Kinnevik Results Presentation Deck

Intro

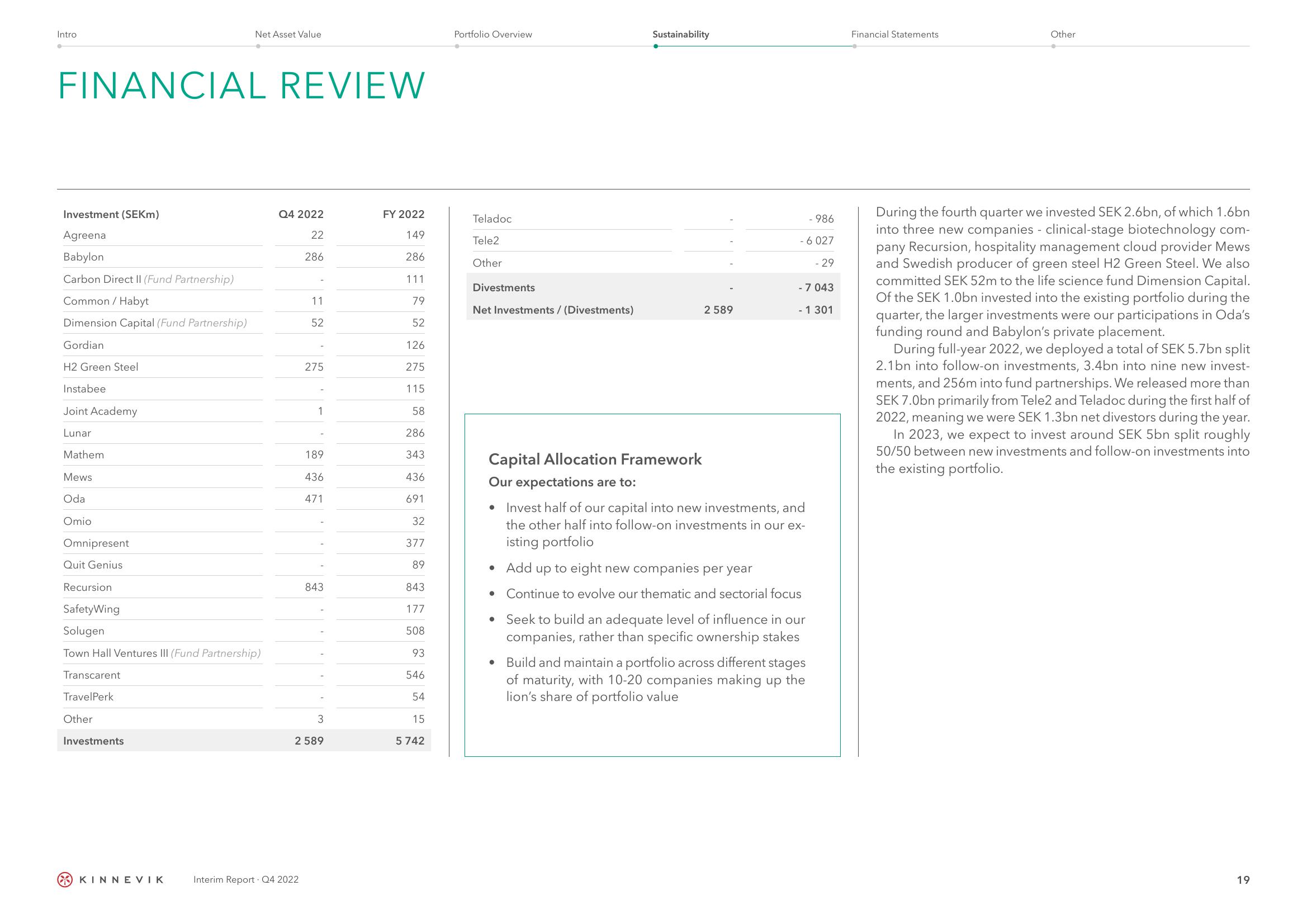

FINANCIAL REVIEW

Investment (SEKm)

Agreena

Babylon

Carbon Direct II (Fund Partnership)

Common / Habyt

Dimension Capital (Fund Partnership)

Gordian

H2 Green Steel

Instabee

Joint Academy

Lunar

Mathem

Mews

Oda

Omio

Omnipresent

Quit Genius

Recursion

SafetyWing

Solugen

Town Hall Ventures III (Fund Partnership)

Transcarent

TravelPerk

Other

Net Asset Value

Investments

KINNEVIK

Q4 2022

22

286

Interim Report. Q4 2022

11

52

275

1

189

436

471

843

3

2 589

FY 2022

149

286

111

79

52

126

275

115

58

286

343

436

691

32

377

89

843

177

508

93

546

54

5742

Portfolio Overview

Teladoc

Tele2

Other

Divestments

Net Investments / (Divestments)

Sustainability

●

2 589

- 986

- 6 027

Capital Allocation Framework

Our expectations are to:

• Invest half of our capital into new investments, and

the other half into follow-on investments in our ex-

isting portfolio

Add up to eight new companies per year

● Continue to evolve our thematic and sectorial focus

- 7 043

- 1 301

• Seek to build an adequate level of influence in our

companies, rather than specific ownership stakes

- 29

• Build and maintain a portfolio across different stages

of maturity, with 10-20 companies making up the

lion's share of portfolio value

Financial Statements

Other

During the fourth quarter we invested SEK 2.6bn, of which 1.6bn

into three new companies - clinical-stage biotechnology com-

pany Recursion, hospitality management cloud provider Mews

and Swedish producer of green steel H2 Green Steel. We also

committed SEK 52m to the life science fund Dimension Capital.

Of the SEK 1.0bn invested into the existing portfolio during the

quarter, the larger investments were our participations in Oda's

funding round and Babylon's private placement.

During full-year 2022, we deployed a total of SEK 5.7bn split

2.1bn into follow-on investments, 3.4bn into nine new invest-

ments, and 256m into fund partnerships. We released more than

SEK 7.0bn primarily from Tele2 and Teladoc during the first half of

2022, meaning we were SEK 1.3bn net divestors during the year.

In 2023, we expect to invest around SEK 5bn split roughly

50/50 between new investments and follow-on investments into

the existing portfolio.

19View entire presentation