Orthofix Investor Presentation Deck

Pro Forma Non-GAAP Financial Measures

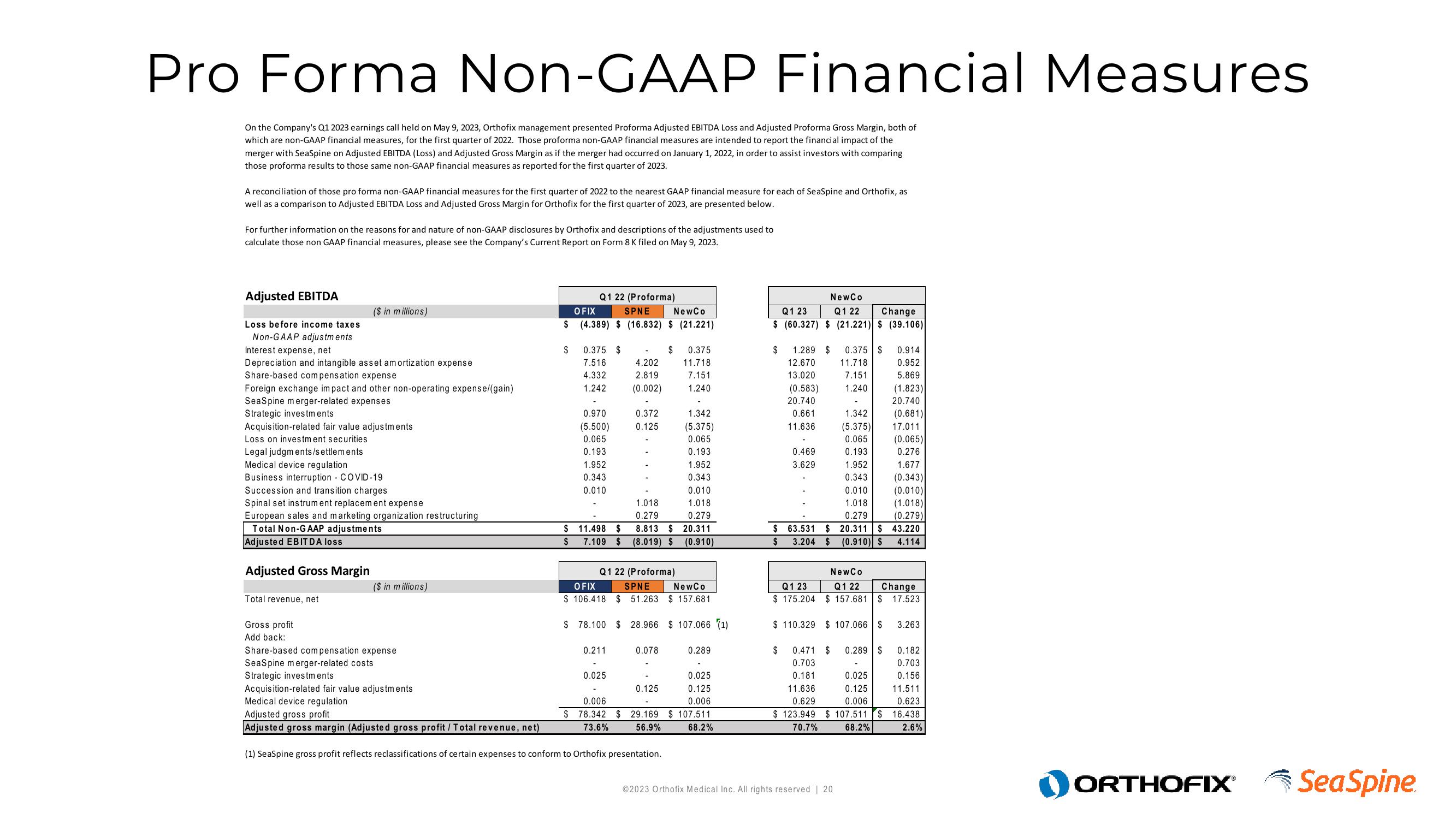

On the Company's Q1 2023 earnings call held on May 9, 2023, Orthofix management presented Proforma Adjusted EBITDA Loss and Adjusted Proforma Gross Margin, both of

which are non-GAAP financial measures, for the first quarter of 2022. Those proforma non-GAAP financial measures are intended to report the financial impact of the

merger with SeaSpine on Adjusted EBITDA (Loss) and Adjusted Gross Margin as if the merger had occurred on January 1, 2022, in order to assist investors with comparing

those proforma results to those same non-GAAP financial measures as reported for the first quarter of 2023.

A reconciliation of those pro forma non-GAAP financial measures for the first quarter of 2022 to the nearest GAAP financial measure for each of SeaSpine and Orthofix, as

well as a comparison to Adjusted EBITDA Loss and Adjusted Gross Margin for Orthofix for the first quarter of 2023, are presented below.

For further information on the reasons for and nature of non-GAAP disclosures by Orthofix and descriptions of the adjustments used to

calculate those non GAAP financial measures, please see the Company's Current Report on Form 8 K filed on May 9, 2023.

Adjusted EBITDA

Loss before income taxes

Non-GAAP adjustments

Interest expense, net

Depreciation and intangible asset amortization expense

Share-based compensation expense

Foreign exchange impact and other non-operating expense/(gain)

SeaSpine merger-related expenses

Strategic investments

($ in millions)

Acquisition-related fair value adjustments

Loss on investment securities

Legal judgments/settlements

Medical device regulation

Business interruption - COVID-19

Succession and transition charges

Spinal set instrument replacement expense

European sales and marketing organization restructuring

Total Non-GAAP adjustments

Adjusted EBITDA loss

Adjusted Gross Margin

Total revenue, net

Gross profit

Add back:

($ in millions)

Share-based compensation expense

SeaSpine merger-related costs

Strategic investments

Acquisition-related fair value adjustments

Medical device regulation

$

$

Q1 22 (Proforma)

OFIX

SPNE

NewCo

(4.389) $ (16.832) $ (21.221)

0.375 $

7.516

4.332

1.242

0.970

(5.500)

0.065

0.193

1.952

0.343

0.010

$11.498

$

7.109

0.211

$

$

4.202

2.819

(0.002)

0.025

0.372

0.125

Q1 22 (Proforma)

OFIX SPNE NewCo

$106.418 $ 51.263 $157.681

$78.100 $28.966 $107.066 (1)

1.018

0.279

8.813 $20.311

(8.019) $ (0.910)

0.078

$ 0.375

11.718

7.151

1.240

1.342

(5.375)

0.065

0.193

1.952

0.343

0.010

1.018

0.279

0.125

0.025

0.125

0.006

0.006

$78.342 $ 29.169 $ 107.511

73.6% 56.9%

68.2%

Adjusted gross profit

Adjusted gross margin (Adjusted gross profit/Total revenue, net)

(1) SeaSpine gross profit reflects reclassifications of certain expenses to conform to Orthofix presentation.

0.289

NewCo

Q1 23

Q1 22

Change

$ (60.327) $ (21.221) $ (39.106)

$

1.289 $

12.670

13.020

(0.583)

20.740

0.661

11.636

0.469

3.629

0.375 $

11.718

7.151

1.240

1.342

(5.375)

0.065

0.193

1.952

43

0.010

1.018

0.279

$63.531 $ 20.311 $

$ 3.204 $ (0.910) $

$110.329 $107.066 $

©2023 Orthofix Medical Inc. All rights reserved | 20

0.914

0.952

5.869

(1.823)

20.740

NewCo

Change

Q1 23 Q1 22

$175.204 $ 157.681. $ 17.523

(0.681)

17.011

(0.065)

0.276

1.677

(0.343)

(0.010)

(1.018)

(0.279)

43.220

4.114

3.263

$ 0.471 $ 0.289 $

0.703

0.181

0.025

11.636 0.125

0.629

0.006

$123.949 $ 107.511 $ 16.438

70.7%

68.2%

11.511

0.623

2.6%

0.182

0.703

0.156

ORTHOFIX®

Sea SpineView entire presentation