Flutter SPAC Presentation Deck

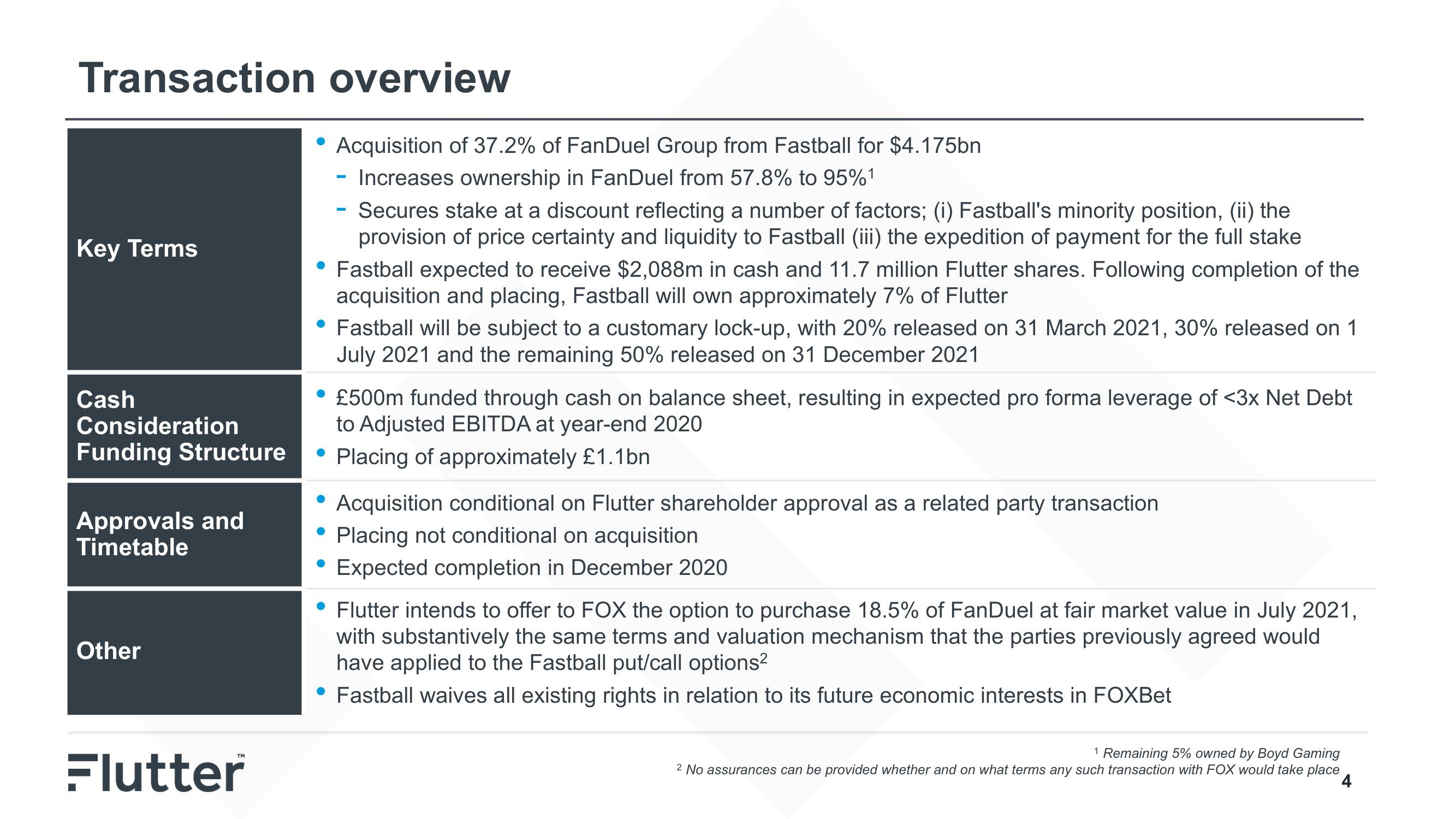

Transaction overview

Key Terms

Cash

Consideration

Funding Structure

Approvals and

Timetable

Other

Flutter

Acquisition of 37.2% of FanDuel Group from Fastball for $4.175bn

- Increases ownership in FanDuel from 57.8% to 95% ¹

-

Secures stake at a discount reflecting a number of factors; (i) Fastball's minority position, (ii) the

provision of price certainty and liquidity to Fastball (iii) the expedition of payment for the full stake

• Fastball expected to receive $2,088m in cash and 11.7 million Flutter shares. Following completion of the

acquisition and placing, Fastball will own approximately 7% of Flutter

• Fastball will be subject to a customary lock-up, with 20% released on 31 March 2021, 30% released on 1

July 2021 and the remaining 50% released on 31 December 2021

• £500m funded through cash on balance sheet, resulting in expected pro forma leverage of <3x Net Debt

to Adjusted EBITDA at year-end 2020

• Placing of approximately £1.1bn

Acquisition conditional on Flutter shareholder approval as a related party transaction

Placing not conditional on acquisition

• Expected completion in December 2020

• Flutter intends to offer to FOX the option to purchase 18.5% of FanDuel at fair market value in July 2021,

with substantively the same terms and valuation mechanism that the parties previously agreed would

have applied to the Fastball put/call options²

• Fastball waives all existing rights in relation to its future economic interests in FOXBet

1 Remaining 5% owned by Boyd Gaming

2 No assurances can be provided whether and on what terms any such transaction with FOX would take placeView entire presentation