GMS Results Presentation Deck

Attractive Capital Structure Supports Strategic Priorities

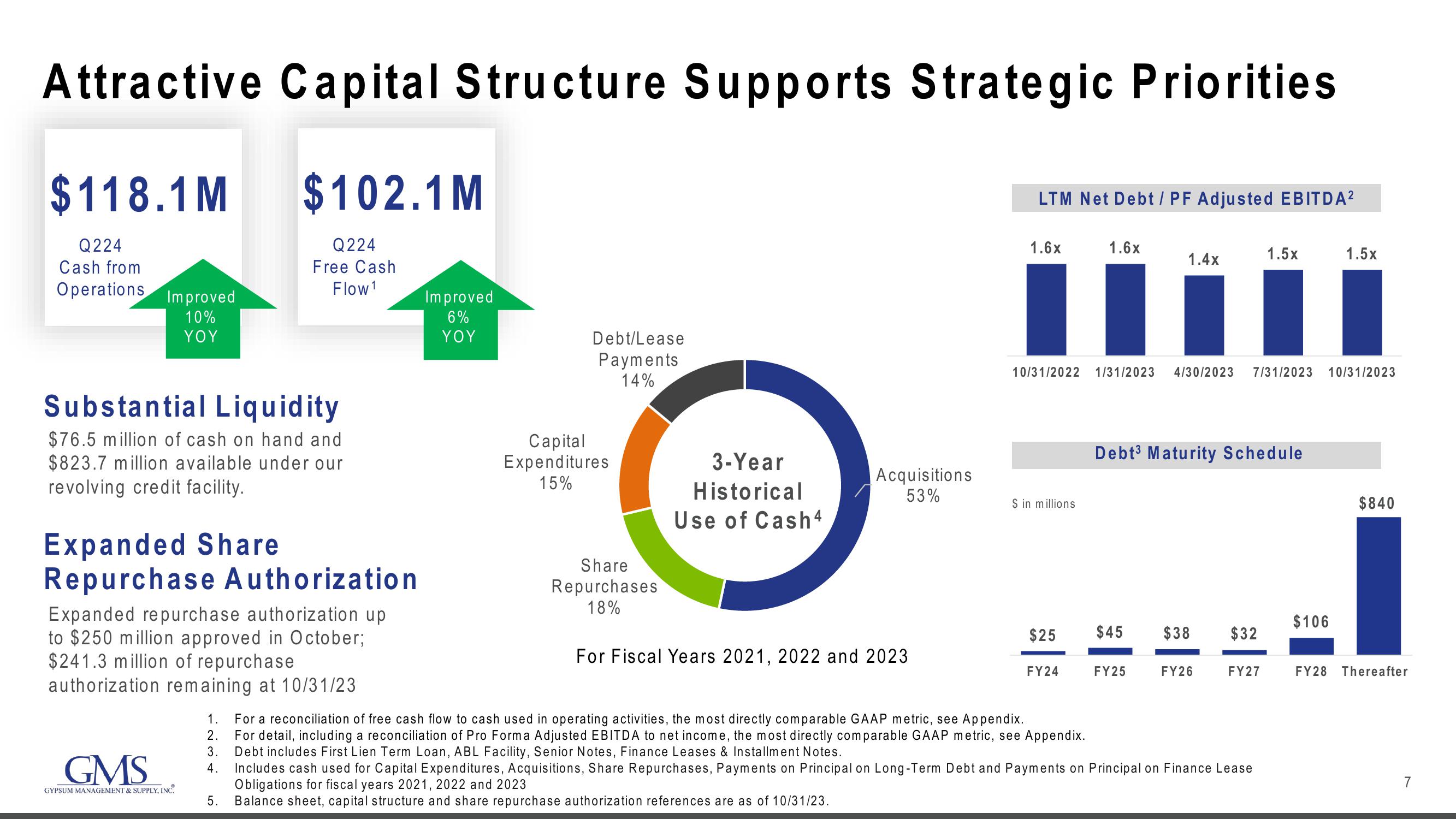

$118.1 M

$102.1M

Q224

Cash from

Operations Improved

10%

YOY

Substantial Liquidity

$76.5 million of cash on hand and

$823.7 million available under our

revolving credit facility.

Expanded Share

Repurchase Authorization

Q224

Free Cash

Flow 1

Expanded repurchase authorization up

to $250 million approved in October;

$241.3 million of repurchase

authorization remaining at 10/31/23

GMS

GYPSUM MANAGEMENT & SUPPLY, INC.

3.

4.

5.

Improved

6%

YOY

Debt/Lease

Payments

14%

Capital

Expenditures

15%

Share

Repurchases

18%

3-Year

Historical

Use of Cash4

Acquisitions

53%

For Fiscal Years 2021, 2022 and 2023

LTM Net Debt / PF Adjusted EBITDA²

1.6x

I

10/31/2022 1/31/2023 4/30/2023 7/31/2023 10/31/2023

$ in millions

$25

1.6x

FY24

$45

1.4x

Debt³ Maturity Schedule

FY25

$38 $32

FY26

1. For a reconciliation of free cash flow to cash used in operating activities, the most directly comparable GAAP metric, see Appendix.

2. For detail, including a reconciliation of Pro Forma Adjusted EBITDA to net income, the most directly comparable GAAP metric, see Appendix.

Debt includes First Lien Term Loan, ABL Facility, Senior Notes, Finance Leases & Installment Notes.

Includes cash used for Capital Expenditures, Acquisitions, Share Repurchases, Payments on Principal on Long-Term Debt and Payments on Principal on Finance Lease

Obligations for fiscal years 2021, 2022 and 2023

Balance sheet, capital structure and share repurchase authorization references are as of 10/31/23.

FY27

1.5x

$106

FY28

1.5x

$840

Thereafter

7View entire presentation