Docebo Investor Presentation Deck

METRIC

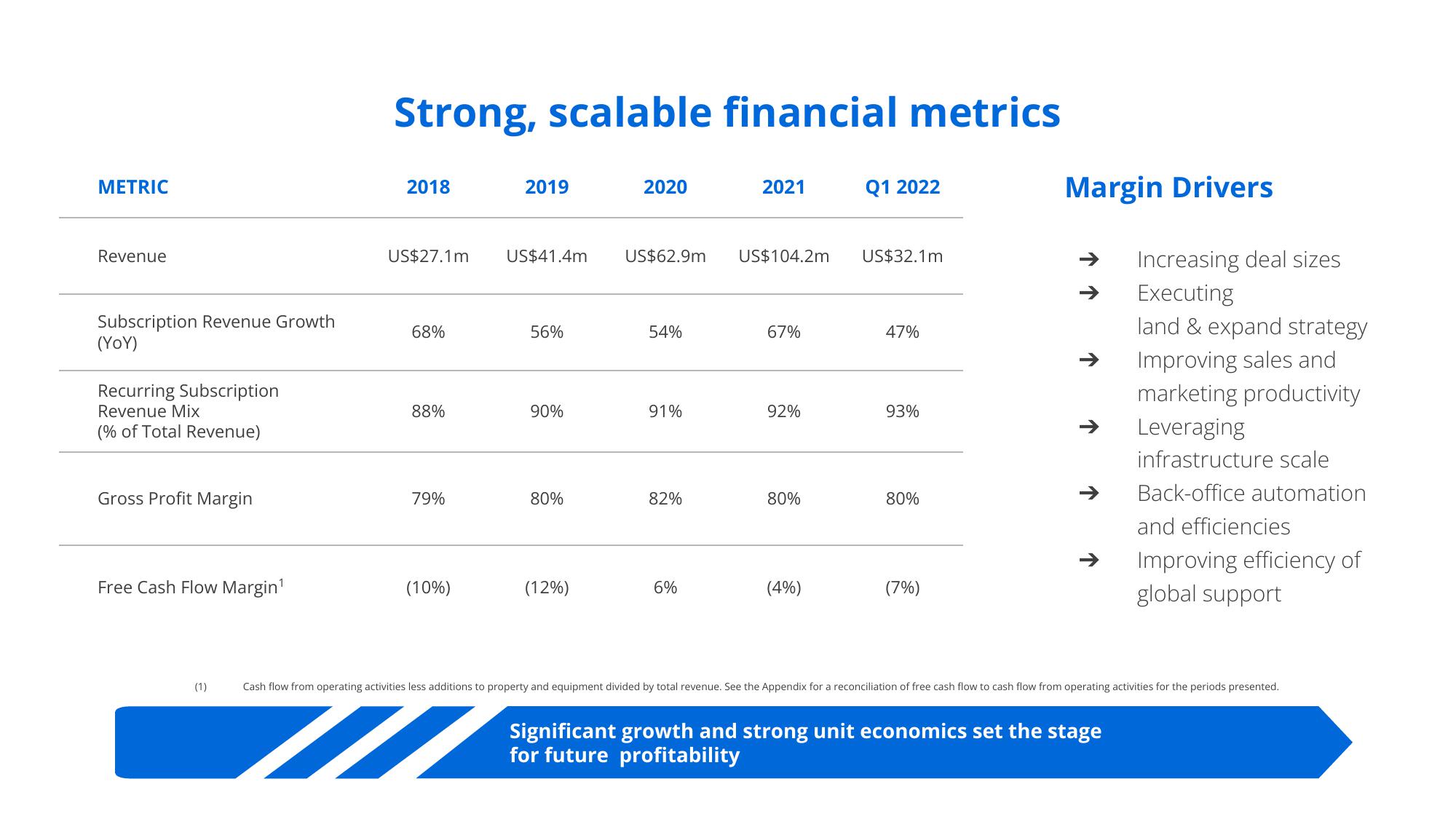

Revenue

Subscription Revenue Growth

(YoY)

Recurring Subscription

Revenue Mix

(% of Total Revenue)

Gross Profit Margin

Free Cash Flow Margin¹

(1)

Strong, scalable financial metrics

2018

US$27.1m

68%

88%

79%

(10%)

2019

US$41.4m

56%

90%

80%

(12%)

2020

US$62.9m

54%

91%

82%

6%

2021

US$104.2m US$32.1m

67%

92%

80%

Q1 2022

(4%)

47%

93%

80%

(7%)

Margin Drivers

↑

个

Increasing deal sizes

Executing

land & expand strategy

Improving sales and

marketing productivity

Leveraging

infrastructure scale

Back-office automation

Significant growth and strong unit economics set the stage

for future profitability

and efficiencies

Improving efficiency of

global support

Cash flow from operating activities less additions to property and equipment divided by total revenue. See the Appendix for a reconciliation of free cash flow to cash flow from operating activities for the periods presented.

MView entire presentation