Ashtead Group Results Presentation Deck

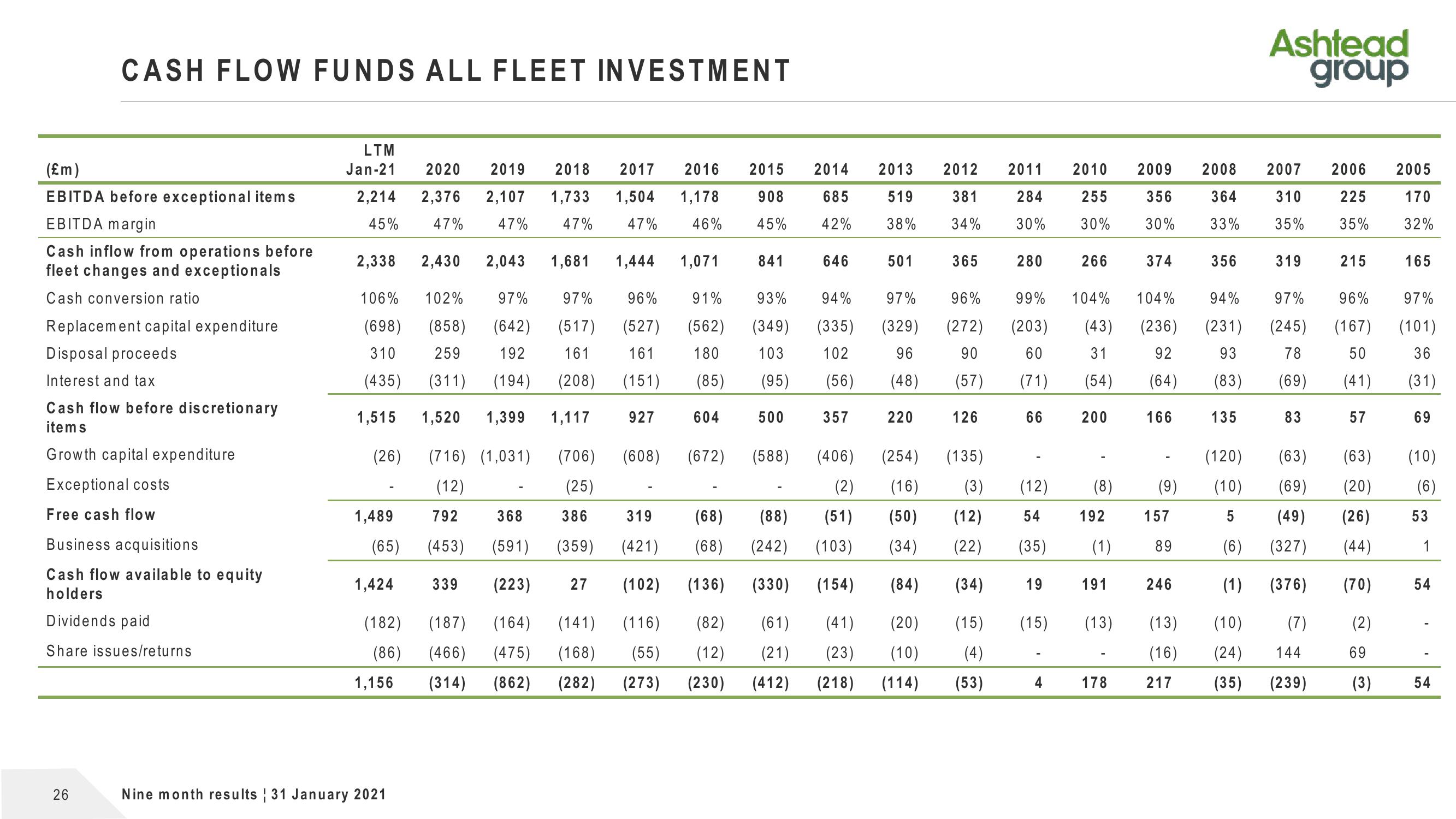

CASH FLOW FUNDS ALL FLEET INVESTMENT

(£m)

EBITDA before exceptional items

EBITDA margin

Cash inflow from operations before

fleet changes and exceptionals

Cash conversion ratio

Replacement capital expenditure

Disposal proceeds

Interest and tax

Cash flow before discretionary

items

Growth capital expenditure

Exceptional costs

Free cash flow

Business acquisitions

Cash flow available to equity

holders

Dividends paid

Share issues/returns

26

LTM

Jan-21 2020 2019

2018 2017 2016 2015

2,214 2,376 2,107 1,733 1,504 1,178 908

45% 47% 47% 47% 47% 46% 45%

1,681 1,444 1,071

91%

96%

(527) (562)

161

180

(151)

(85)

927

604

2,338

106%

(698)

310

(435)

1,515

(26) (716) (1,031) (706)

(12)

(25)

1,489

(65)

1,424

(182)

(86)

1,156

2,430 2,043

102%

97% 97%

(858) (642) (517)

259 192 161

(311) (194) (208)

1,520 1,399 1,117

Nine month results 31 January 2021

792

(453)

339

(608)

(466) (475)

(187) (164) (141)

(168)

(282)

(314)

(862)

(672)

368

386

319

(421) (68)

(591)

(359)

(223) 27 (102) (136)

841

93%

(349)

103

(95)

500

(588)

(68) (88)

(242)

(330)

(116) (82) (61)

(55) (12) (21)

(273) (230) (412)

2014

685

42%

646

94%

(335)

102

(56)

357

2013 2012 2011

381 284

34% 30%

519

38%

501

97%

(329)

96

(48)

220

365

280

96% 99%

(272) (203)

90

60

(57) (71)

126

(406) (254)

(135)

(2)

(16)

(3)

(51)

(50)

(12)

(103) (34) (22)

(154)

(84)

(34)

(41)

(20)

(15)

(23) (10) (4)

(218) (114) (53)

66

19

(15)

2010

255

30%

4

266

(12)

54

(35) (1)

200

104% 104%

(43)

(236)

31

92

(54)

(64)

166

(8)

192

191

(13)

2009 2008

356

30%

364

33%

178

374

(9)

157

89

246

(13)

(16)

217

356

94%

(231)

93

(83)

135

Ashtead

group

2007

310

35%

319

97%

(245)

78

(69)

83

(63)

(120)

(10)

(69)

5

(49)

(6)

(327)

(1) (376)

(10)

(7)

(24)

144

(35) (239)

2006 2005

225

35%

170

32%

215

96%

(167)

50

(41)

57

(63)

(20)

(26)

(44)

(70)

(2)

165

97%

(101)

36

(31)

69

(10)

(6)

53

1

54

69

(3) 54View entire presentation