LKQ Mergers and Acquisitions Presentation Deck

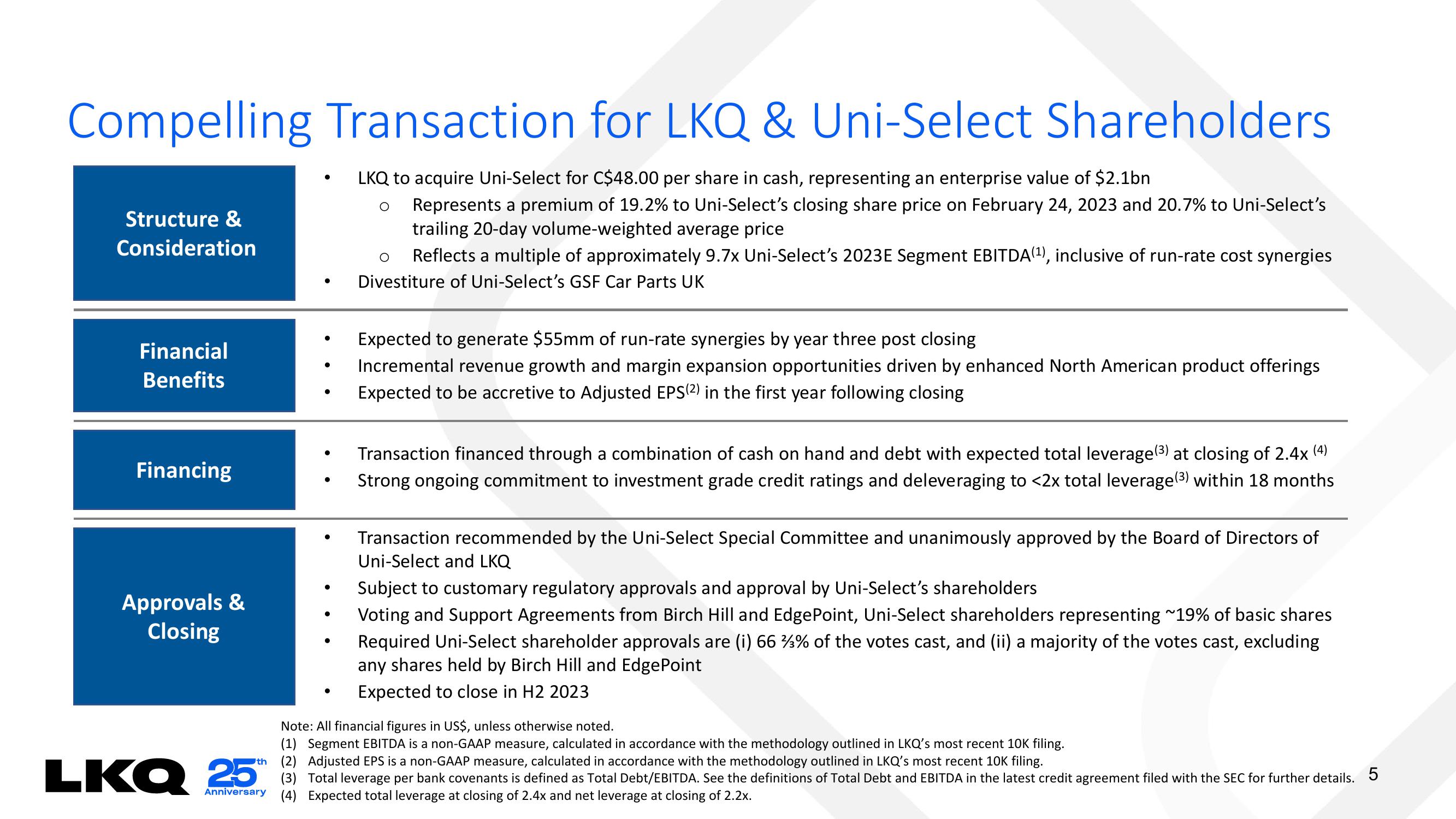

Compelling Transaction for LKQ & Uni-Select Shareholders

LKQ to acquire Uni-Select for C$48.00 per share in cash, representing an enterprise value of $2.1bn

O

Represents a premium of 19.2% to Uni-Select's closing share price on February 24, 2023 and 20.7% to Uni-Select's

trailing 20-day volume-weighted average price

Reflects a multiple of approximately 9.7x Uni-Select's 2023E Segment EBITDA(¹), inclusive of run-rate cost synergies

Divestiture of Uni-Select's GSF Car Parts UK

Structure &

Consideration

Financial

Benefits

Financing

Approvals &

Closing

●

LKQ 25th

●

●

●

●

●

●

●

●

●

O

Expected to generate $55mm of run-rate synergies by year three post closing

Incremental revenue growth and margin expansion opportunities driven by enhanced North American product offerings

Expected to be accretive to Adjusted EPS(²) in the first year following closing

Transaction financed through a combination of cash on hand and debt with expected total leverage (3) at closing of 2.4x (4)

Strong ongoing commitment to investment grade credit ratings and deleveraging to <2x total leverage (3) within 18 months

Transaction recommended by the Uni-Select Special Committee and unanimously approved by the Board of Directors of

Uni-Select and LKQ

Subject to customary regulatory approvals and approval by Uni-Select's shareholders

Voting and Support Agreements from Birch Hill and EdgePoint, Uni-Select shareholders representing ~19% of basic shares

Required Uni-Select shareholder approvals are (i) 66 %% of the votes cast, and (ii) a majority of the votes cast, excluding

any shares held by Birch Hill and EdgePoint

Expected to close in H2 2023

Note: All financial figures in US$, unless otherwise noted.

(1) Segment EBITDA is a non-GAAP measure, calculated in accordance with the methodology outlined in LKQ's most recent 10K filing.

(2) Adjusted EPS is a non-GAAP measure, calculated in accordance with the methodology outlined in LKQ's most recent 10K filing.

(3)

Total leverage per bank covenants is defined as Total Debt/EBITDA. See the definitions of Total Debt and EBITDA in the latest credit agreement filed with the SEC for further details. 5

Anniversary (4) Expected total leverage at closing of 2.4x and net leverage at closing of 2.2x.View entire presentation