Ford Investor Conference Presentation Deck

Ford Credit

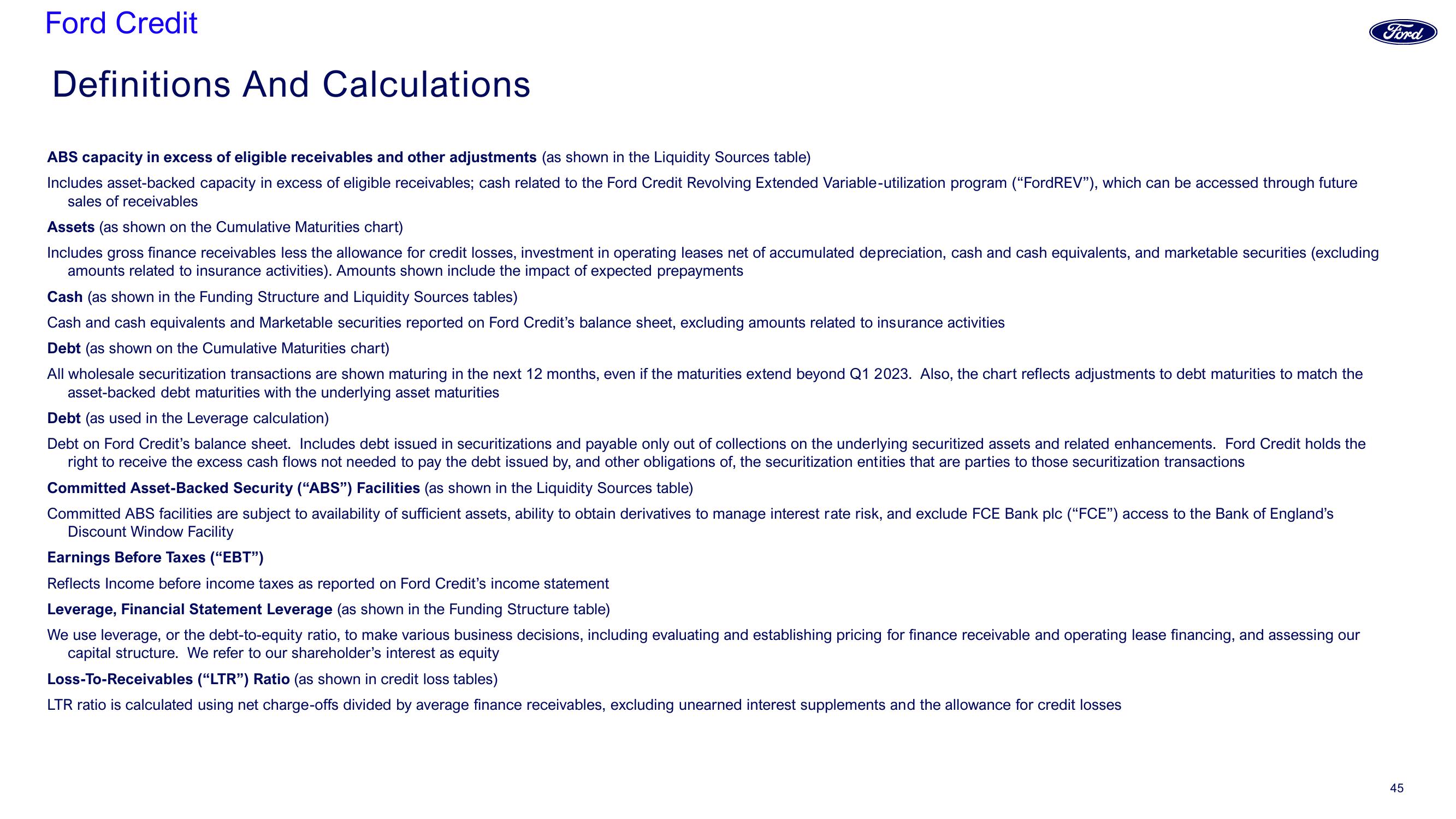

Definitions And Calculations

ABS capacity in excess of eligible receivables and other adjustments (as shown in the Liquidity Sources table)

Includes asset-backed capacity in excess of eligible receivables; cash related to the Ford Credit Revolving Extended Variable-utilization program ("FordREV"), which can be accessed through future

sales of receivables

Assets (as shown on the Cumulative Maturities chart)

Includes gross finance receivables less the allowance for credit losses, investment in operating leases of accumulated depreciation, cas and cash equivalents, and marketable securities (excluding

amounts related to insurance activities). Amounts shown include the impact of expected prepayments

Cash (as shown in the Funding Structure and Liquidity Sources tables)

Cash and cash equivalents and Marketable securities reported on Ford Credit's balance sheet, excluding amounts related to insurance activities

Debt (as shown on the Cumulative Maturities chart)

All wholesale securitization transactions are shown maturing in the next 12 months, even if the maturities extend beyond Q1 2023. Also, the chart reflects adjustments to debt maturities to match the

asset-backed debt maturities with the underlying asset maturities

Debt (as used in the Leverage calculation)

Debt on Ford Credit's balance sheet. Includes debt issued in securitizations and payable only out of collections on the underlying securitized assets and related enhancements. Ford Credit holds the

right to receive the excess cash flows not needed to pay the debt issued by, and other obligations of, the securitization entities that are parties to those securitization transactions

Committed Asset-Backed Security ("ABS") Facilities (as shown in the Liquidity Sources table)

Committed ABS facilities are subject to availability of sufficient assets, ability to obtain derivatives to manage interest rate risk, and exclude FCE Bank plc ("FCE") access to the Bank of England's

Discount Window Facility

Earnings Before Taxes ("EBT")

Reflects Income before income taxes as reported on Ford Credit's income statement

Leverage, Financial Statement Leverage (as shown in the Funding Structure table)

We use leverage, or the debt-to-equity ratio, to make various business decisions, including evaluating and establishing pricing for finance receivable and operating lease financing, and assessing our

capital structure. We refer to our shareholder's interest as equity

Loss-To-Receivables ("LTR") Ratio (as shown in credit loss tables)

LTR ratio is calculated using net charge-offs divided by average finance receivables, excluding unearned interest supplements and the allowance for credit losses

Ford

45View entire presentation