KKR Real Estate Finance Trust Investor Presentation Deck

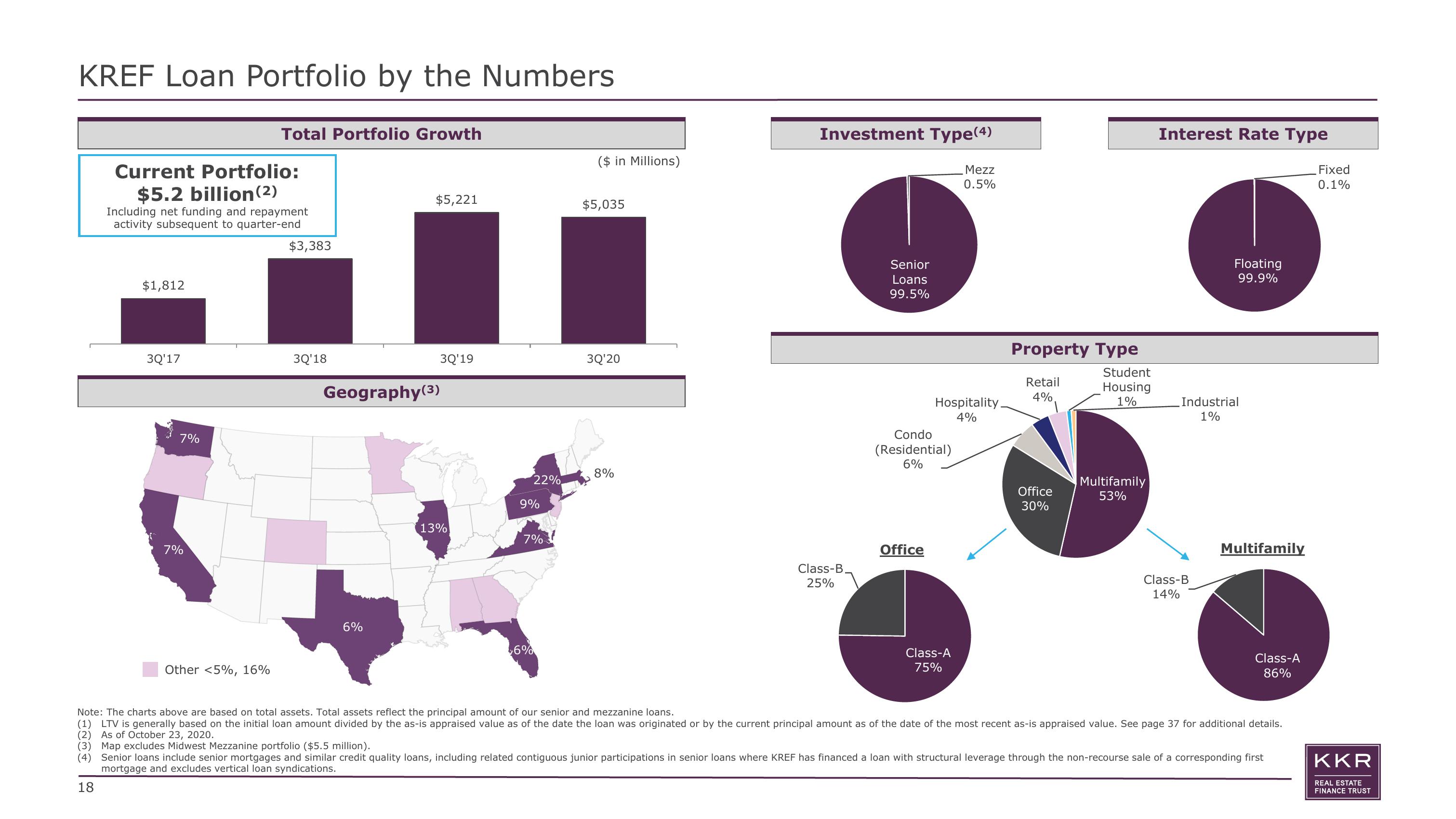

KREF Loan Portfolio by the Numbers

Current Portfolio:

$5.2 billion (2)

Including net funding and repayment

activity subsequent to quarter-end

$1,812

3Q'17

7%

7%

Total Portfolio Growth

Other <5%, 16%

$3,383

3Q'18

$5,221

6%

3Q'19

Geography (3)

13%

22%

9%

7%

$6%

($ in Millions)

$5,035

3Q'20

8%

Investment Type(4)

Mezz

0.5%

Class-B

25%

Senior

Loans

99.5%

Hospitality

4%

Condo

(Residential)

6%

Office

Class-A

75%

Property Type

Student

Housing

1%

Retail

4%

Office

30%

Multifamily

53%

Interest Rate Type

Floating

99.9%

Industrial

1%

Class-B

14%

Multifamily

Class-A

86%

Note: The charts above are based on total assets. Total assets reflect the principal amount of our senior and mezzanine loans.

(1) LTV is generally based on the initial loan amount divided by the as-is appraised value as of the date the loan was originated or by the current principal amount as of the date of the most recent as-is appraised value. See page 37 for additional details.

(2) As of October 23, 2020.

(3) Map excludes Midwest Mezzanine portfolio ($5.5 million).

(4) Senior loans include senior mortgages and similar credit quality loans, including related contiguous junior participations in senior loans where KREF has financed a loan with structural leverage through the non-recourse sale of a corresponding first

mortgage and excludes vertical loan syndications.

18

Fixed

0.1%

KKR

REAL ESTATE

FINANCE TRUSTView entire presentation