Carlyle Investor Conference Presentation Deck

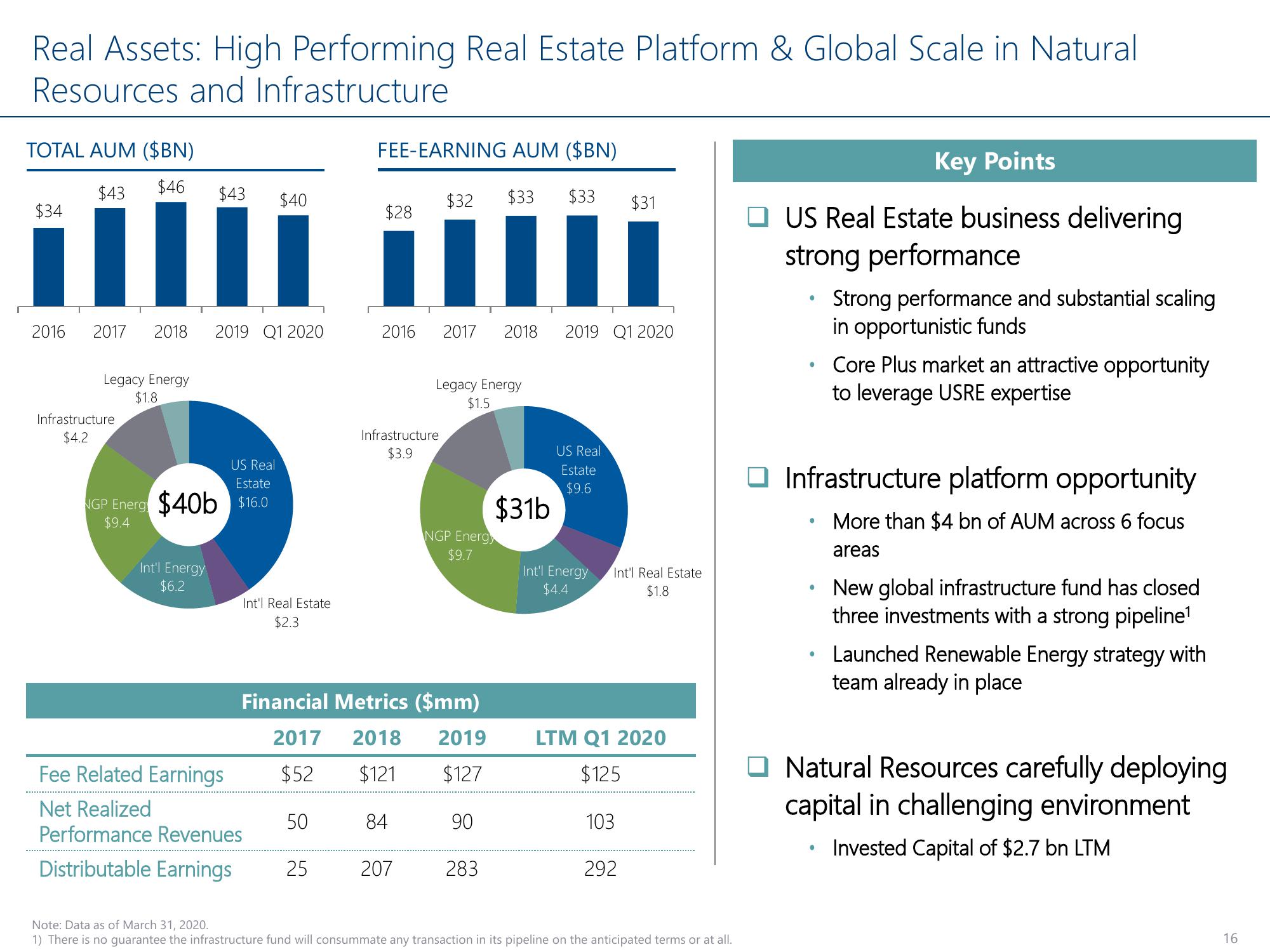

Real Assets: High Performing Real Estate Platform & Global Scale in Natural

Resources and Infrastructure

TOTAL AUM ($BN)

$34

2016

$43 $46 $43 $40

2017 2018 2019 Q1 2020

Legacy Energy

$1.8

Infrastructure

$4.2

US Real

Estate

NGP Energy $40b $16.0

$9.4

Int'l Energy

$6.2

Int'l Real Estate

$2.3

Fee Related Earnings

Net Realized

Performance Revenues

Distributable Earnings

FEE-EARNING AUM ($BN)

25

$28

2016

Infrastructure

$3.9

$32 $33 $33 $31

1

2018 2019 Q1 2020

207

2017

Legacy Energy

$1.5

Financial Metrics ($mm)

2017 2018 2019

$52 $121 $127

50

84

NGP Energy

$9.7

90

283

$31b

US Real

Estate

$9.6

Int'l Energy

$4.4

Int'l Real Estate

$1.8

LTM Q1 2020

$125

103

292

Note: Data as of March 31, 2020.

1) There is no guarantee the infrastructure fund will consummate any transaction in its pipeline on the anticipated terms or at all.

Key Points

US Real Estate business delivering

strong performance

●

Infrastructure platform opportunity

More than $4 bn of AUM across 6 focus

areas

●

Strong performance and substantial scaling

in opportunistic funds

Core Plus market an attractive opportunity

to leverage USRE expertise

●

New global infrastructure fund has closed

three investments with a strong pipeline¹

Launched Renewable Energy strategy with

team already in place

Natural Resources carefully deploying

capital in challenging environment

Invested Capital of $2.7 bn LTM

16View entire presentation