Deutsche Bank Results Presentation Deck

Effective capital management driving improved outlook ✓

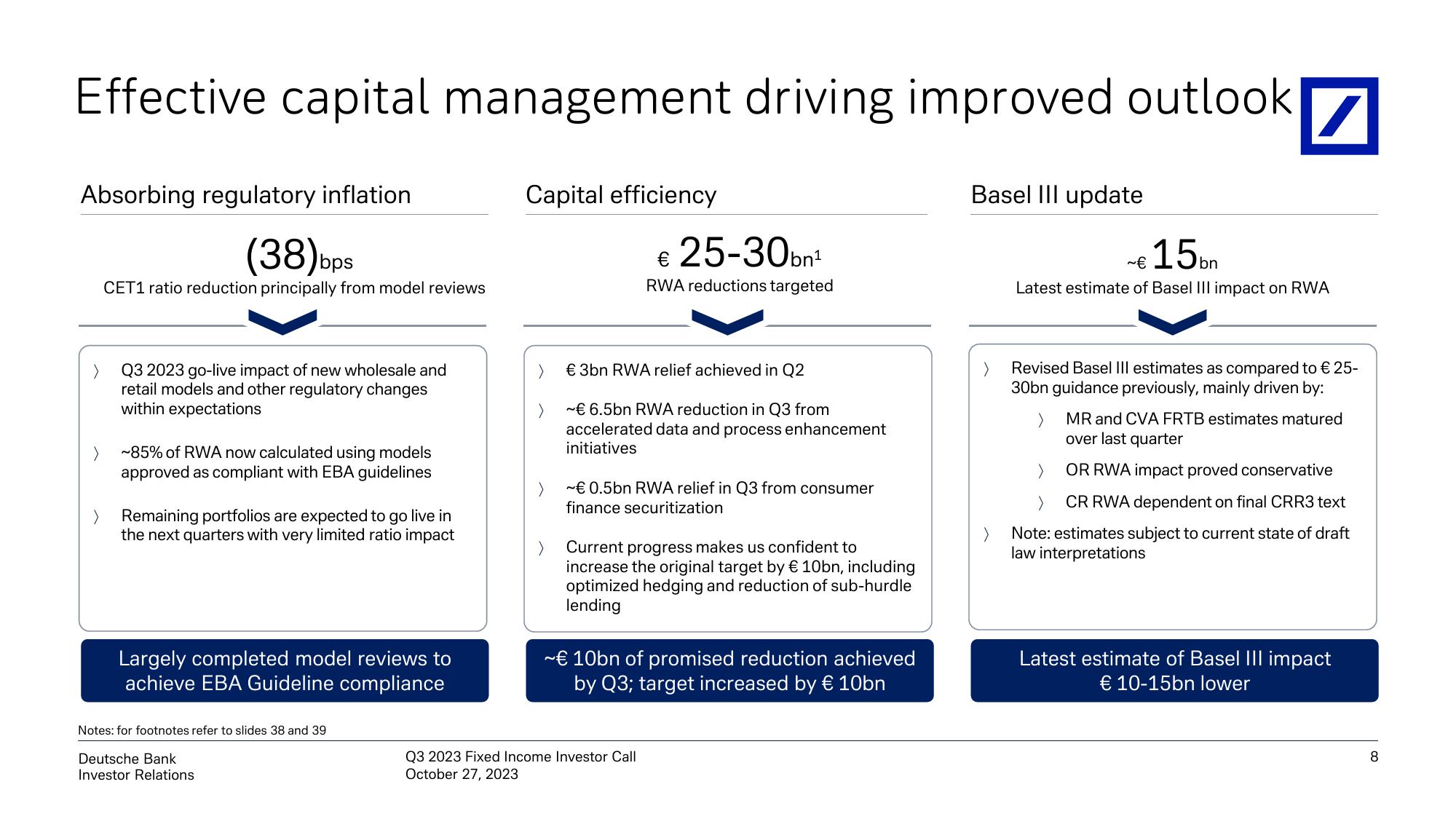

Absorbing regulatory inflation

(38)bps

CET1 ratio reduction principally from model reviews

>

Q3 2023 go-live impact of new wholesale and

retail models and other regulatory changes

within expectations

>

~85% of RWA now calculated using models

approved as compliant with EBA guidelines

>

Remaining portfolios are expected to go live in

the next quarters with very limited ratio impact

Largely completed model reviews to

achieve EBA Guideline compliance

Notes: for footnotes refer to slides 38 and 39

Deutsche Bank

Investor Relations

Capital efficiency

€ 25-30bn¹

RWA reductions targeted

€ 3bn RWA relief achieved in Q2

~€ 6.5bn RWA reduction in Q3 from

accelerated data and process enhancement

initiatives

~€ 0.5bn RWA relief in Q3 from consumer

finance securitization

Current progress makes us confident to

increase the original target by € 10bn, including

optimized hedging and reduction of sub-hurdle

lending

~€ 10bn of promised reduction achieved

by Q3; target increased by € 10bn

Q3 2023 Fixed Income Investor Call

October 27, 2023

Basel III update

>

~€ 15bn

Latest estimate of Basel III impact on RWA

Revised Basel III estimates as compared to € 25-

30bn guidance previously, mainly driven by:

>

MR and CVA FRTB estimates matured

over last quarter

OR RWA impact proved conservative

CR RWA dependent on final CRR3 text

Note: estimates subject to current state of draft

law interpretations

Latest estimate of Basel III impact

€ 10-15bn lower

8View entire presentation