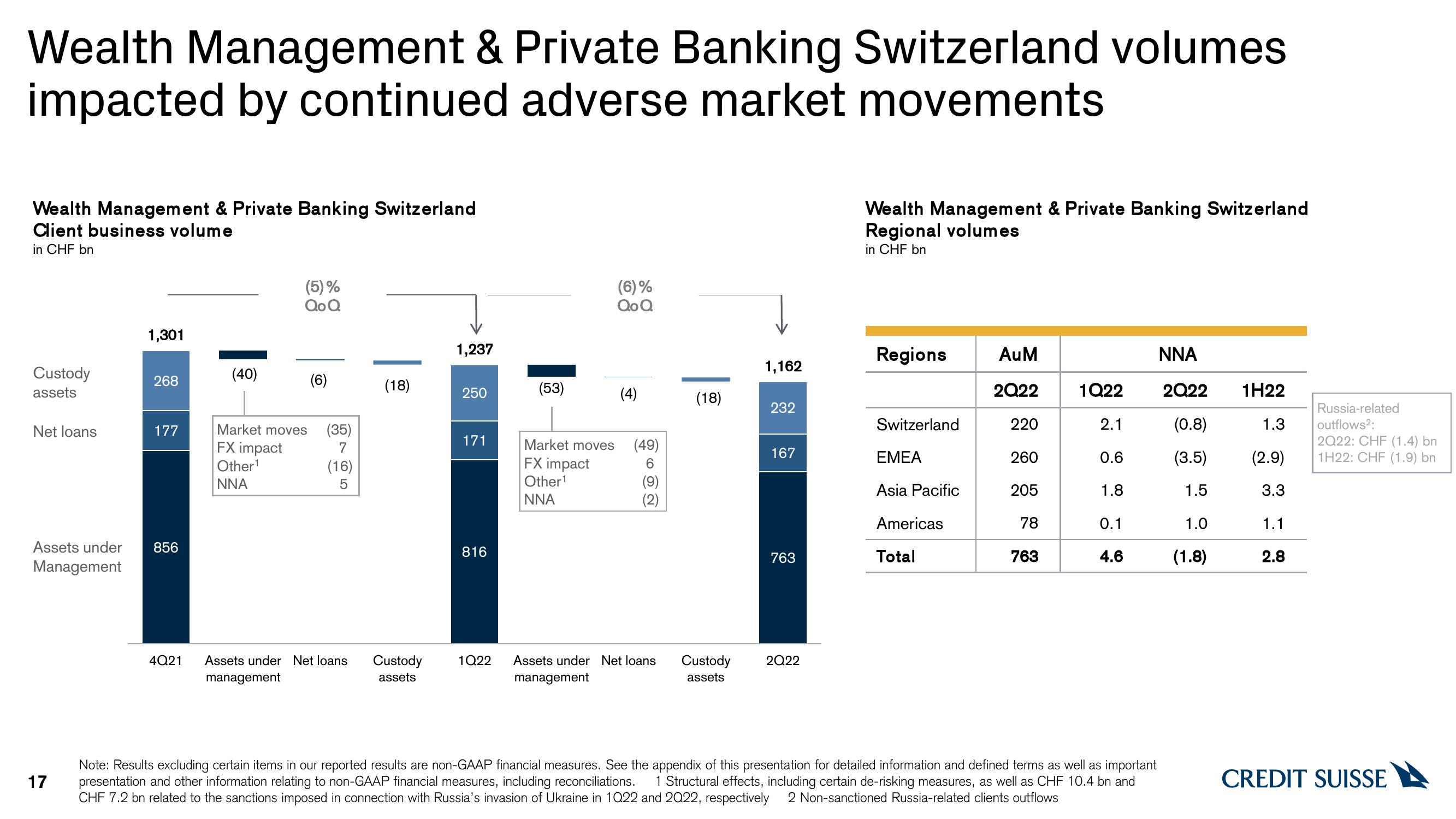

Wealth Management & Private Banking Switzerland volumes

impacted by continued adverse market movements

Wealth Management & Private Banking Switzerland

Client business volume

in CHF bn

Custody

assets

Net loans

1,301

17

268

177

Assets under 856

Management

(40)

(5)%

QoQ

Market moves

FX impact

Other¹

NNA

(6)

(35)

7

(16)

5

4Q21 Assets under Net loans

management

(18)

Custody

assets

1,237

250

171

816

(53)

Market moves

FX impact

Other¹

NNA

(6) %

QoQ

(49)

6

(9)

(2)

1Q22 Assets under Net loans

management

(18)

Custody

assets

1,162

232

167

763

2Q22

Wealth Management & Private Banking Switzerland

Regional volumes

in CHF bn

Regions

Switzerland

EMEA

Asia Pacific

Americas

Total

AuM

NNA

2Q22 1Q22 2022 1H22

(0.8)

220

260

(3.5)

205

1.5

78

763

2.1

0.6

1.8

0.1

4.6

Note: Results excluding certain items in our reported results are non-GAAP financial measures. See the appendix of this presentation for detailed information and defined terms as well as important

presentation and other information relating to non-GAAP financial measures, including reconciliations. 1 Structural effects, including certain de-risking measures, as well as CHF 10.4 bn and

CHF 7.2 bn related to the sanctions imposed in connection with Russia's invasion of Ukraine in 1022 and 2022, respectively 2 Non-sanctioned Russia-related clients outflows

1.0

(1.8)

1.3

(2.9)

3.3

1.1

2.8

Russia-related

outflows²:

2022: CHF (1.4) bn

1H22: CHF (1.9) bn

CREDIT SUISSEView entire presentation