Credit Suisse Results Presentation Deck

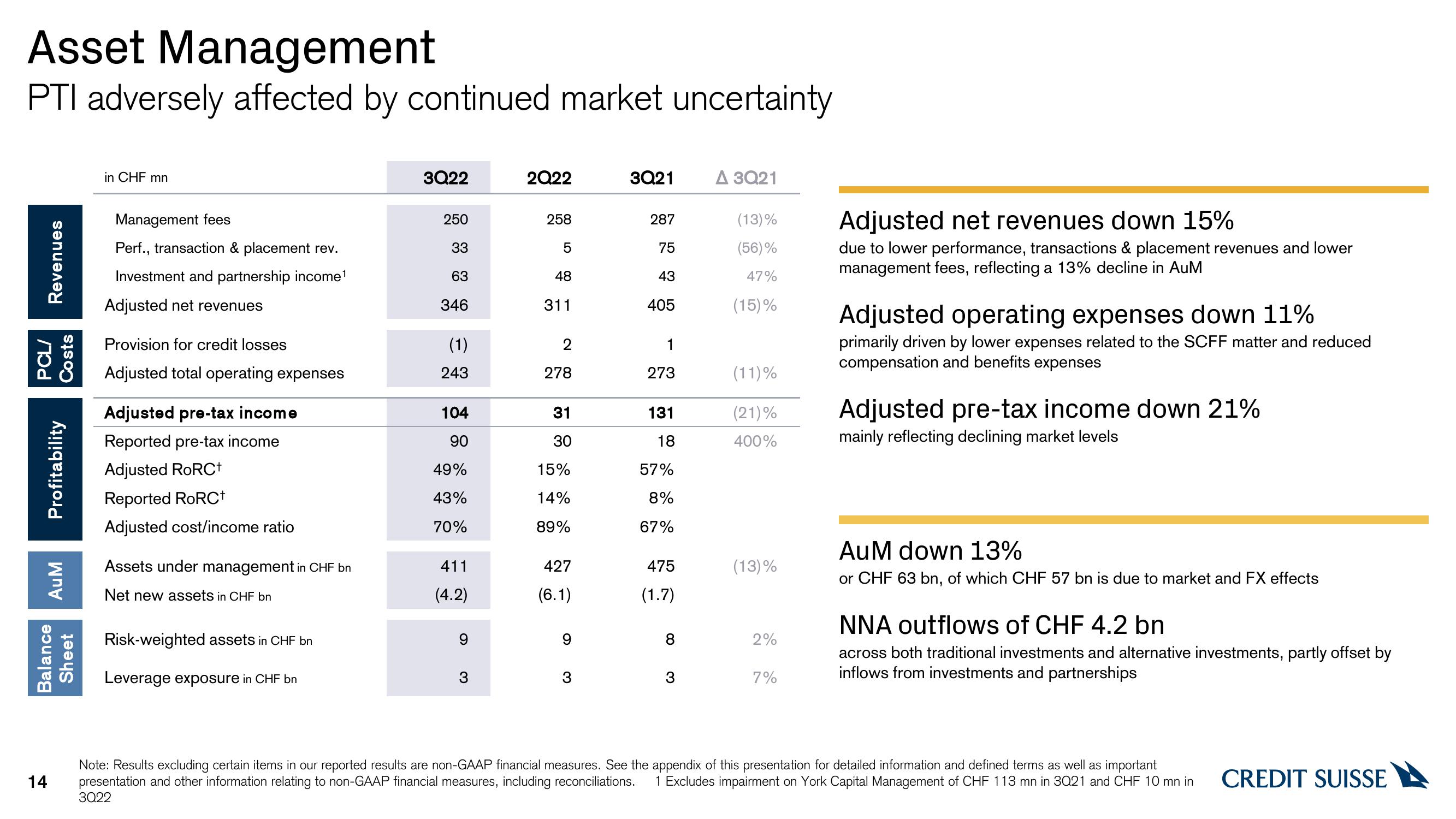

Asset Management

PTI adversely affected by continued market uncertainty

Revenues

PCL/

Costs

Profitability

AuM

Balance

Sheet

in CHF mn

Management fees

Perf., transaction & placement rev.

Investment and partnership income¹

Adjusted net revenues

Provision for credit losses

Adjusted total operating expenses

Adjusted pre-tax income

Reported pre-tax income

Adjusted RoRC+

Reported RoRCt

Adjusted cost/income ratio

Assets under management in CHF bn

Net new assets in CHF bn

Risk-weighted assets in CHF bn

Leverage exposure in CHF bn

3Q22

250

33

63

346

(1)

243

104

90

49%

43%

70%

411

(4.2)

9

2022

258

5

48

311

2

278

31

30

15%

14%

89%

427

(6.1)

9

3

3Q21

287

75

43

405

1

273

131

18

57%

8%

67%

475

(1.7)

8

3

A 3Q21

(13)%

(56)%

47%

(15)%

(11)%

(21)%

400%

(13)%

2%

7%

Adjusted net revenues down 15%

due to lower performance, transactions & placement revenues and lower

management fees, reflecting a 13% decline in AuM

Adjusted operating expenses down 11%

primarily driven by lower expenses related to the SCFF matter and reduced

compensation and benefits expenses

Adjusted pre-tax income down 21%

mainly reflecting declining market levels

AuM down 13%

or CHF 63 bn, of which CHF 57 bn is due to market and FX effects

NNA outflows of CHF 4.2 bn

across both traditional investments and alternative investments, partly offset by

inflows from investments and partnerships

Note: Results excluding certain items in our reported results are non-GAAP financial measures. See the appendix of this presentation for detailed information and defined terms as well as important

14 presentation and other information relating to non-GAAP financial measures, including reconciliations. 1 Excludes impairment on York Capital Management of CHF 113 mn in 3Q21 and CHF 10 mn in CREDIT SUISSE

3Q22View entire presentation