Melrose Results Presentation Deck

Melrose key financial numbers: GKN & Nortek both highly cash generative

Melrose

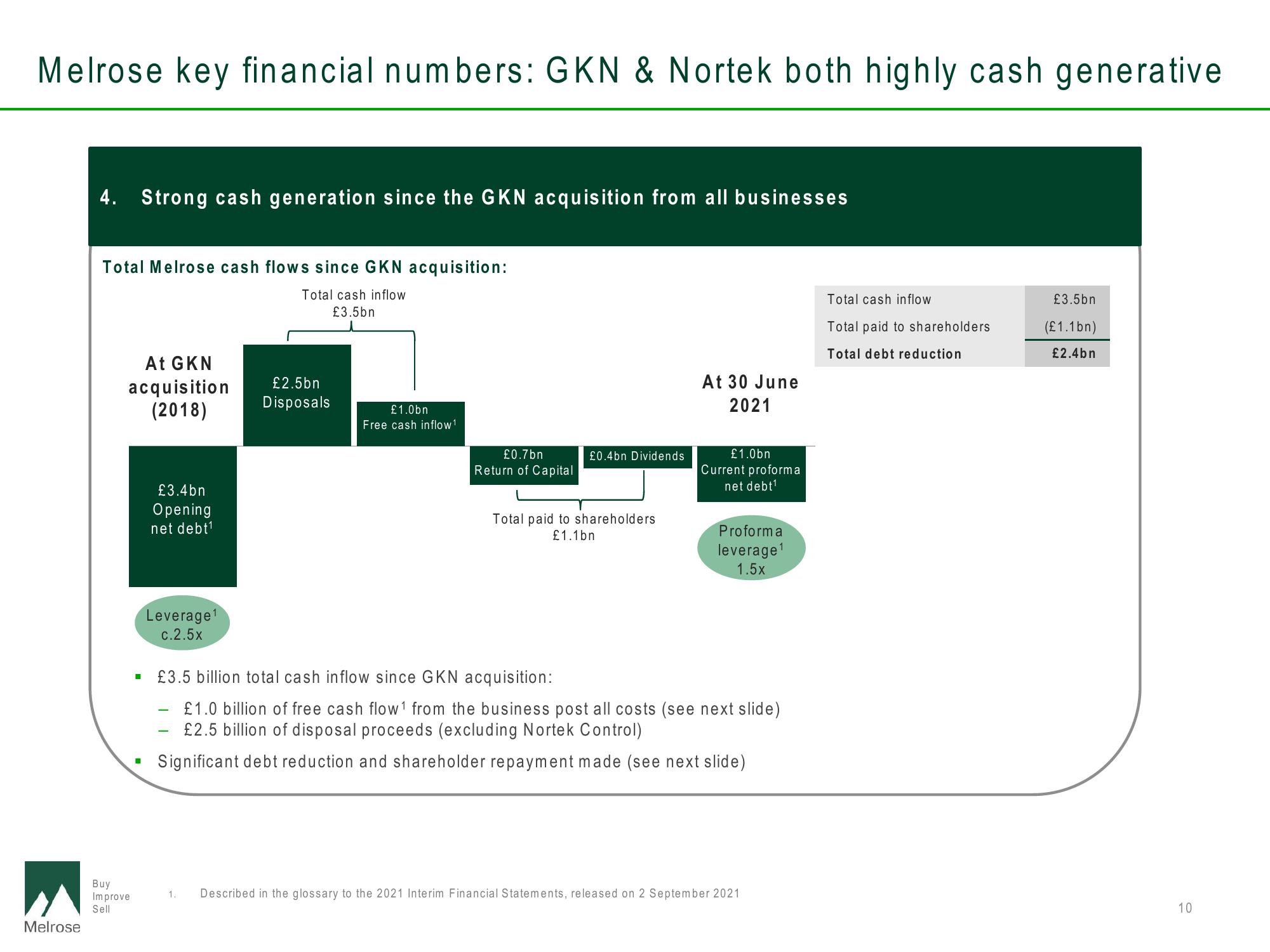

4. Strong cash generation since the GKN acquisition from all businesses

Total Melrose cash flows since GKN acquisition:

Total cash inflow

£3.5bn

At GKN

acquisition

(2018)

Buy

Improve

Sell

£3.4bn

Opening

net debt¹

Leverage ¹

c.2.5x

£2.5bn

Disposals

£1.0bn

Free cash inflow ¹

£0.7bn

Return of Capital

£0.4bn Dividends

Total paid to shareholders

£1.1bn

At 30 June

2021

£1.0bn

Current proforma

net debt¹

Proforma

leverage ¹

1.5x

£3.5 billion total cash inflow since GKN acquisition:

£1.0 billion of free cash flow¹ from the business post all costs (see next slide)

£2.5 billion of disposal proceeds (excluding Nortek Control)

Significant debt reduction and shareholder repayment made (see next slide)

1. Described in the glossary to the 2021 Interim Financial Statements, released on 2 September 2021

Total cash inflow

Total paid to shareholders

Total debt reduction

£3.5bn

(£1.1bn)

£2.4bn

10View entire presentation