OSP Value Fund IV LP Q4 2022

OSP

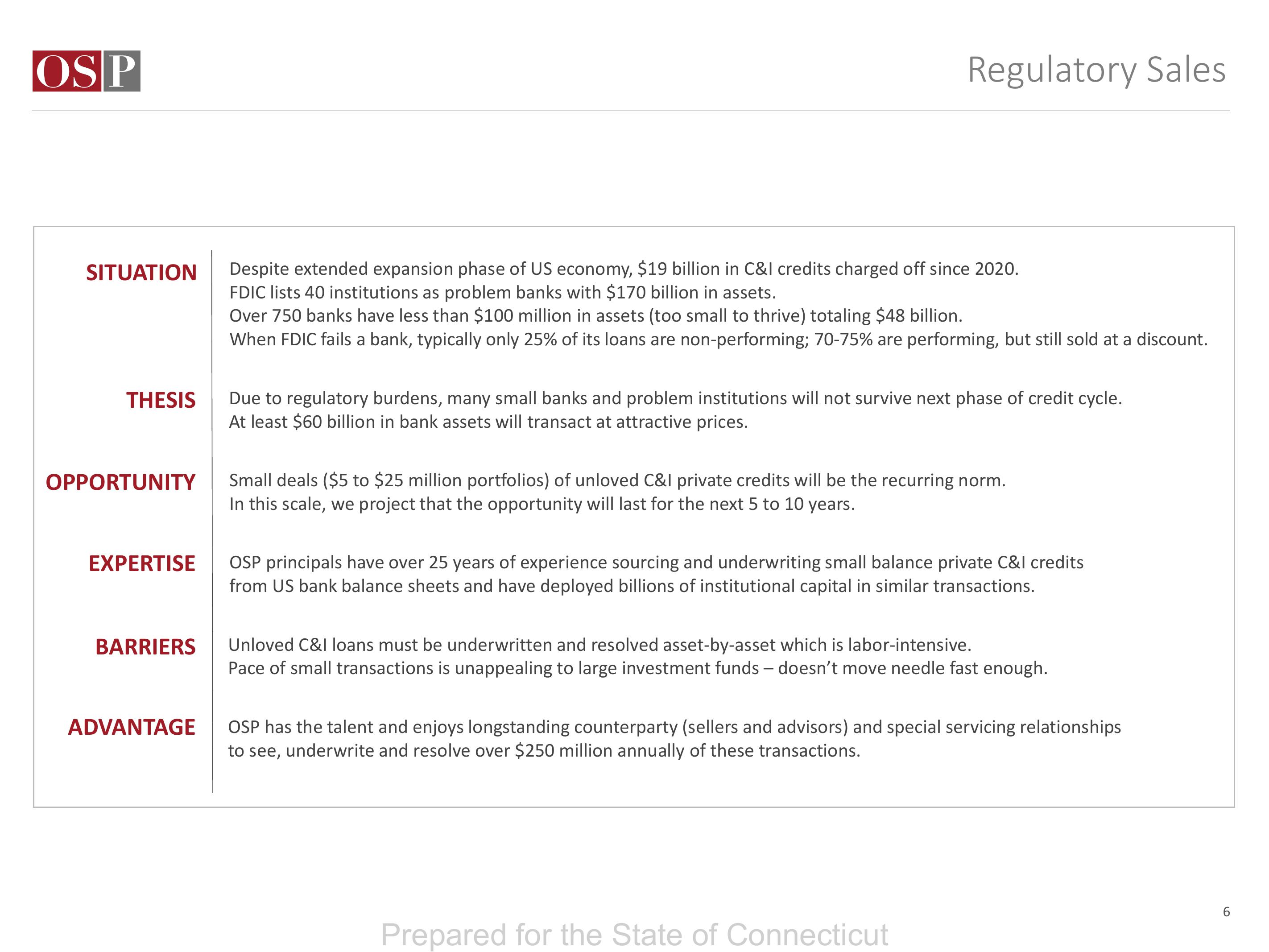

SITUATION

THESIS

OPPORTUNITY

EXPERTISE

BARRIERS

ADVANTAGE

Regulatory Sales

Despite extended expansion phase of US economy, $19 billion in C&I credits charged off since 2020.

FDIC lists 40 institutions as problem banks with $170 billion in assets.

Over 750 banks have less than $100 million in assets (too small to thrive) totaling $48 billion.

When FDIC fails a bank, typically only 25% of its loans are non-performing; 70-75% are performing, but still sold at a discount.

Due to regulatory burdens, many small banks and problem institutions will not survive next phase of credit cycle.

At least $60 billion in bank assets will transact at attractive prices.

Small deals ($5 to $25 million portfolios) of unloved C&I private credits will be the recurring norm.

In this scale, we project that the opportunity will last for the next 5 to 10 years.

OSP principals have over 25 years of experience sourcing and underwriting small balance private C&I credits

from US bank balance sheets and have deployed billions of institutional capital in similar transactions.

Unloved C&I loans must be underwritten and resolved asset-by-asset which is labor-intensive.

Pace of small transactions is unappealing to large investment funds - doesn't move needle fast enough.

OSP has the talent and enjoys longstanding counterparty (sellers and advisors) and special servicing relationships

to see, underwrite and resolve over $250 million annually of these transactions.

Prepared for the State of Connecticut

6View entire presentation