J.P.Morgan Investment Banking Pitch Book

KEY TRANSACTION CONSIDERATIONS

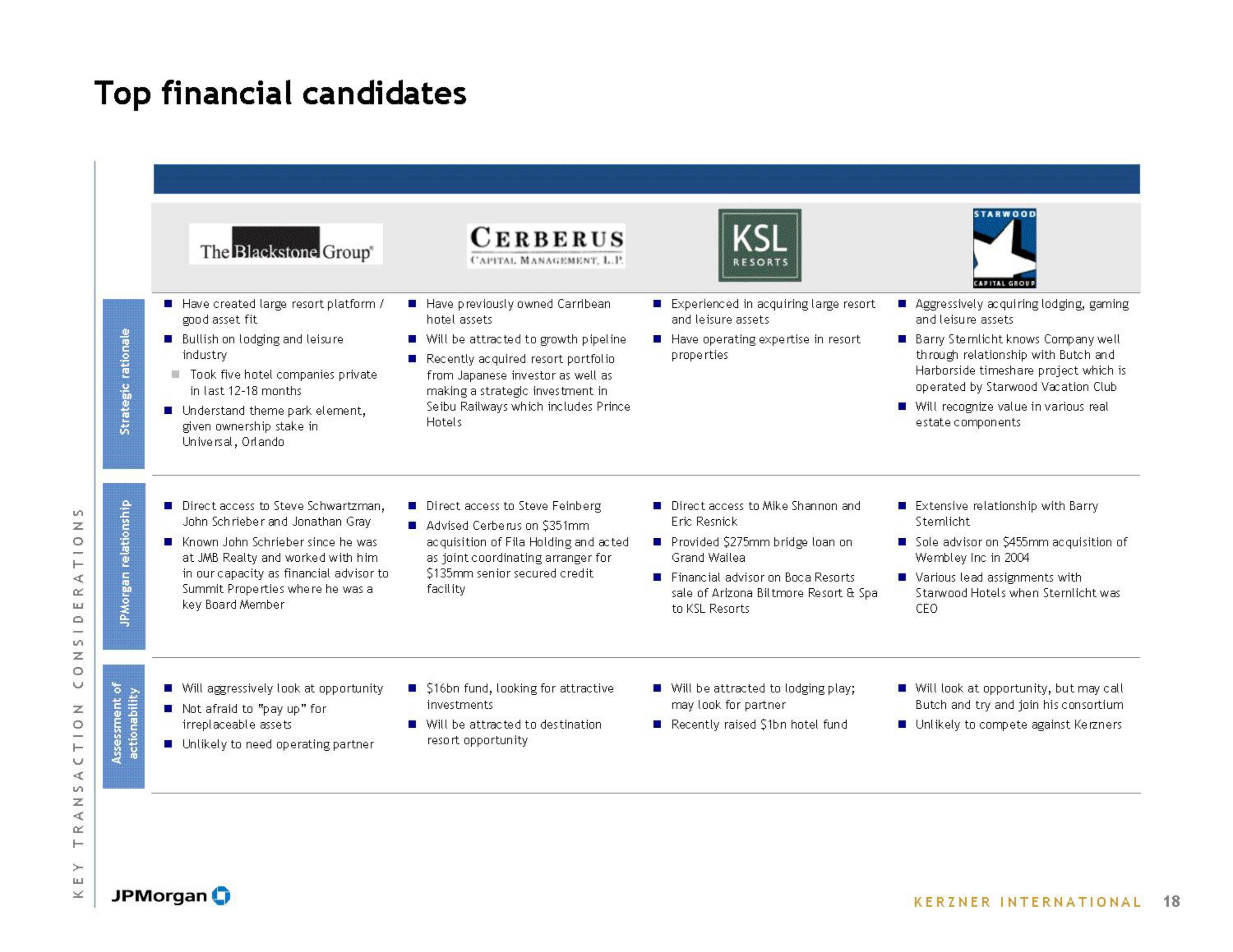

Top financial candidates

Strategic rationale

JPMorgan relationship

Assessment of

actionability

The Blackstone Group

Have created large resort platform /

good asset fit

Bullish on lodging and leisure

industry

Took five hotel companies private

in last 12-18 months

Understand theme park element,

given ownership stake in

Universal, Orlando

Direct access to Steve Schwartzman,

John Schrieber and Jonathan Gray

Known John Schrieber since he was

at JMB Realty and worked with him

in our capacity as financial advisor to

Summit Properties where he was a

key Board Member

Will aggressively look at opportunity

Not afraid to "pay up" for

irreplaceable assets

■ Unlikely to need operating partner

JPMorgan

CERBERUS

CAPITAL MANAGEMENT, L.P.

Have previously owned Carribean

hotel assets

Will be attracted to growth pipeline

Recently acquired resort portfolio

from Japanese investor as well as

making a strategic investment in

Seibu Railways which includes Prince

Hotels

Direct access to Steve Feinberg

Advised Cerberus on $351mm

acquisition of Fila Holding and acted

as joint coordinating arranger for

$135mm senior secured credit

facility

$16bn fund, looking for attractive

investments

Will be attracted to destination

resort opportunity

KSL

RESORTS

Experienced in acquiring large resort

and leisure assets

Have operating expertise in resort

properties

Direct access to Mike Shannon and

Eric Resnick

Provided $275mm bridge loan on

Grand Wailea

Financial advisor on Boca Resorts

sale of Arizona Biltmore Resort & Spa

to KSL Resorts

Will be attracted to lodging play;

may look for partner

■ Recently raised $1bn hotel fund

STARWOOD

CAPITAL GROUP

Aggressively acquiring lodging, gaming

and leisure assets

■Barry Sternlicht knows Company well

through relationship with Butch and

Harborside timeshare project which is

operated by Starwood Vacation Club

■Will recognize value in various real

estate components

Extensive relationship with Barry

Sternlicht

■ Sole advisor on $455mm acquisition of

Wembley Inc in 2004

Various lead assignments with

Starwood Hotels when Sternlicht was

CEO

Will look at opportunity, but may call

Butch and try and join his consortium

■ Unlikely to compete against Kerzners

KERZNER INTERNATIONAL 18View entire presentation