Ready Capital Investor Presentation Deck

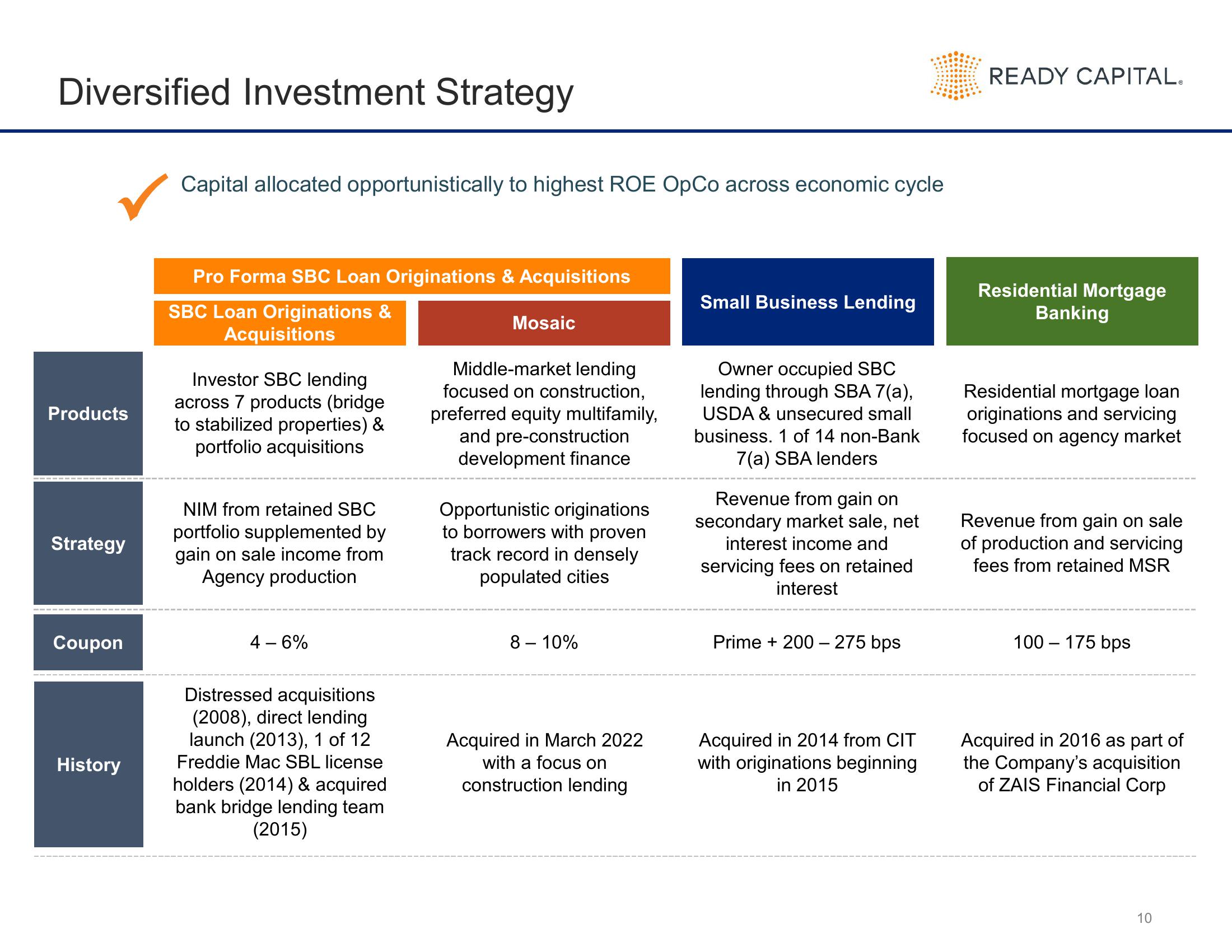

Diversified Investment Strategy

Products

Strategy

Coupon

History

Capital allocated opportunistically to highest ROE OpCo across economic cycle

Pro Forma SBC Loan Originations & Acquisitions

SBC Loan Originations &

Acquisitions

Investor SBC lending

across 7 products (bridge

to stabilized properties) &

portfolio acquisitions

NIM from retained SBC

portfolio supplemented by

gain on sale income from

Agency production

4 - 6%

Distressed acquisitions

(2008), direct lending

launch (2013), 1 of 12

Freddie Mac SBL license

holders (2014) & acquired

bank bridge lending team

(2015)

Mosaic

Middle-market lending

focused on construction,

preferred equity multifamily,

and pre-construction

development finance

Opportunistic originations

to borrowers with proven

track record in densely

populated cities

8 - 10%

Acquired in March 2022

with a focus on

construction lending

Small Business Lending

Owner occupied SBC

lending through SBA 7(a),

USDA & unsecured small

business. 1 of 14 non-Bank

7(a) SBA lenders

Revenue from gain on

secondary market sale, net

interest income and

servicing fees on retained

interest

Prime + 200 - 275 bps

Acquired in 2014 from CIT

with originations beginning

in 2015

READY CAPITAL.

Residential Mortgage

Banking

Residential mortgage loan

originations and servicing

focused on agency market

Revenue from gain on sale

of production and servicing

fees from retained MSR

100 - 175 bps

Acquired in 2016 as part of

the Company's acquisition

of ZAIS Financial Corp

10View entire presentation