Moelis & Company Investment Banking Pitch Book

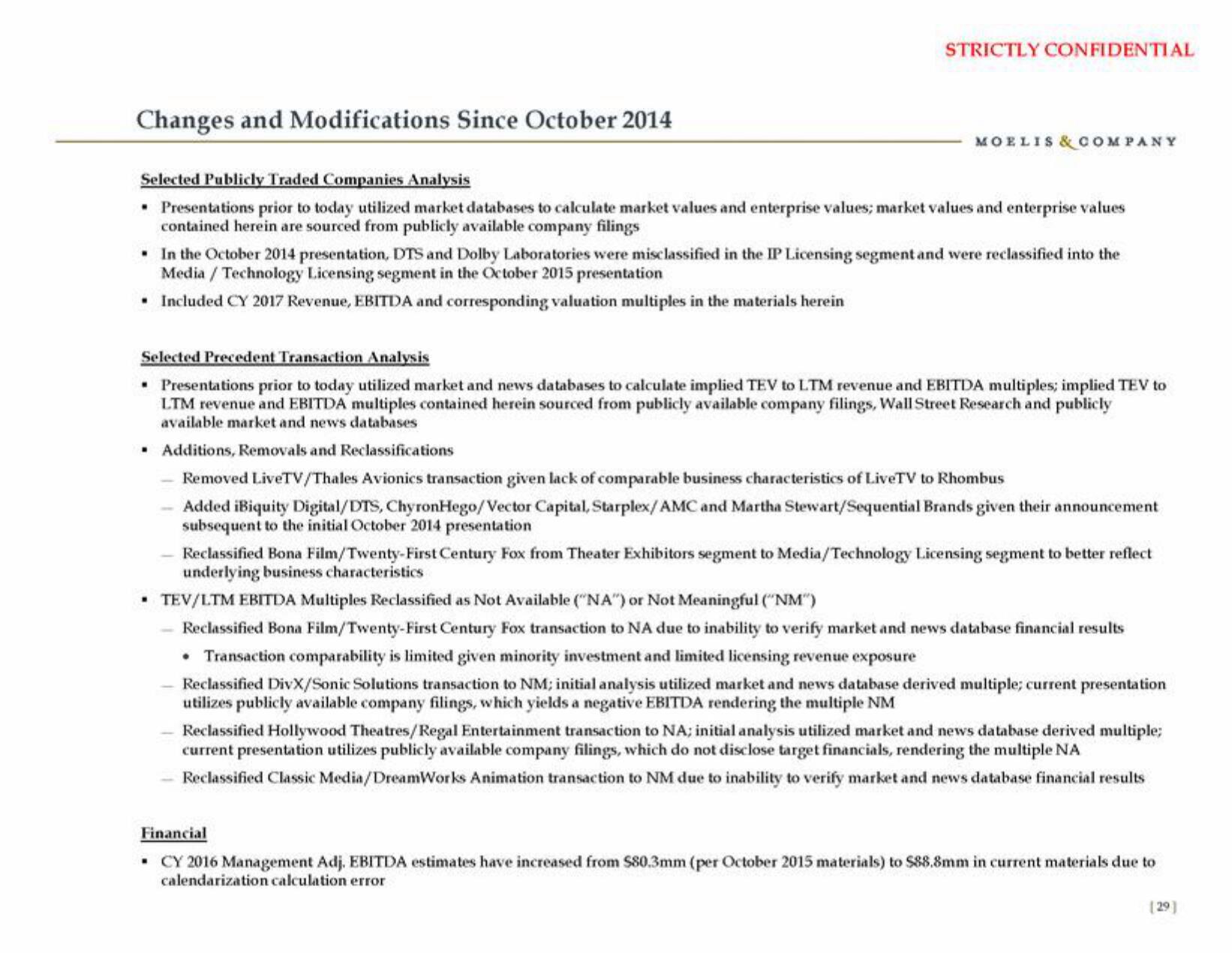

Changes and Modifications Since October 2014

STRICTLY CONFIDENTIAL

MOELIS & COMPANY

Selected Publicly Traded Companies Analysis

• Presentations prior to today utilized market databases to calculate market values and enterprise values; market values and enterprise values

contained herein are sourced from publicly available company filings

• In the October 2014 presentation, DTS and Dolby Laboratories were misclassified in the IP Licensing segment and were reclassified into the

Media/Technology Licensing segment in the October 2015 presentation

Included CY 2017 Revenue, EBITDA and corresponding valuation multiples in the materials herein

Selected Precedent Transaction Analysis

• Presentations prior to today utilized market and news databases to calculate implied TEV to LTM revenue and EBITDA multiples; implied TEV to

LTM revenue and EBITDA multiples contained herein sourced from publicly available company filings, Wall Street Research and publicly

available market and news databases

▪ Additions, Removals and Reclassifications

Removed LiveTV/ Thales Avionics transaction given lack of comparable business characteristics of LiveTV to Rhombus

Added iBiquity Digital/DTS, ChyronHego/Vector Capital, Starplex/ AMC and Martha Stewart/Sequential Brands given their announcement

subsequent to the initial October 2014 presentation

Reclassified Bona Film/Twenty-First Century Fox from Theater Exhibitors segment to Media/Technology Licensing segment to better reflect

underlying business characteristics

• TEV/LTM EBITDA Multiples Reclassified as Not Available ("NA") or Not Meaningful ("NM")

Reclassified Bona Film/Twenty-First Century Fox transaction to NA due to inability to verify market and news database financial results

Transaction comparability is limited given minority investment and limited licensing revenue exposure

Reclassified DivX/Sonic Solutions transaction to NM; initial analysis utilized market and news database derived multiple; current presentation

utilizes publicly available company filings, which yields a negative EBITDA rendering the multiple NM

Reclassified Hollywood Theatres/Regal Entertainment transaction to NA; initial analysis utilized market and news database derived multiple;

current presentation utilizes publicly available company filings, which do not disclose target financials, rendering the multiple NA

Reclassified Classic Media/DreamWorks Animation transaction to NM due to inability to verify market and news database financial results

Financial

. CY 2016 Management Adj. EBITDA estimates have increased from $80.3mm (per October 2015 materials) to $88.8mm in current materials due to

calendarization calculation error

[29]View entire presentation