Apollo Global Management Investor Presentation Deck

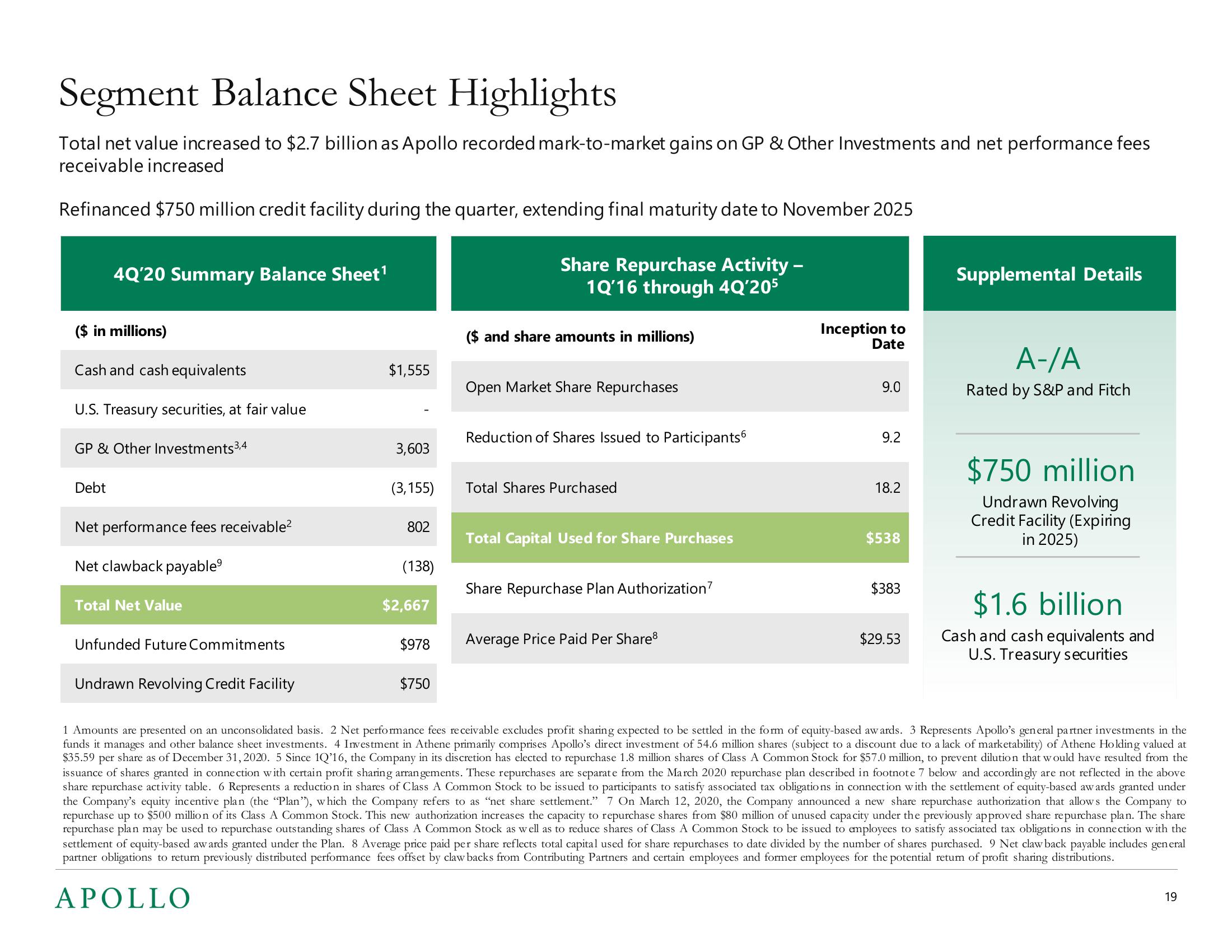

Segment Balance Sheet Highlights

Total net value increased to $2.7 billion as Apollo recorded mark-to-market gains on GP & Other Investments and net performance fees

receivable increased

Refinanced $750 million credit facility during the quarter, extending final maturity date to November 2025

4Q'20 Summary Balance Sheet¹

($ in millions)

Cash and cash equivalents

U.S. Treasury securities, at fair value

GP & Other Investments 3,4

Debt

Net performance fees receivable²

Net clawback payable⁹

Total Net Value

Unfunded Future Commitments

Undrawn Revolving Credit Facility

$1,555

3,603

(3,155)

802

(138)

$2,667

$978

$750

Share Repurchase Activity -

10'16 through 4Q'205

($ and share amounts in millions)

Open Market Share Repurchases

Reduction of Shares Issued to Participants

Total Shares Purchased

Total Capital Used for Share Purchases

Share Repurchase Plan Authorization7

Average Price Paid Per Share8

Inception to

Date

9.0

9.2

18.2

$538

$383

$29.53

Supplemental Details

A-/A

Rated by S&P and Fitch

$750 million

Undrawn Revolving

Credit Facility (Expiring

in 2025)

$1.6 billion

Cash and cash equivalents and

U.S. Treasury securities

1 Amounts are presented on an unconsolidated basis. 2 Net performance fees receivable excludes profit sharing expected to be settled in the form of equity-based awards. 3 Represents Apollo's general partner investments in the

funds it manages and other balance sheet investments. 4 Investment in Athene primarily comprises Apollo's direct investment of 54.6 million shares (subject to a discount due to a lack of marketability) of Athene Holding valued

$35.59 per share as of December 31, 2020. 5 Since 1Q'16, the Company in its discretion has elected to repurchase 1.8 million shares of Class A Common Stock for $57.0 million, to prevent dilution that would have resulted from the

issuance of shares granted in connection with certain profit sharing arrangements. These repurchases are separate from the March 2020 repurchase plan described in footnote 7 below and accordingly are not reflected in the above

share repurchase activity table. 6 Represents a reduction in shares of Class A Common Stock to be issued to participants to satisfy associated tax obligations in connection with the settlement of equity-based awards granted under

the Company's equity incentive plan (the "Plan"), which the Company refers to as "net share settlement." 7 On March 12, 2020, the Company announced a new share repurchase authorization that allows the Company to

repurchase up to $500 million of its Class A Common Stock. This new authorization increases the capacity to repurchase shares from $80 million of unused capacity under the previously approved share repurchase plan. The share

repurchase plan may be used to repurchase outstanding shares of Class A Common Stock as well as to reduce shares of Class A Common Stock to be issued to employees to satisfy associated tax obligations in connection with the

settlement of equity-based awards granted under the Plan. 8 Average price paid per share reflects total capital used for share repurchases to date divided by the number of shares purchased. 9 Net claw back payable includes general

partner obligations to return previously distributed performance fees offset by clawbacks from Contributing Partners and certain employees and former employees for the potential return of profit sharing distributions.

APOLLO

19View entire presentation