Baird Investment Banking Pitch Book

ILLUSTRATIVE HAS / GETS ANALYSIS (CONT.)

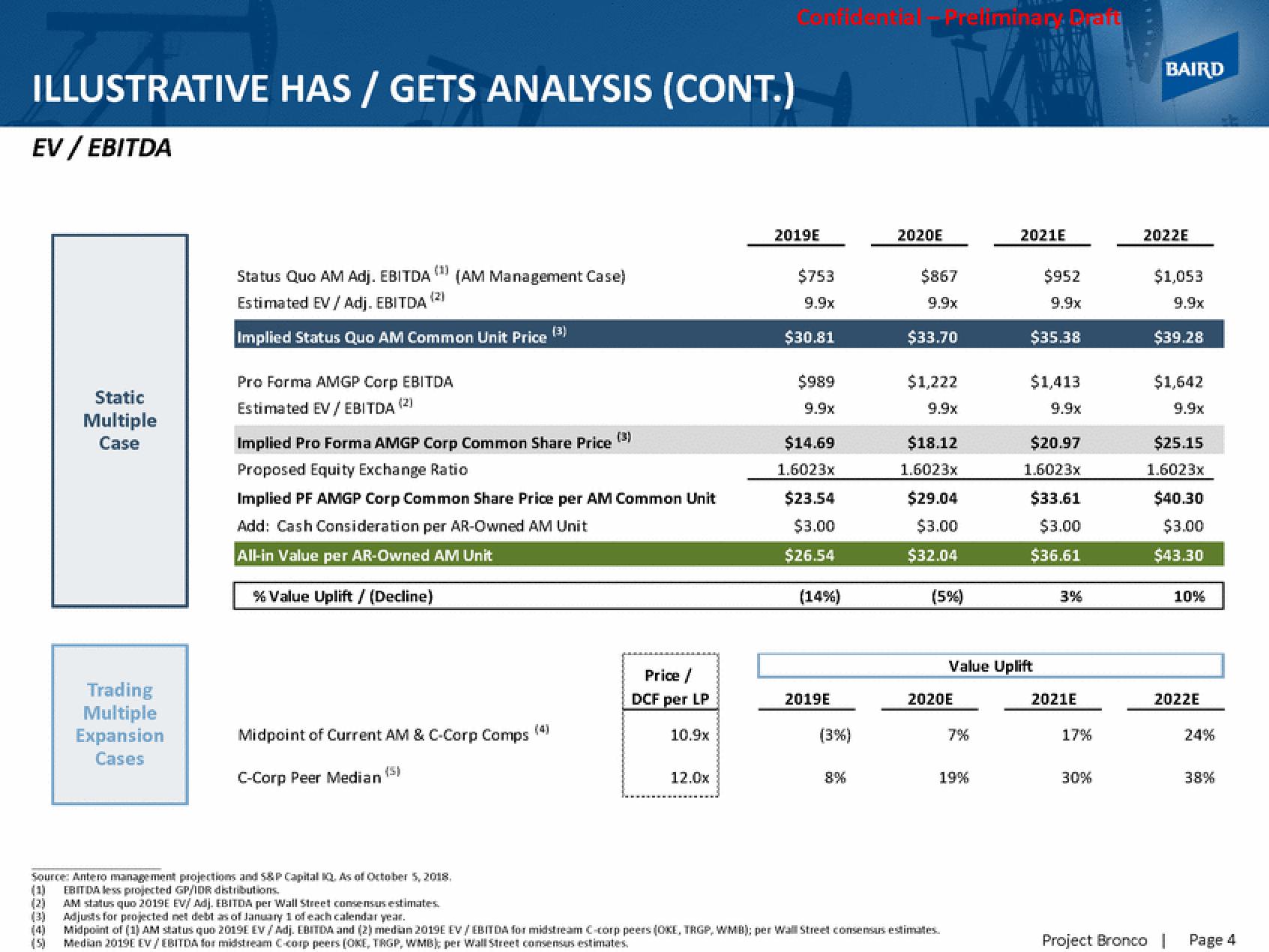

EV/EBITDA

(1)

(2)

(3)

Static

Multiple

Case

(5)

Trading

Multiple

Expansion

Cases

Status Quo AM Adj. EBITDA (AM Management Case)

Estimated EV / Adj. EBITDA

Implied Status Quo AM Common Unit Price (3)

Pro Forma AMGP Corp EBITDA

Estimated EV / EBITDA (2)

(3)

Implied Pro Forma AMGP Corp Common Share Price

Proposed Equity Exchange Ratio

Implied PF AMGP Corp Common Share Price per AM Common Unit

Add: Cash Consideration per AR-Owned AM Unit

All-in Value per AR-Owned AM Unit

% Value Uplift / (Decline)

Source: Antero management projections and S&P Capital IQ. As of October 5, 2018.

EBITDA less projected GP/IDR distributions.

Midpoint of Current AM & C-Corp Comps

C-Corp Peer Median

Price /

DCF per LP

10.9x

12.0x

2019E

$753

9.9x

$30.81

$989

9.9x

$14.69

1.6023x

$23.54

$3.00

$26.54

(14%)

2019E

(3%)

8%

Preliminar. Prant

2020E

$867

9.9x

$33.70

$1,222

9.9x

$18.12

1.6023x

$29.04

$3.00

$32.04

(5%)

2020E

AM status quo 2019E EV/ Adj. EBITDA per Wall Street consensus estimates.

Adjusts for projected net debt as of January 1 of each calendar year.

Midpoint of (1) AM status quo 2019E EV / Adj. EBITDA and (2) median 2019E EV/EBITDA for midstream C-corp peers (OKE, TRGP, WMB): per Wall Street consensus estimates.

Median 2019E EV / EBITDA for midstream C-corp peers (OKE, TRGP, WMB) per Wall Street consensus estimates.

7%

19%

2021E

$952

9.9x

$35.38

$1,413

9.9x

Value Uplift

$20.97

1.6023x

$33.61

$3.00

$36.61

3%

2021E

17%

30%

BAIRD

2022E

Project Bronco

$1,053

9.9x

$39.28

$1,642

9.9x

$25.15

1.6023x

$40.30

$3.00

$43.30

10%

2022E

24%

38%

Page 4View entire presentation