Lyft Results Presentation Deck

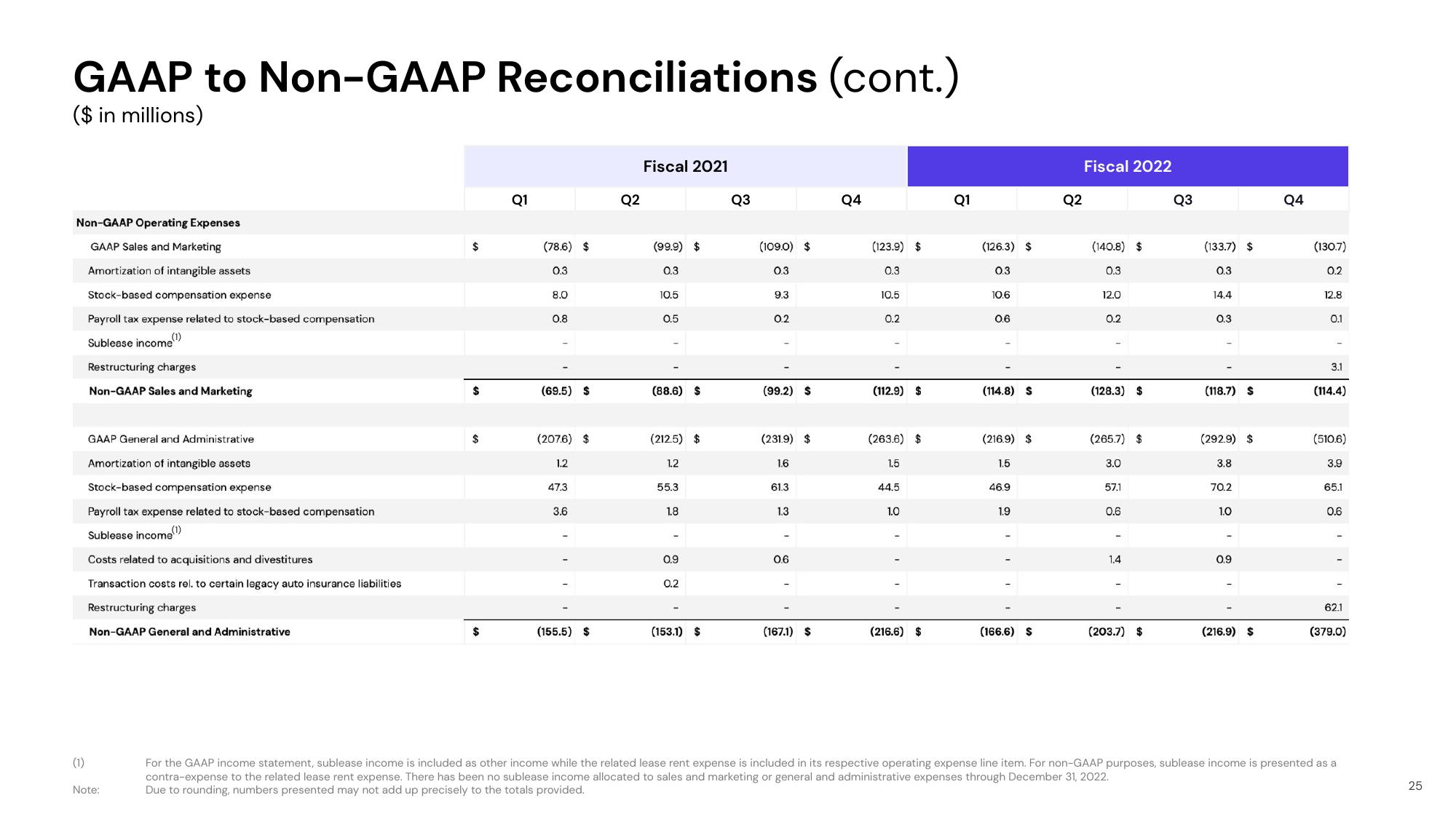

GAAP to Non-GAAP Reconciliations (cont.)

($ in millions)

Non-GAAP Operating Expenses

GAAP Sales and Marketing

Amortization of intangible assets

Stock-based compensation expense

(1)

Payroll tax expense related to stock-based compensation

Sublease income (1)

Restructuring charges

Non-GAAP Sales and Marketing

GAAP General and Administrative

Amortization of intangible assets

Stock-based compensation expense

Payroll tax expense related to stock-based compensation

Sublease income (1)

Costs related to acquisitions and divestitures

Transaction costs rel. to certain legacy auto insurance liabilities

Restructuring charges

Non-GAAP General and Administrative

Note:

$

$

Q1

(78.6) $

0.3

8.0

0.8

(69.5) $

(207.6) $

1.2

47.3

3.6

(155.5) $

Q2

Fiscal 2021

(99.9) $

0.3

10.5

0.5

(88.6) $

(212.5) $

1.2

55.3

1.8

0.9

0.2

(153.1) $

Q3

(109.0) $

0.3

9.3

0.2

(99.2) $

(231.9) $

1.6

61.3

1.3

0.6

(167.1) $

Q4

(123.9) $

0.3

10.5

0.2

(112.9) $

(263.6) $

1.5

44.5

1.0

(216.6) $

Q1

(126.3) $

0.3

10.6

0.6

(114.8) S

(216.9) $

1.5

46.9

1.9

(166.6) $

Q2

Fiscal 2022

(140.8) $

0.3

12.0

0.2

(128.3) $

(265.7) $

3.0

57.1

0.6

1.4

(203.7) $

Q3

(133.7) $

0.3

14.4

0.3

(118.7) S

(292.9) $

3.8

70.2

1.0

0.9

(216.9) $

Q4

(130.7)

0.2

12.8

0.1

3.1

(114.4)

(510.6)

3.9

65.1

0.6

62.1

(379.0)

For the GAAP income statement, sublease income is included as other income while the related lease rent expense is included in its respective operating expense line item. For non-GAAP purposes, sublease income is presented as a

contra-expense to the related lease rent expense. There has been no sublease income allocated to sales and marketing or general and administrative expenses through December 31, 2022.

Due to rounding, numbers presented may not add up precisely to the totals provided.

25View entire presentation