Better SPAC Presentation Deck

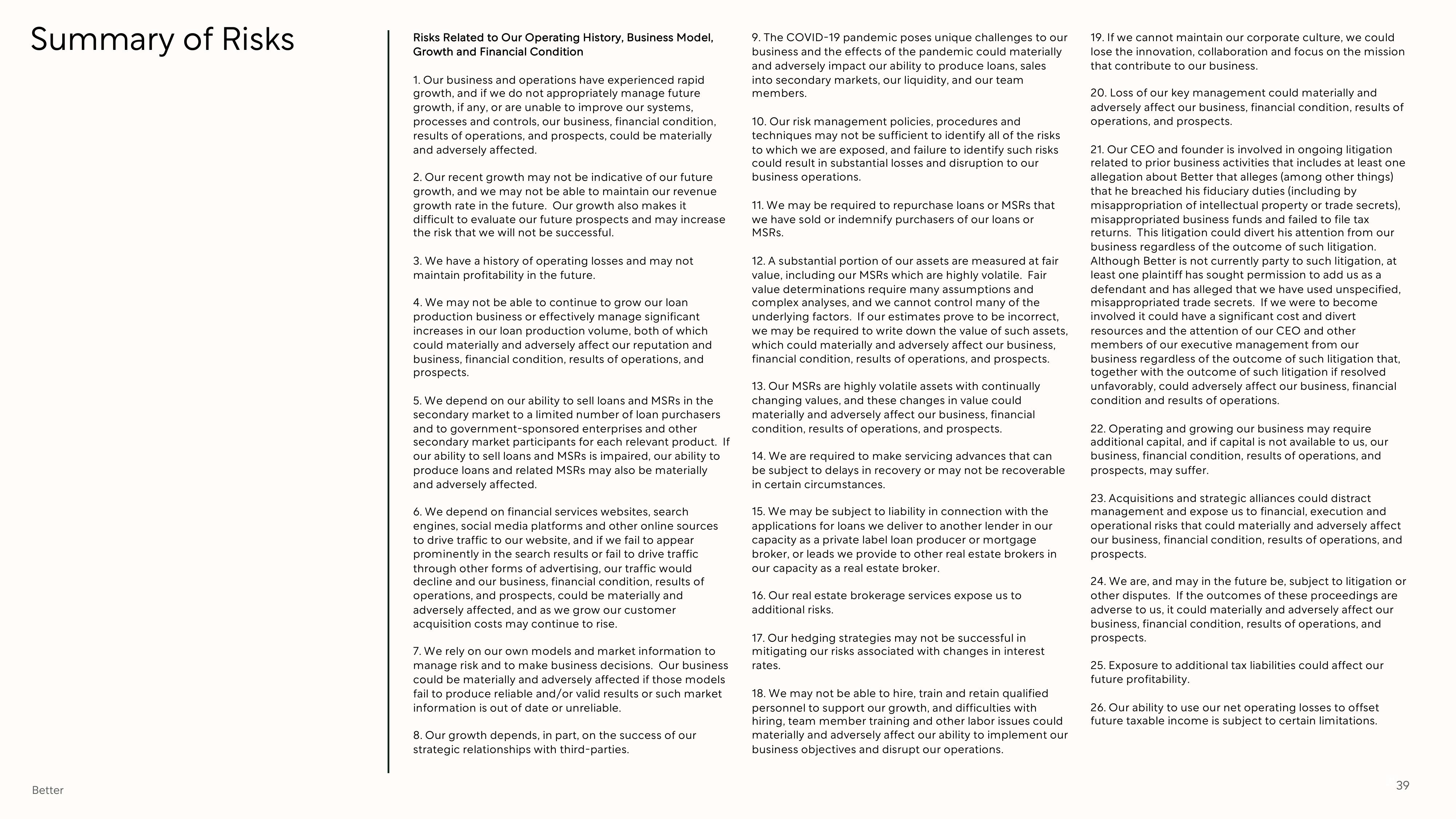

Summary of Risks

Better

Risks Related to Our Operating History, Business Model,

Growth and Financial Condition

1. Our business and operations have experienced rapid

growth, and if we do not appropriately manage future

growth, if any, or are unable to improve our systems,

processes and controls, our business, financial condition,

results of operations, and prospects, could be materially

and adversely affected.

2. Our recent growth may not be indicative of our future

growth, and we may not be able to maintain our revenue

growth rate in the future. Our growth also makes it

difficult to evaluate our future prospects and may increase

the risk that we will not be successful.

3. We have a history of operating losses and may not

maintain profitability in the future.

4. We may not be able to continue to grow our loan

production business or effectively manage significant

increases in our loan production volume, both of which

could materially and adversely affect our reputation and

business, financial condition, results of operations, and

prospects.

5. We depend on our ability to sell loans and MSRs in the

secondary market to a limited number of loan purchasers

and to government-sponsored enterprises and other

secondary market participants for each relevant product. If

our ability to sell loans and MSRS is impaired, our ability to

produce loans and related MSRs may also be materially

and adversely affected.

6. We depend on financial services websites, search

engines, social media platforms and other online sources

to drive traffic to our website, and if we fail to appear

prominently in the search results or fail to drive traffic

through other forms of advertising, our traffic would

decline and our business, financial condition, results of

operations, and prospects, could be materially and

adversely affected, and as we grow our customer

acquisition costs may continue to rise.

7. We rely on our own models and market information to

manage risk and to make business decisions. Our business

could be materially and adversely affected if those models

fail to produce reliable and/or valid results or such market

information is out of date or unreliable.

8. Our growth depends, in part, on the success of our

strategic relationships with third-parties.

9. The COVID-19 pandemic poses unique challenges to our

business and the effects of the pandemic could materially

and adversely impact our ability to produce loans, sales

into secondary markets, our liquidity, and our team

members.

10. Our risk management policies, procedures and

techniques may not be sufficient to identify all of the risks

to which we are exposed, and failure to identify such risks

could result in substantial losses and disruption to our

business operations.

11. We may be required to repurchase loans or MSRs that

we have sold or indemnify purchasers of our loans or

MSRs.

12. A substantial portion of our assets are measured at fair

value, including our MSRs which are highly volatile. Fair

value determinations require many assumptions and

complex analyses, and we cannot control many of the

underlying factors. If our estimates prove to be incorrect,

we may be required to write down the value of such assets,

which could materially and adversely affect our business,

financial condition, results of operations, and prospects.

13. Our MSRS are highly volatile assets with continually

changing values, and these changes in value could.

materially and adversely affect our business, financial

condition, results of operations, and prospects.

14. We are required to make servicing advances that can

be subject to delays in recovery or may not be recoverable

in certain circumstances.

15. We may be subject to liability in connection with the

applications for loans we deliver to another lender in our

capacity as a private label loan producer or mortgage

broker, or leads we provide to other real estate brokers in

our capacity as a real estate broker.

16. Our real estate brokerage services expose us to

additional risks.

17. Our hedging strategies may not be successful in

mitigating our risks associated with changes in interest

rates.

18. We may not be able to hire, train and retain qualified

personnel to support our growth, and difficulties with

hiring, team member training and other labor issues could

materially and adversely affect our ability to implement our

business objectives and disrupt our operations.

19. If we cannot maintain our corporate culture, we could

lose the innovation, collaboration and focus on the mission

that contribute to our business.

20. Loss of our key management could materially and

adversely affect our business, financial condition, results of

operations, and prospects.

21. Our CEO and founder is involved in ongoing litigation

related to prior business activities that includes at least one

allegation about Better that alleges (among other things)

that he breached his fiduciary duties (including by

misappropriation of intellectual property or trade secrets),

misappropriated business funds and failed to file tax

returns. This litigation could divert his attention from our

business regardless of the outcome of such litigation.

Although Better is not currently party to such litigation, at

least one plaintiff has sought permission to add us as a

defendant and has alleged that we have used unspecified,

misappropriated trade secrets. If we were to become

involved it could have a significant cost and divert

resources and the attention of our CEO and other

members of our executive management from our

business regardless of the outcome of such litigation that,

together with the outcome of such litigation if resolved

unfavorably, could adversely affect our business, financial

condition and results of operations.

22. Operating and growing our business may require

additional capital, and if capital is not available to us, our

business, financial condition, results of operations, and

prospects, may suffer.

23. Acquisitions and strategic alliances could distract

management and expose us to financial, execution and

operational risks that could materially and adversely affect

our business, financial condition, results of operations, and

prospects.

24. We are, and may in the future be, subject to litigation or

other disputes. If the outcomes of these proceedings are

adverse to us, it could materially and adversely affect our

business, financial condition, results of operations, and

prospects.

25. Exposure to additional tax liabilities could affect our

future profitability.

26. Our ability to use our net operating losses to offset

future taxable income is subject to certain limitations.

39View entire presentation